Prepare Income Statements For Both Garcon Company And Pepper Company

Holbox

Mar 22, 2025 · 6 min read

Table of Contents

- Prepare Income Statements For Both Garcon Company And Pepper Company

- Table of Contents

- Preparing Income Statements for Garcon Company and Pepper Company: A Comprehensive Guide

- Understanding the Income Statement

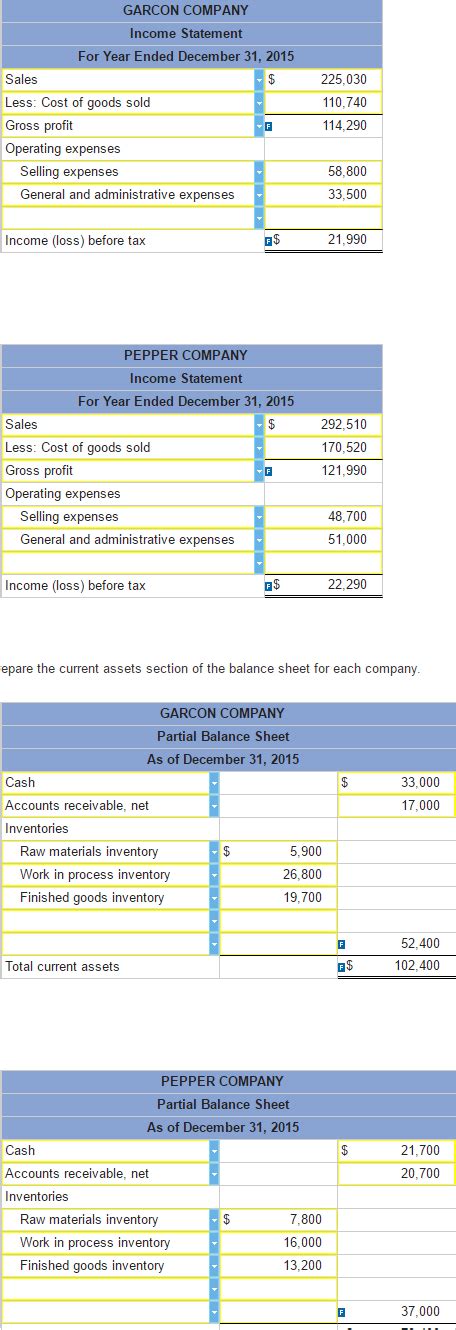

- Garcon Company Income Statement Example

- Pepper Company Income Statement Example

- Analyzing the Income Statements: Key Differences and Insights

- Challenges in Preparing Accurate Income Statements

- Best Practices for Accurate Income Statement Preparation

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

Preparing Income Statements for Garcon Company and Pepper Company: A Comprehensive Guide

Understanding how to prepare income statements is crucial for any business, regardless of size or industry. This comprehensive guide will walk you through the process, using the fictional Garcon Company and Pepper Company as examples. We'll explore different aspects of income statement preparation, including the importance of accurate data, common challenges, and best practices for ensuring accuracy and clarity.

Understanding the Income Statement

The income statement, also known as the profit and loss (P&L) statement, is a financial statement that summarizes a company's revenues, costs, and expenses during a specific period, usually a month, quarter, or year. Its primary purpose is to show the company's profitability over that period. A well-prepared income statement provides valuable insights into a company's financial health and performance, allowing for informed decision-making.

Key Components of an Income Statement:

- Revenue: The total amount of money a company earns from its primary operations. This includes sales of goods or services.

- Cost of Goods Sold (COGS): The direct costs associated with producing goods or services sold. This includes raw materials, direct labor, and manufacturing overhead.

- Gross Profit: The difference between revenue and COGS. This represents the profit a company makes after covering its direct costs. Gross Profit = Revenue - COGS

- Operating Expenses: Expenses incurred in running the business, excluding COGS. Examples include salaries, rent, utilities, marketing, and administrative expenses.

- Operating Income (EBIT): Earnings before interest and taxes. This indicates the profit generated from a company's core operations. Operating Income = Gross Profit - Operating Expenses

- Interest Expense: Expenses incurred on borrowed funds.

- Income Tax Expense: Taxes payable on the company's income.

- Net Income: The final profit after deducting all expenses and taxes. Net Income = Operating Income - Interest Expense - Income Tax Expense

Garcon Company Income Statement Example

Let's assume Garcon Company is a small retailer selling clothing. Here's a sample income statement for the year ended December 31, 2023:

Garcon Company Income Statement For the Year Ended December 31, 2023

| Revenue | $500,000 | |

|---|---|---|

| Cost of Goods Sold | $250,000 | |

| Gross Profit | $250,000 | |

| Operating Expenses: | ||

| Salaries | $80,000 | |

| Rent | $20,000 | |

| Utilities | $10,000 | |

| Marketing | $30,000 | |

| Administrative | $20,000 | |

| Total Operating Expenses | $160,000 | |

| Operating Income (EBIT) | $90,000 | |

| Interest Expense | $5,000 | |

| Income Before Taxes | $85,000 | |

| Income Tax Expense | $25,500 | |

| Net Income | $59,500 |

Pepper Company Income Statement Example

Pepper Company, on the other hand, is a manufacturing company producing furniture. Its income statement will have some differences due to its different nature of business.

Pepper Company Income Statement For the Year Ended December 31, 2023

| Revenue | $1,000,000 | |

|---|---|---|

| Cost of Goods Sold: | ||

| Raw Materials | $200,000 | |

| Direct Labor | $300,000 | |

| Manufacturing Overhead | $100,000 | |

| Total Cost of Goods Sold | $600,000 | |

| Gross Profit | $400,000 | |

| Operating Expenses: | ||

| Salaries | $150,000 | |

| Rent | $50,000 | |

| Utilities | $25,000 | |

| Marketing | $75,000 | |

| Administrative | $50,000 | |

| Total Operating Expenses | $350,000 | |

| Operating Income (EBIT) | $50,000 | |

| Interest Expense | $10,000 | |

| Income Before Taxes | $40,000 | |

| Income Tax Expense | $12,000 | |

| Net Income | $28,000 |

Analyzing the Income Statements: Key Differences and Insights

Comparing the income statements of Garcon and Pepper reveals significant differences reflecting their distinct business models:

-

Revenue Scale: Pepper Company generates significantly higher revenue than Garcon Company, reflecting its larger scale and different product offerings.

-

COGS: Pepper Company's COGS is considerably higher due to its manufacturing process, which includes substantial raw materials, direct labor, and manufacturing overhead. Garcon Company, as a retailer, has a much lower COGS.

-

Gross Profit Margin: The gross profit margin (Gross Profit / Revenue) is higher for Garcon Company (50%) than for Pepper Company (40%). This indicates that Garcon Company is more efficient in managing its direct costs compared to Pepper Company.

-

Operating Expenses: Pepper Company incurs significantly higher operating expenses, especially in salaries and marketing, reflecting the demands of its larger scale operation.

-

Net Income: While Pepper Company has much higher revenue, its net income is lower than Garcon Company's, primarily due to higher COGS and operating expenses. This highlights the importance of managing both revenue generation and expense control.

Challenges in Preparing Accurate Income Statements

Preparing accurate income statements can present various challenges:

-

Data Accuracy: Inaccurate or incomplete data is a major obstacle. Errors in recording revenue, costs, or expenses can significantly distort the financial picture. Robust accounting systems and procedures are crucial.

-

Timing Differences: Accrual accounting requires recognizing revenue and expenses when they are earned or incurred, rather than when cash changes hands. This can be complex and require careful judgment.

-

Allocation of Costs: Allocating indirect costs (like rent or utilities) across different departments or products can be challenging and requires a clear costing methodology.

-

Inventory Valuation: Proper valuation of inventory using methods like FIFO (First-In, First-Out) or LIFO (Last-In, First-Out) is vital for accurate COGS calculation.

-

Tax Compliance: Understanding and correctly applying tax regulations is crucial for accurate income tax expense calculation.

Best Practices for Accurate Income Statement Preparation

To ensure accurate and reliable income statements, follow these best practices:

-

Implement a robust accounting system: Invest in a reliable accounting software or system that automates data entry, tracks transactions, and generates financial reports accurately.

-

Develop clear accounting policies and procedures: Establish standardized procedures for recording revenue, expenses, and inventory. This ensures consistency and minimizes errors.

-

Regularly reconcile bank statements and accounts: Comparing bank statements with accounting records helps identify discrepancies and correct errors promptly.

-

Perform regular internal audits: Internal audits provide an independent assessment of the accuracy and reliability of financial information.

-

Seek professional accounting advice: Consult with a qualified accountant or CPA for assistance with complex accounting issues and tax compliance.

-

Utilize budgeting and forecasting: Developing realistic budgets and forecasts helps in planning and monitoring financial performance. Comparing actual results with the budget provides valuable insights into areas requiring attention.

-

Analyze variances: Regularly analyze variances between budgeted and actual figures to identify areas for improvement and take corrective actions.

Conclusion

Preparing accurate and insightful income statements is a cornerstone of effective financial management. By understanding the key components, common challenges, and best practices discussed in this guide, businesses like Garcon Company and Pepper Company can leverage their income statements to make informed decisions, improve profitability, and build a strong financial foundation. Remember that consistency, accuracy, and a proactive approach to financial management are key to creating truly valuable income statements. Regularly reviewing and analyzing these statements, coupled with robust accounting practices, will enable informed decision-making and sustainable business growth.

Latest Posts

Latest Posts

-

C Is Trying To Determine Whether To Convert

Mar 24, 2025

-

Which Of The Following Statements About Protein Digestion Are True

Mar 24, 2025

-

First Spouses Have No Influence Over Public Policy

Mar 24, 2025

-

A Customer Contacts A Chat Agent

Mar 24, 2025

-

The Installation Of Production Improvement Option D

Mar 24, 2025

Related Post

Thank you for visiting our website which covers about Prepare Income Statements For Both Garcon Company And Pepper Company . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.