Perfect Price Discrimination Is Mostly Hypothetical

Holbox

Mar 28, 2025 · 5 min read

Table of Contents

- Perfect Price Discrimination Is Mostly Hypothetical

- Table of Contents

- Perfect Price Discrimination: A Mostly Hypothetical Ideal

- The Alluring Promise of Perfect Price Discrimination

- The Mechanics of Perfect Price Discrimination

- The Reality Check: Why Perfect Price Discrimination is Mostly Hypothetical

- 1. Information Asymmetry: The Knowledge Gap

- 2. The High Cost of Information Gathering

- 3. Practical Implementation Challenges

- 4. Ethical Concerns and Public Perception

- 5. The Problem of Resale and Arbitrage

- 6. Transaction Costs

- Examples of Imperfect Price Discrimination

- Conclusion: Perfect Price Discrimination as a Theoretical Benchmark

- Latest Posts

- Latest Posts

- Related Post

Perfect Price Discrimination: A Mostly Hypothetical Ideal

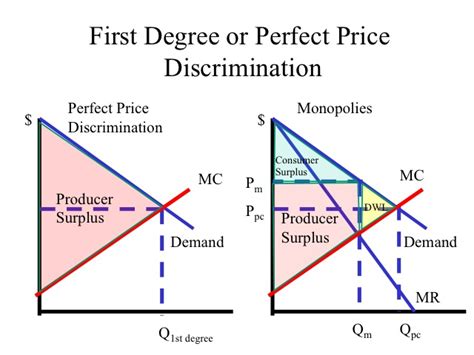

Perfect price discrimination, also known as first-degree price discrimination, is a theoretical microeconomic concept where a seller charges each customer the maximum price they are willing to pay. While it represents a theoretical maximum for a firm's profit, its practical application is largely hypothetical due to a number of significant constraints. This article delves into the intricacies of perfect price discrimination, exploring its theoretical underpinnings, its limitations, and why it remains primarily a useful theoretical tool rather than a realistic business model.

The Alluring Promise of Perfect Price Discrimination

The allure of perfect price discrimination is undeniable. Imagine a world where a business could extract the absolute maximum value from every single customer. No revenue would be left on the table; every sale would be optimized for maximum profit. This is the core promise of this pricing strategy. Theoretically, it leads to several compelling outcomes:

- Maximum Profit: By charging each customer their individual reservation price (the highest price they're willing to pay), the firm captures the entire consumer surplus, maximizing its profits.

- Increased Output: Because the firm can sell to consumers at their varying willingness-to-pay, it can expand its output beyond what would be possible under uniform pricing. Consumers who previously wouldn't have purchased the good at the market price now become profitable customers.

- No Deadweight Loss: In standard market models, deadweight loss represents a loss of potential economic efficiency. Under perfect price discrimination, this deadweight loss is entirely eliminated as all mutually beneficial trades occur.

The Mechanics of Perfect Price Discrimination

Achieving perfect price discrimination necessitates a deep understanding of each customer's individual demand curve. This requires the firm to:

- Identify Individual Demand: The firm must accurately determine the maximum price each potential customer is willing to pay for its product or service. This is often achieved through detailed market research, customer surveys, or sophisticated data analytics.

- Segment the Market: The firm needs to be able to divide its customer base into distinct segments based on their willingness-to-pay. This segmentation must be precise enough to allow for personalized pricing.

- Prevent Resale: Crucially, the firm must prevent customers who purchase at a lower price from reselling to those who purchased at a higher price. This prevents arbitrage and undermines the entire system.

The Reality Check: Why Perfect Price Discrimination is Mostly Hypothetical

Despite its theoretical appeal, several significant hurdles make perfect price discrimination a largely unattainable ideal in the real world:

1. Information Asymmetry: The Knowledge Gap

The most significant obstacle is information asymmetry. Firms rarely possess complete knowledge of each customer's willingness-to-pay. Customers often strategically conceal their true valuation to secure a better deal. Gathering this information accurately across a large customer base is exceptionally challenging and expensive.

2. The High Cost of Information Gathering

The process of collecting individual demand data is often prohibitively expensive. Extensive market research, customer profiling, and data analytics require significant resources, potentially outweighing the incremental profits generated by perfect price discrimination.

3. Practical Implementation Challenges

Implementing personalized pricing at scale is a logistical nightmare. It necessitates sophisticated IT infrastructure, dynamic pricing algorithms, and robust customer relationship management systems. The complexity of managing these systems can be overwhelming for many businesses.

4. Ethical Concerns and Public Perception

Perfect price discrimination can raise ethical concerns, particularly regarding fairness and equity. Charging customers different prices for the same product based on their perceived ability to pay can lead to negative public perception and potential regulatory scrutiny. This can significantly harm a brand's reputation.

5. The Problem of Resale and Arbitrage

Preventing resale is paramount for the success of perfect price discrimination. If customers who buy at a low price can easily resell to those who pay a higher price, the entire system collapses. This is especially challenging in digital markets where goods can be easily copied and distributed.

6. Transaction Costs

The administrative costs associated with implementing and maintaining a system of perfect price discrimination can be substantial. This includes the costs of data collection, analysis, customer segmentation, and personalized pricing adjustments. These costs often outweigh the potential benefits.

Examples of Imperfect Price Discrimination

While perfect price discrimination remains largely a theoretical concept, several business practices aim to approximate it. These strategies, however, fall short of true perfect price discrimination due to the aforementioned limitations:

- Versioning: Offering different versions of a product or service at different price points (e.g., different software packages with varying features). This leverages customer heterogeneity in their valuation of product features, but it doesn't capture the entire consumer surplus.

- Bundling: Offering a package deal combining multiple products or services at a discounted price. This allows businesses to extract more value from customers with diverse preferences but still falls short of individual pricing.

- Targeted Advertising and Personalized Offers: Using data analytics to target specific customer segments with tailored pricing offers. This improves efficiency over uniform pricing, but it doesn't reach the level of individual price optimization.

- Negotiation: Engaging in price negotiations with individual customers, particularly in B2B settings. This allows some degree of personalized pricing but is labor-intensive and doesn't guarantee extracting the maximum price.

These examples demonstrate that businesses constantly strive to find ways to better align price with willingness to pay. However, true perfect price discrimination remains a challenging goal due to informational and implementation barriers.

Conclusion: Perfect Price Discrimination as a Theoretical Benchmark

Perfect price discrimination, while theoretically compelling, remains mostly a hypothetical ideal. The complexities of information gathering, the high costs of implementation, ethical concerns, and the ever-present risk of arbitrage all conspire to prevent its widespread adoption. Its value lies primarily in its function as a theoretical benchmark, illustrating the potential maximum profit a firm could achieve under ideal conditions. Understanding its limitations helps us appreciate the practical challenges businesses face in setting optimal prices and in navigating the complexities of consumer behavior and market dynamics. The pursuit of more efficient pricing strategies continues, but the fully realized goal of perfect price discrimination remains firmly in the realm of theoretical economics. Real-world pricing strategies invariably involve compromises and approximations of this ideal, continually adapting to the challenges of information asymmetry, market competition, and consumer preferences. The continued exploration of these strategies, however, remains a vital area of research for economists and business strategists alike, leading to the development of increasingly sophisticated pricing models in a constantly evolving market environment.

Latest Posts

Latest Posts

-

Moles And Chemical Formulas Lab Report Answers

Mar 31, 2025

-

Unspoken Language Is Another Way To Describe Communication

Mar 31, 2025

-

Choose The Best Lewis Structure For Xei2

Mar 31, 2025

-

Which Of These Is Not A Product Of Glycolysis

Mar 31, 2025

-

Which Of The Following May Indicate A Potential Drug Overdose

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Perfect Price Discrimination Is Mostly Hypothetical . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.