Pensions Are Referred To As Defined Benefits Plans Because __________.

Holbox

Mar 21, 2025 · 6 min read

Table of Contents

- Pensions Are Referred To As Defined Benefits Plans Because __________.

- Table of Contents

- Pensions Are Referred to as Defined Benefit Plans Because… They Define Your Retirement Income

- Understanding the Core Promise: A Defined Retirement Income

- The Defining Formula: How Your Benefit is Calculated

- The Contrast: Defined Benefit vs. Defined Contribution

- Defined Contribution (DC) Plans: Uncertainty in Retirement

- Key Differences Summarized: DB vs. DC

- The Employer's Role: A Crucial Difference

- Actuarial Science and Funding: Managing the Risk

- The Evolution and Current State of Defined Benefit Plans

- The Rise of Defined Contribution Plans: A Shift in Paradigm

- Funding Challenges and Regulatory Changes: Increased Employer Burden

- The Impact of Economic Downturns: Increased Risk for Employers

- The Future of Defined Benefit Plans: A Look Ahead

- The Advantages of DB Plans: Still Relevant Today

- Potential for Revival and Hybrid Models: Exploring New Approaches

- Conclusion: A Defined Legacy

- Latest Posts

- Latest Posts

- Related Post

Pensions Are Referred to as Defined Benefit Plans Because… They Define Your Retirement Income

Pensions, often lauded as the gold standard of retirement savings, are formally known as Defined Benefit (DB) plans. But why the name? The answer lies in the core promise of a DB pension: a defined level of retirement income. Unlike Defined Contribution (DC) plans, where the final payout is uncertain, DB plans guarantee a specific monthly payment upon retirement, making them significantly different from other retirement savings vehicles. This article delves deep into the characteristics of DB plans, exploring why they earn their moniker, contrasting them with DC plans, and examining their current status and future prospects.

Understanding the Core Promise: A Defined Retirement Income

The term "defined benefit" is crucial. It means the plan explicitly defines the amount of retirement income you'll receive. This amount is typically calculated based on a formula considering factors such as your salary, years of service, and sometimes, age at retirement. This formula is laid out in the pension plan document, providing employees with a clear picture of their future retirement income. This contrasts sharply with the uncertainty inherent in DC plans, which depend on investment performance and individual contribution levels.

The Defining Formula: How Your Benefit is Calculated

The precise formula used to calculate the benefit varies between pension plans, but common elements include:

- Average Salary: Often, the average salary over a specific period (e.g., the final three or five years of employment) is used. This helps to smooth out any temporary fluctuations in income.

- Years of Service: The longer you work for the company, the larger your pension benefit will be. This incentivizes employee loyalty and retention.

- Accrual Rate: This is a percentage that determines how much of your salary is converted into pension income for each year of service. A higher accrual rate means a larger pension benefit for the same amount of service.

Example: A typical formula might be: (Average Salary x Years of Service x Accrual Rate). If your average salary was $70,000, you worked for 30 years, and the accrual rate is 2%, your annual pension benefit would be calculated as: ($70,000 x 30 x 0.02) = $42,000. This would usually be paid monthly.

This clear and predetermined calculation is the cornerstone of a Defined Benefit plan, distinguishing it from the variable nature of Defined Contribution schemes.

The Contrast: Defined Benefit vs. Defined Contribution

To fully appreciate the "defined benefit" aspect, a comparison with Defined Contribution (DC) plans is essential.

Defined Contribution (DC) Plans: Uncertainty in Retirement

In a DC plan, such as a 401(k) or 403(b), your contributions (and often employer matching contributions) are invested in various assets, like stocks and bonds. The final value of your retirement savings depends entirely on the performance of these investments. There's no guaranteed amount; the final payout is variable and uncertain. While you have control over your investment choices, market fluctuations can significantly impact your retirement savings. The risk is entirely on the employee.

Key Differences Summarized: DB vs. DC

| Feature | Defined Benefit (DB) | Defined Contribution (DC) |

|---|---|---|

| Benefit | Guaranteed monthly payment at retirement | Variable, depends on investment returns |

| Risk | Primarily borne by the employer | Primarily borne by the employee |

| Contribution | Employer determines and contributes | Employee contributes, employer may match |

| Investment | Employer manages investments | Employee manages investments |

| Predictability | Highly predictable | Highly unpredictable |

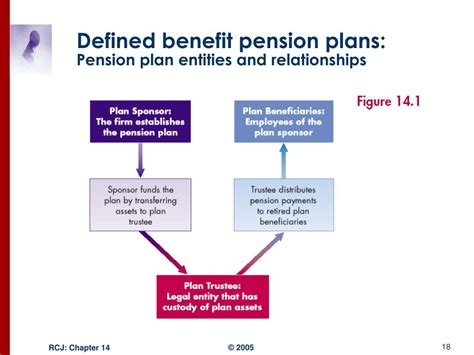

The Employer's Role: A Crucial Difference

In a DB plan, the employer shoulders the investment risk. They are responsible for ensuring that the plan has sufficient assets to pay out the promised benefits to retirees. This responsibility requires sophisticated actuarial calculations to project future liabilities and manage the plan's assets accordingly. This is a significant undertaking, contrasting sharply with DC plans where the investment responsibility rests solely with the employee.

Actuarial Science and Funding: Managing the Risk

Actuaries play a vital role in managing DB plans. They use complex statistical models to project future pension obligations, considering factors like employee demographics, salary growth, and expected investment returns. Based on these projections, employers contribute funds to the plan to ensure it remains adequately funded to meet its future liabilities. This process is crucial for maintaining the plan's solvency and ensuring that retirees receive their promised benefits.

The Evolution and Current State of Defined Benefit Plans

While once the dominant form of retirement plan, the prevalence of DB pensions has declined significantly in recent decades. Several factors have contributed to this shift.

The Rise of Defined Contribution Plans: A Shift in Paradigm

The increasing popularity of DC plans, partly fueled by the perception of greater employee control and flexibility, has led to a reduction in the number of DB plans offered by employers. The administrative simplicity and reduced liability for employers make DC plans attractive alternatives.

Funding Challenges and Regulatory Changes: Increased Employer Burden

Funding DB plans has become increasingly challenging due to prolonged periods of low interest rates, increased longevity, and higher-than-anticipated healthcare costs for retirees. Regulatory changes have also added to the administrative burden and cost of managing DB plans.

The Impact of Economic Downturns: Increased Risk for Employers

Economic downturns exacerbate the challenges faced by DB plans, as investment losses can deplete the plan's assets and increase the employer's funding obligations. This risk makes employers hesitant to offer or maintain DB plans.

The Future of Defined Benefit Plans: A Look Ahead

Despite their decline, DB plans still hold significant value and may experience a resurgence in certain sectors.

The Advantages of DB Plans: Still Relevant Today

DB plans offer several advantages, including:

- Guaranteed Income: The most significant advantage is the guaranteed income stream in retirement. This provides retirees with financial security and predictability.

- Reduced Investment Risk: The risk of investment losses is borne by the employer, freeing retirees from market volatility concerns.

- Inflation Protection: Some DB plans offer inflation protection, ensuring that the pension keeps pace with rising prices.

Potential for Revival and Hybrid Models: Exploring New Approaches

The future of DB plans may involve a combination of factors. The development of more sophisticated actuarial models, innovative investment strategies, and potentially government support could make DB plans more financially viable for employers. We may also see a rise in hybrid models that combine elements of DB and DC plans, offering employees a degree of certainty and flexibility.

Conclusion: A Defined Legacy

Pensions are indeed referred to as defined benefit plans because they offer a defined and guaranteed level of retirement income. This clear and predetermined benefit, calculated using a specific formula, distinguishes DB plans from the variable payouts of DC plans. While their prevalence has decreased due to various factors, the inherent advantages of DB plans, namely the guaranteed income and reduced risk for retirees, remain compelling. The future likely holds a mixture of traditional DB plans, innovative hybrid models, and continued growth of DC plans, reflecting a broader spectrum of retirement savings solutions. The key takeaway remains that DB plans, despite the challenges they face, continue to represent a powerful and sought-after promise: a defined path to a secure retirement.

Latest Posts

Latest Posts

-

Is About 239 000 Miles From Earth

Mar 28, 2025

-

Type D Personality Is Most Closely Associated With

Mar 28, 2025

-

An Inverted U Tube Manometer Containing Oil

Mar 28, 2025

-

The Four Major Types Of Enterprise Applications Are

Mar 28, 2025

-

The Following Costs Were Incurred In May

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about Pensions Are Referred To As Defined Benefits Plans Because __________. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.