Post The Transactions To The T-accounts

Holbox

Apr 04, 2025 · 6 min read

Table of Contents

- Post The Transactions To The T-accounts

- Table of Contents

- Posting Transactions to T-Accounts: A Comprehensive Guide

- Understanding T-Accounts

- The Journal Entry: The Foundation for T-Account Posting

- Posting to T-Accounts: A Step-by-Step Guide

- Different Transaction Types and Their Impact on T-Accounts

- Trial Balance and its Importance

- Advanced T-Account Applications: Adjusting Entries

- Importance of Accuracy and Best Practices

- Conclusion: Mastering T-Accounts for Financial Success

- Latest Posts

- Latest Posts

- Related Post

Posting Transactions to T-Accounts: A Comprehensive Guide

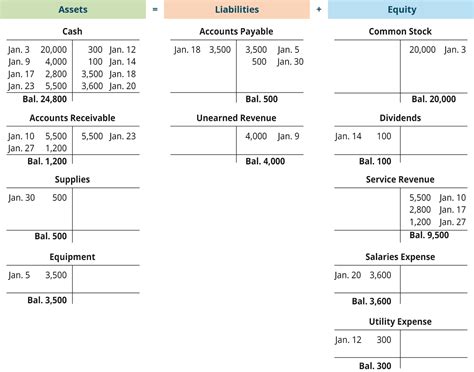

Posting transactions to T-accounts is a fundamental step in accounting. It's the process of transferring information from a journal entry to the respective accounts in the general ledger. Mastering this skill is crucial for understanding financial statements and ensuring the accuracy of your financial records. This comprehensive guide will walk you through the process step-by-step, covering various transaction types and offering practical examples.

Understanding T-Accounts

A T-account is a visual representation of a general ledger account. It resembles the letter "T," with the account name at the top. The left side (debit) and right side (credit) are used to record increases and decreases in the account balance, respectively.

Key Elements of a T-Account:

- Account Name: Clearly identifies the account (e.g., Cash, Accounts Receivable, Rent Expense).

- Debit Side (Left): Increases in asset, expense, and dividend accounts are recorded here.

- Credit Side (Right): Increases in liability, owner's equity, and revenue accounts are recorded here.

The Accounting Equation:

Understanding the accounting equation (Assets = Liabilities + Owner's Equity) is essential for accurate T-account posting. Every transaction affects at least two accounts, maintaining the balance of this equation.

The Journal Entry: The Foundation for T-Account Posting

Before posting to T-accounts, you need a journal entry. A journal entry is a chronological record of a business transaction. It includes:

- Date: The date the transaction occurred.

- Account Titles and Explanation: The accounts affected and a brief description of the transaction.

- Debit Column: The amount debited to each account.

- Credit Column: The amount credited to each account.

Example Journal Entry:

Let's say a company purchased office supplies for $100 cash. The journal entry would look like this:

| Date | Account Title and Explanation | Debit | Credit |

|---|---|---|---|

| October 26 | Office Supplies | $100 | |

| Cash | $100 | ||

| Purchased office supplies with cash |

Posting to T-Accounts: A Step-by-Step Guide

Now, let's post this journal entry to the respective T-accounts:

1. Office Supplies T-Account:

Office Supplies

-----------------

| Debit | Credit |

-----------------

| $100 | |

-----------------

The $100 debit increases the Office Supplies account, reflecting the increase in office supplies.

2. Cash T-Account:

Cash

-----------------

| Debit | Credit |

-----------------

| | $100 |

-----------------

The $100 credit decreases the Cash account, reflecting the cash outflow for the purchase.

Different Transaction Types and Their Impact on T-Accounts

Let's explore how various transaction types are posted to T-accounts:

1. Purchasing Inventory on Credit:

Suppose a company purchased inventory worth $500 on credit from a supplier.

- Journal Entry:

| Date | Account Title and Explanation | Debit | Credit |

|---|---|---|---|

| Nov 1 | Inventory | $500 | |

| Accounts Payable | $500 | ||

| Purchased inventory on credit |

- T-Accounts:

Inventory

-----------------

| Debit | Credit |

-----------------

| $500 | |

-----------------

Accounts Payable

-----------------

| Debit | Credit |

-----------------

| | $500 |

-----------------

2. Receiving Cash from Customers:

A company received $200 cash from a customer for services rendered.

- Journal Entry:

| Date | Account Title and Explanation | Debit | Credit |

|---|---|---|---|

| Nov 15 | Cash | $200 | |

| Service Revenue | $200 | ||

| Received cash for services rendered |

- T-Accounts:

Cash

-----------------

| Debit | Credit |

-----------------

| $200 | |

-----------------

Service Revenue

-----------------

| Debit | Credit |

-----------------

| | $200 |

-----------------

3. Paying Salaries:

The company paid its employees $1000 in salaries.

- Journal Entry:

| Date | Account Title and Explanation | Debit | Credit |

|---|---|---|---|

| Nov 30 | Salaries Expense | $1000 | |

| Cash | $1000 | ||

| Paid salaries to employees |

- T-Accounts:

Salaries Expense

-----------------

| Debit | Credit |

-----------------

| $1000 | |

-----------------

Cash

-----------------

| Debit | Credit |

-----------------

| | $1000 |

-----------------

4. Depreciation:

The company recorded depreciation expense of $50 on equipment.

- Journal Entry:

| Date | Account Title and Explanation | Debit | Credit |

|---|---|---|---|

| Dec 31 | Depreciation Expense | $50 | |

| Accumulated Depreciation - Equipment | $50 | ||

| Recorded depreciation expense |

- T-Accounts:

Depreciation Expense

-----------------

| Debit | Credit |

-----------------

| $50 | |

-----------------

Accumulated Depreciation - Equipment

-----------------

| Debit | Credit |

-----------------

| | $50 |

-----------------

Accumulated Depreciation is a contra-asset account. It reduces the value of the asset on the balance sheet.

Trial Balance and its Importance

After posting all transactions, a trial balance is prepared. A trial balance is a list of all general ledger accounts and their balances. It verifies that the total debits equal the total credits, ensuring the accounting equation remains balanced. This is a crucial step in the accounting cycle before preparing financial statements.

Advanced T-Account Applications: Adjusting Entries

Adjusting entries are made at the end of an accounting period to update accounts for transactions that haven't been fully recorded. These entries often involve accruals (expenses or revenues incurred but not yet recorded) or deferrals (prepaid expenses or unearned revenues). The same T-account posting principles apply.

Example: Accrued Salaries:

Suppose at the end of the year, $200 of salaries are owed to employees but haven't been paid yet.

- Adjusting Entry:

| Date | Account Title and Explanation | Debit | Credit |

|---|---|---|---|

| Dec 31 | Salaries Expense | $200 | |

| Salaries Payable | $200 | ||

| Accrued salaries |

- T-Accounts: The Salaries Expense account will be updated with the additional $200 debit, and a new Salaries Payable account will be created with a $200 credit.

Importance of Accuracy and Best Practices

Accuracy in posting transactions to T-accounts is paramount. Errors can lead to inaccurate financial statements and incorrect decision-making. Here are some best practices to ensure accuracy:

- Double-check your journal entries: Ensure debits equal credits before posting.

- Use a systematic approach: Post transactions in a logical order.

- Clearly label your T-accounts: Include the account name and date of transactions.

- Regularly reconcile your accounts: Compare your accounting records to bank statements and other external sources.

- Utilize accounting software: Accounting software automates many of these processes, reducing the risk of human error.

Conclusion: Mastering T-Accounts for Financial Success

Understanding and accurately posting transactions to T-accounts is a cornerstone of accounting. This process provides the foundation for generating accurate financial statements, which are crucial for making informed business decisions, attracting investors, and ensuring the long-term financial health of any organization. By following the steps outlined in this guide and adopting best practices, you can confidently navigate the complexities of accounting and maintain accurate financial records. Remember, practice makes perfect – the more you work with T-accounts, the more comfortable and proficient you will become.

Latest Posts

Latest Posts

-

The Phrase Ability To Do Work Is A Definition Of

Apr 07, 2025

-

What Expression Is Represented In The Model Below

Apr 07, 2025

-

When Hildegard Visited A Church Of Christ

Apr 07, 2025

-

Match Each Term With The Appropriate Definition

Apr 07, 2025

-

What Does I Mean In Python

Apr 07, 2025

Related Post

Thank you for visiting our website which covers about Post The Transactions To The T-accounts . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.