Record The Entry To Close The Income Summary Account.

Holbox

Mar 24, 2025 · 6 min read

Table of Contents

- Record The Entry To Close The Income Summary Account.

- Table of Contents

- Recording the Entry to Close the Income Summary Account: A Comprehensive Guide

- What is the Income Summary Account?

- Understanding the Closing Process

- Closing the Income Summary Account: A Step-by-Step Guide

- Illustrative Example with Multiple Accounts

- Importance of Accurate Closing Entries

- Potential Errors and How to Avoid Them

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

Recording the Entry to Close the Income Summary Account: A Comprehensive Guide

Closing the books at the end of an accounting period is a crucial step in the accounting cycle. One of the most important closing entries involves the income summary account. This account acts as a temporary holding place for all revenue and expense accounts. Understanding how to properly close this account is vital for accurate financial reporting and preparing for the next accounting period. This comprehensive guide will walk you through the process, explaining the rationale behind each step and offering practical examples.

What is the Income Summary Account?

The income summary account is a temporary account used only at the end of an accounting period. Its primary purpose is to simplify the closing process by consolidating all revenue and expense accounts. Think of it as a central hub where all the financial activity of the period converges before being transferred to the permanent accounts—the retained earnings (or capital) account.

Key Characteristics:

- Temporary Account: Unlike permanent accounts (like assets, liabilities, and equity), the income summary account is closed at the end of each accounting period. Its balance is zeroed out.

- Consolidation Point: It aggregates all revenues and expenses, providing a single location to calculate net income or net loss.

- Facilitates Closing: It streamlines the closing process, reducing the number of individual entries required.

Understanding the Closing Process

The closing process is a series of journal entries designed to transfer the balances of temporary accounts (revenue, expense, and income summary) to the permanent retained earnings account. This prepares the general ledger for the next accounting period, ensuring that the beginning balances accurately reflect the financial position.

The closing process generally involves the following steps:

-

Closing Revenue Accounts: Debit each revenue account and credit the income summary account. This transfers the revenue balances to the income summary account.

-

Closing Expense Accounts: Credit each expense account and debit the income summary account. This transfers the expense balances to the income summary account.

-

Closing the Income Summary Account: This is the crucial step we will focus on in detail. The balance in the income summary account represents the net income (credit balance) or net loss (debit balance) for the period. This balance is then closed to the retained earnings account.

-

Closing the Dividends Account (if applicable): If the company has declared dividends, the dividends account is closed to the retained earnings account. This reduces retained earnings reflecting the distribution of profits to shareholders.

Closing the Income Summary Account: A Step-by-Step Guide

The method for closing the income summary account depends on whether the company had a net income or a net loss for the period.

Scenario 1: Net Income (Credit Balance in Income Summary)

Let's assume the following balances after closing revenue and expense accounts:

- Income Summary: Credit balance of $50,000 (representing net income)

- Retained Earnings: Existing balance of $100,000

The closing entry would be:

| **Date | Account | Debit | Credit** |

|---|---|---|---|

| Dec 31 | Income Summary | $50,000 |

| Retained Earnings | | $50,000

| *To close net income to retained earnings*

This entry debits the income summary account to zero its balance and credits the retained earnings account, increasing it by the amount of net income. The retained earnings account now reflects the increased equity resulting from the profitable period.

Scenario 2: Net Loss (Debit Balance in Income Summary)

Let's assume the following balances after closing revenue and expense accounts:

- Income Summary: Debit balance of $10,000 (representing net loss)

- Retained Earnings: Existing balance of $100,000

The closing entry would be:

| **Date | Account | Debit | Credit** |

|---|---|---|---|

| Dec 31 | Retained Earnings | $10,000 |

| Income Summary | | $10,000

| *To close net loss to retained earnings*

In this case, the income summary account is credited to zero its balance, while the retained earnings account is debited, reducing its balance by the amount of the net loss. This accurately reflects the decrease in equity due to the unprofitable period.

Illustrative Example with Multiple Accounts

Let's illustrate with a more complex scenario involving multiple revenue and expense accounts.

Trial Balance Before Closing:

| Account Name | Debit | Credit |

|---|---|---|

| Sales Revenue | $150,000 | |

| Service Revenue | $50,000 | |

| Cost of Goods Sold | $80,000 | |

| Salaries Expense | $30,000 | |

| Rent Expense | $10,000 | |

| Utilities Expense | $5,000 | |

| Income Summary | ||

| Retained Earnings | $100,000 |

Step 1: Close Revenue Accounts

| **Date | Account | Debit | Credit** |

|---|---|---|---|

| Dec 31 | Sales Revenue | $150,000 |

| Service Revenue | $50,000 |

| Income Summary | | $200,000 |

| *To close revenue accounts*

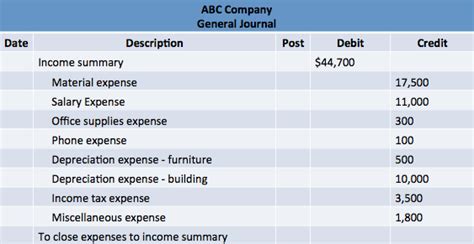

Step 2: Close Expense Accounts

| **Date | Account | Debit | Credit** |

|---|---|---|---|

| Dec 31 | Income Summary | $125,000 |

| Cost of Goods Sold | | $80,000 |

| Salaries Expense | | $30,000 |

| Rent Expense | | $10,000 |

| Utilities Expense | | $5,000 |

| *To close expense accounts*

Step 3: Calculate Income Summary Balance and Close

After steps 1 and 2, the Income Summary account has a credit balance of $75,000 ($200,000 - $125,000), representing net income. The closing entry is:

| **Date | Account | Debit | Credit** |

|---|---|---|---|

| Dec 31 | Income Summary | $75,000 |

| Retained Earnings | | $75,000 |

| *To close net income to retained earnings*

Post-Closing Trial Balance:

After these closing entries, only the permanent accounts (assets, liabilities, and equity) will have balances. The temporary accounts will all have zero balances, ready for the next accounting period.

Importance of Accurate Closing Entries

Accurate closing entries are crucial for several reasons:

- Accurate Financial Statements: Incorrect closing entries can lead to inaccurate financial statements, misrepresenting the company's financial position and performance.

- Tax Reporting: Accurate financial statements are essential for accurate tax reporting, avoiding potential penalties and audits.

- Decision-Making: Reliable financial data is critical for informed decision-making by management and investors.

- Future Planning: Accurate closing entries provide a clean starting point for the next accounting period, facilitating accurate budgeting and forecasting.

Potential Errors and How to Avoid Them

Common errors in closing the income summary account include:

- Incorrect Account Balances: Double-check all revenue and expense account balances before closing.

- Incorrect Debit/Credit: Ensure the correct debits and credits are used in the closing entries. Remember, debits decrease credit balances and credits decrease debit balances.

- Omitting Accounts: Ensure all revenue and expense accounts are closed.

- Mathematical Errors: Carefully check all calculations to avoid mathematical errors.

To minimize errors, use a systematic approach, carefully review each entry, and consider using accounting software to help automate the process and reduce the risk of manual errors.

Conclusion

Closing the income summary account is a fundamental aspect of the accounting closing process. Understanding the steps involved, whether the business has a net income or net loss, and paying attention to detail are crucial for generating accurate financial statements and preparing for the next accounting period. By following the steps outlined in this guide, accountants can ensure the integrity of their financial records and provide reliable information for informed decision-making. Remember to always double-check your work and utilize resources available to you to ensure accuracy. Accurate financial records are the foundation of a healthy and successful business.

Latest Posts

Latest Posts

-

The Following Graph Shows The Demand For A Good

Mar 29, 2025

-

Your Company Offers A Single Premium

Mar 29, 2025

-

Draw The Structure Of 4 Isopropyl 2 4 5 Trimethylheptane

Mar 29, 2025

-

The Disadvantage Of Turning While Reversing Is

Mar 29, 2025

-

Determine The T Value In Each Of The Cases

Mar 29, 2025

Related Post

Thank you for visiting our website which covers about Record The Entry To Close The Income Summary Account. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.