On July 1 A Company Receives An Invoice For $800

Holbox

Mar 12, 2025 · 6 min read

Table of Contents

- On July 1 A Company Receives An Invoice For $800

- Table of Contents

- On July 1st, a Company Receives an Invoice for $800: A Deep Dive into Accounting and Financial Management Implications

- Understanding the Invoice: Beyond the Numbers

- The Accounting Treatment: Recording the Transaction

- The Importance of Accurate Recording

- Financial Statement Impact: Analyzing the $800 Invoice

- Implications for Cash Flow Management: Planning for Payment

- Beyond the $800: Long-Term Strategic Considerations

- The Importance of Technology in Invoice Processing

- Compliance and Legal Considerations

- Conclusion: The $800 Invoice as a Microcosm of Financial Health

- Latest Posts

- Related Post

On July 1st, a Company Receives an Invoice for $800: A Deep Dive into Accounting and Financial Management Implications

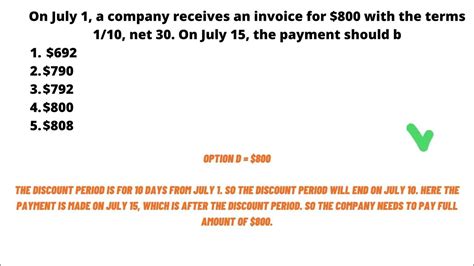

On July 1st, a seemingly simple event occurs: a company receives an invoice for $800. While this might seem insignificant on the surface, this transaction triggers a cascade of accounting procedures, financial management decisions, and potential future implications that warrant a thorough understanding. This article will delve into the detailed processes surrounding this seemingly simple invoice, exploring its impact on various aspects of a company's financial health.

Understanding the Invoice: Beyond the Numbers

Before delving into the accounting treatment, let's understand the invoice itself. The $800 invoice represents a liability for the receiving company. It's a formal request for payment for goods or services rendered. Key information included in a properly formatted invoice typically includes:

- Invoice Number: A unique identifier for tracking purposes.

- Invoice Date: July 1st, in this case. Crucial for accurate recording and timely payment.

- Due Date: The date by which payment is expected. This is usually specified and impacts cash flow planning.

- Vendor/Supplier Information: Details about the entity issuing the invoice.

- Company Information: The receiving company's details.

- Description of Goods/Services: A clear and concise description of what the $800 represents. This could be raw materials, consulting services, software licenses, etc.

- Quantity and Unit Price: If applicable, specifying the number of units and their individual cost.

- Total Amount Due: The final sum, in this case $800.

- Payment Terms: Details on acceptable payment methods (e.g., check, wire transfer, credit card) and any potential discounts for early payment.

The Accounting Treatment: Recording the Transaction

The receipt of this invoice necessitates a journal entry in the company's accounting system. This entry reflects the increase in liabilities and the corresponding impact on the company's financial statements. The specific accounts used will depend on the nature of the goods or services purchased.

Scenario 1: Purchase of Goods (Inventory)

If the $800 represents the purchase of inventory, the journal entry would be:

- Debit: Inventory (Asset) - $800

- Credit: Accounts Payable (Liability) - $800

This entry increases the inventory asset (representing the goods received) and increases the accounts payable liability (reflecting the debt owed to the supplier).

Scenario 2: Purchase of Services (Operating Expenses)

If the $800 represents the purchase of services, such as consulting or marketing, the journal entry would be:

- Debit: Consulting Expense (or appropriate expense account) - $800

- Credit: Accounts Payable (Liability) - $800

Here, the expense account increases (reflecting the cost of doing business), and the accounts payable liability also increases.

Scenario 3: Purchase of Equipment (Fixed Asset)

If the $800 is for equipment, the journal entry is more complex and might involve depreciation:

- Debit: Equipment (Asset) - $800

- Credit: Accounts Payable (Liability) - $800

However, if the equipment's useful life extends beyond one year, the company must account for depreciation over its lifetime.

The Importance of Accurate Recording

Accurate recording is paramount. Errors in recording this seemingly small invoice can snowball, leading to inaccurate financial reports, miscalculations in cash flow projections, and potentially even tax issues. The principle of double-entry bookkeeping ensures that every transaction affects at least two accounts, maintaining the balance of the accounting equation (Assets = Liabilities + Equity).

Financial Statement Impact: Analyzing the $800 Invoice

The $800 invoice impacts various financial statements:

-

Balance Sheet: The invoice increases the company's liabilities (accounts payable) and, depending on the nature of the purchase, may also increase assets (inventory or fixed assets). This directly affects the company's current ratio (current assets/current liabilities), a crucial indicator of short-term liquidity.

-

Income Statement: If the purchase is for goods sold directly, it will indirectly affect the income statement through the cost of goods sold, ultimately impacting gross profit and net income. If it's for services, it will directly affect the expenses and net income in the period the service is consumed.

-

Cash Flow Statement: The payment of the invoice will be recorded as a cash outflow in the operating activities section of the cash flow statement. The timing of this payment is crucial for managing cash flow.

Implications for Cash Flow Management: Planning for Payment

The invoice's due date plays a vital role in cash flow management. The company needs to ensure it has sufficient funds available to meet its payment obligations. Delays can damage the company's credit rating and supplier relationships.

Effective cash flow management strategies include:

- Cash Forecasting: Predicting future cash inflows and outflows to anticipate potential shortfalls.

- Early Payment Discounts: Negotiating discounts for early payment if offered by the supplier. This can significantly reduce the overall cost.

- Negotiating Payment Terms: Working with the supplier to extend the payment due date if facing cash flow challenges. However, this should be done strategically and respectfully.

- Maintaining Adequate Reserves: Keeping a sufficient level of cash on hand to cover unexpected expenses and invoice payments.

Beyond the $800: Long-Term Strategic Considerations

The $800 invoice, while seemingly insignificant in isolation, reflects larger business operations and strategies. The nature of the purchase signifies the company's operational needs, investment decisions, and overall financial health.

For example, purchasing inventory suggests a company is actively involved in production or sales. Investments in equipment denote long-term growth plans. Regularly reviewing the nature of purchases and associated expenses can help identify areas for cost optimization and efficiency improvements. Analyzing invoice data over time can reveal spending patterns and trends.

The Importance of Technology in Invoice Processing

Modern accounting software and ERP systems automate many invoice processing steps, reducing manual labor and errors. Features like automated invoice matching, optical character recognition (OCR) for data extraction, and integration with payment platforms improve efficiency and accuracy. This automated approach minimizes the risk of human error, accelerates payment processes, and contributes to better cash flow management.

Compliance and Legal Considerations

Processing invoices accurately and timely is crucial for maintaining compliance with relevant tax laws and regulations. Depending on the company's location and industry, specific rules govern invoicing, record-keeping, and tax reporting. Properly documented invoices and organized accounting records ensure smooth audits and prevent legal issues.

Conclusion: The $800 Invoice as a Microcosm of Financial Health

The $800 invoice, initially perceived as a minor transaction, becomes a significant element when considered within the broader context of a company's financial management. Its processing reveals critical insights into operational expenses, cash flow, financial reporting, and overall strategic direction. By understanding the accounting implications, managing cash flow effectively, leveraging technology, and adhering to legal requirements, companies can transform a seemingly small invoice into a valuable tool for strategic planning and enhanced financial health. This detailed analysis underscores the importance of meticulous record-keeping, proactive cash flow management, and the utilization of technology to streamline accounting processes. Effective financial management is built on the careful attention to detail, even in seemingly minor transactions like the receipt of an $800 invoice.

Latest Posts

Related Post

Thank you for visiting our website which covers about On July 1 A Company Receives An Invoice For $800 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.