Product Costs That Have Become Expenses Can Be Found In

Holbox

Mar 26, 2025 · 6 min read

Table of Contents

- Product Costs That Have Become Expenses Can Be Found In

- Table of Contents

- Product Costs That Have Become Expenses: A Comprehensive Guide

- What are Product Costs?

- 1. Direct Materials:

- 2. Direct Labor:

- 3. Manufacturing Overhead:

- The Transition from Product Cost to Expense: Cost of Goods Sold (COGS)

- Product Costs Becoming Period Expenses: Beyond COGS

- 1. Spoilage and Waste:

- 2. Obsolescence:

- 3. Write-downs of Inventory:

- 4. Research and Development (R&D) Costs:

- 5. Marketing and Distribution Costs:

- Accounting for the Transition: Inventory Management Systems

- 1. First-In, First-Out (FIFO):

- 2. Last-In, First-Out (LIFO):

- Impact on Financial Statements

- Strategic Implications for Business Decision-Making

- Conclusion: A Holistic View of Product Cost Management

- Latest Posts

- Latest Posts

- Related Post

Product Costs That Have Become Expenses: A Comprehensive Guide

Understanding the journey of a product cost from its inception to its final classification as an expense is crucial for accurate financial reporting and effective business management. Many costs associated with producing a product don't remain neatly categorized as "product costs" forever. They transition into expenses at various stages of the business lifecycle. This comprehensive guide will delve into the various product costs that eventually become expenses, exploring the accounting principles and practical implications involved.

What are Product Costs?

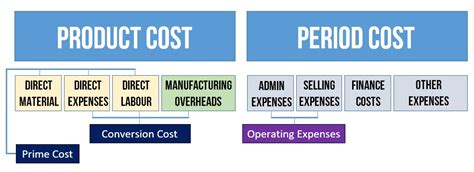

Before understanding their transformation into expenses, let's define product costs. These are all the costs directly attributable to the production of goods. They're capitalized on the balance sheet as inventory until the goods are sold. Only then do they transition to the income statement as the cost of goods sold (COGS). Key components of product costs include:

1. Direct Materials:

These are the raw materials that become an integral part of the finished product. Think of the wood in a chair, the fabric in a shirt, or the silicon in a computer chip. The cost of these materials is directly traceable to the production process.

2. Direct Labor:

This encompasses the wages and benefits paid to workers directly involved in manufacturing the product. This includes assembly line workers, machine operators, and other personnel whose time can be directly linked to the creation of the product.

3. Manufacturing Overhead:

This is a catch-all category encompassing indirect costs associated with production. These costs are not easily traceable to a specific product but are necessary for the manufacturing process. Examples include:

- Factory Rent: The cost of renting or owning the manufacturing facility.

- Utilities: Electricity, water, and gas used in the factory.

- Depreciation of Equipment: The allocation of the cost of manufacturing equipment over its useful life.

- Factory Supervisor Salaries: Salaries paid to supervisors overseeing the production process.

- Maintenance and Repairs: Costs associated with maintaining and repairing factory equipment.

- Insurance: Insurance premiums for the factory and equipment.

The Transition from Product Cost to Expense: Cost of Goods Sold (COGS)

The pivotal moment where product costs become expenses occurs when the finished goods are sold. At this point, the capitalized product costs are moved from the balance sheet (inventory) to the income statement as the cost of goods sold (COGS). COGS is a crucial element in calculating gross profit and ultimately, net income. The formula for calculating COGS is often:

Beginning Inventory + Purchases – Ending Inventory = Cost of Goods Sold

This formula works for businesses that buy and resell finished goods, while a slightly more nuanced approach is required for manufacturers who produce their own goods.

Product Costs Becoming Period Expenses: Beyond COGS

While COGS represents the primary transition of product costs into expenses, other scenarios exist where product costs morph into period expenses. These situations often arise due to inefficiencies, spoilage, or changes in market conditions.

1. Spoilage and Waste:

If raw materials or finished goods are spoiled or rendered unusable during the production process, their cost becomes an expense rather than a part of COGS. This is recognized as a loss and charged to the income statement in the period the spoilage occurs. Effective inventory management and quality control processes minimize such losses.

2. Obsolescence:

Products can become obsolete due to technological advancements, changing consumer preferences, or shifts in market demand. The cost of obsolete inventory is written down as an expense, recognizing the loss in value. This write-down reflects the reality that these products are unlikely to be sold at their original cost.

3. Write-downs of Inventory:

Similar to obsolescence, market fluctuations can lead to a decrease in the market value of inventory. If the net realizable value (the estimated selling price less costs to sell) of inventory falls below its cost, a write-down is necessary. This write-down is recorded as an expense, reflecting the reduction in the inventory's value.

4. Research and Development (R&D) Costs:

While some R&D costs might contribute to future product development, many are expensed immediately. Costs associated with unsuccessful product prototypes, failed experiments, or market research that doesn't lead to a successful product are immediately treated as period expenses.

5. Marketing and Distribution Costs:

Although related to the product's ultimate sale, marketing and distribution costs are generally treated as period expenses rather than product costs. This is because they are not directly tied to the manufacturing process. These costs support the sale of the product but are not part of its creation. Examples include advertising, sales commissions, and shipping costs.

Accounting for the Transition: Inventory Management Systems

Accurate accounting for the transition of product costs to expenses relies heavily on efficient inventory management systems. Two common methods are:

1. First-In, First-Out (FIFO):

This method assumes that the oldest inventory items are sold first. Therefore, the cost of goods sold reflects the cost of the oldest inventory.

2. Last-In, First-Out (LIFO):

This method assumes that the newest inventory items are sold first. Therefore, the cost of goods sold reflects the cost of the newest inventory.

The choice between FIFO and LIFO can significantly impact the reported COGS and gross profit, especially during periods of inflation or deflation. Understanding the implications of each method is essential for accurate financial reporting and tax planning.

Impact on Financial Statements

The accurate classification of product costs and their eventual recognition as expenses directly impacts the financial statements:

-

Income Statement: COGS directly affects gross profit (revenue - COGS), which influences net income. Incorrectly classifying costs can lead to inaccurate profit calculations and misrepresent the financial health of the business. Similarly, period expenses related to spoilage, obsolescence, or R&D directly impact the operating expenses section.

-

Balance Sheet: Inventory is a significant asset for many businesses. The accurate valuation of inventory, considering write-downs and obsolescence, is crucial for a true and fair representation of the company's financial position.

Strategic Implications for Business Decision-Making

Understanding the transition of product costs to expenses is not merely an accounting exercise; it has significant implications for strategic business decision-making:

-

Pricing Strategy: Accurate cost accounting enables businesses to determine a profitable selling price that covers both product costs and other expenses.

-

Inventory Management: Understanding the potential for spoilage, obsolescence, and write-downs drives efficient inventory management practices to minimize losses.

-

Production Planning: Analysis of production costs helps optimize production processes, identifying areas for cost reduction and improvement.

-

Investment Decisions: Detailed cost analysis is essential for making informed investment decisions in new equipment, technologies, or product lines.

Conclusion: A Holistic View of Product Cost Management

The journey of a product cost from its initial incurrence to its final classification as an expense is multifaceted. While COGS represents the primary transition point, various other scenarios can lead to product costs becoming period expenses. Effective accounting practices, robust inventory management systems, and a keen understanding of these transitions are critical for accurate financial reporting, strategic business decision-making, and overall success. Mastering these concepts empowers businesses to optimize their production processes, control costs, and enhance profitability. By accurately tracking and analyzing the entire lifecycle of product costs, businesses can develop a holistic understanding of their financial performance and make informed choices that drive sustainable growth. Continuous monitoring, regular reviews, and adaptation to market changes are essential for maintaining the accuracy and relevance of cost accounting practices in a dynamic business environment.

Latest Posts

Latest Posts

-

Evaluate The Line Integral Along The Curve C

Mar 27, 2025

-

Blitzer College Algebra 8th Edition Vs 9

Mar 27, 2025

-

Systems That Emphasize Collectivism Tend Toward

Mar 27, 2025

-

New Trade Theory Suggests That Nations

Mar 27, 2025

-

Basic Laboratory Techniques Pre Lab Questions Answers

Mar 27, 2025

Related Post

Thank you for visiting our website which covers about Product Costs That Have Become Expenses Can Be Found In . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.