Outstanding Checks Refer To Checks That Have Been

Holbox

Mar 17, 2025 · 7 min read

Table of Contents

Outstanding Checks: A Comprehensive Guide for Businesses and Individuals

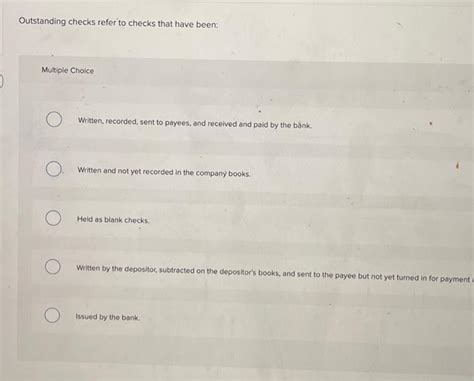

Outstanding checks refer to checks that have been issued but haven't yet been cashed or processed by the bank. Understanding outstanding checks is crucial for accurate financial record-keeping, preventing overdrafts, and maintaining a healthy cash flow. This comprehensive guide will delve into the intricacies of outstanding checks, exploring their implications for both businesses and individuals, and offering practical strategies for effective management.

What are Outstanding Checks?

An outstanding check represents a discrepancy between your records and your bank's records. You've written the check, deducted it from your checkbook register, but the recipient hasn't yet deposited it. This creates a temporary imbalance, as your bank statement doesn't reflect this expenditure. These checks remain "outstanding" until they are cleared by the bank.

The Reconciliation Process: Unveiling the Mystery of Outstanding Checks

The process of reconciling your bank statement is where outstanding checks become highly relevant. Reconciliation involves comparing your bank statement with your own records (checkbook register, accounting software) to identify discrepancies. Outstanding checks are a major source of these discrepancies. You'll list all outstanding checks on your reconciliation statement, ensuring that the amounts are properly accounted for. This process helps ensure accuracy and prevents unexpected overdrafts.

Why are Outstanding Checks Important?

Understanding and managing outstanding checks is paramount for several reasons:

- Accurate Financial Statements: Outstanding checks directly impact the accuracy of your financial statements. Failure to account for them leads to inaccurate cash balances and potentially flawed financial reporting.

- Preventing Overdrafts: Ignoring outstanding checks can lead to overdraft fees. If you write a check for a larger amount than available in your account, and several outstanding checks are also pending, you risk incurring overdraft charges.

- Improved Cash Flow Management: Tracking outstanding checks helps you monitor your cash flow more effectively. By knowing which checks are still outstanding, you can better predict your future cash position.

- Fraud Detection: Monitoring outstanding checks can be a valuable tool in detecting potential fraud. Unusually large or numerous outstanding checks might warrant further investigation.

- Improved Internal Controls: A robust system for tracking outstanding checks strengthens your internal controls, enhancing the accuracy and reliability of your financial reporting.

Identifying and Tracking Outstanding Checks: Practical Strategies

Effective management of outstanding checks requires a robust system for identifying and tracking them. Here's a breakdown of effective strategies:

- Maintain a Detailed Check Register: This is the cornerstone of outstanding check management. Every check you write should be meticulously recorded in your check register, including the check number, date, payee, and amount.

- Regular Bank Reconciliation: Regularly reconcile your bank statement with your check register. This process should be performed at least monthly, if not more frequently.

- Use Checkbook Software: Accounting software or dedicated checkbook software can automate many aspects of check tracking and reconciliation, reducing the risk of errors.

- Digital Check Imaging: Some banks offer digital check imaging services, providing you with electronic copies of your checks. This can facilitate easier tracking and reconciliation.

- Dedicated Outstanding Check Register: Maintaining a separate register specifically for outstanding checks can further enhance tracking accuracy. This allows you to clearly monitor which checks are still outstanding and their corresponding amounts.

Outstanding Checks: Implications for Businesses

For businesses, the implications of outstanding checks are even more significant. Accurate and timely processing of checks is crucial for maintaining accurate financial records, ensuring smooth operations, and meeting legal and regulatory obligations.

Businesses and Cash Flow Projections: The Crucial Role of Outstanding Checks

Effective management of outstanding checks is essential for accurate cash flow forecasting. Businesses rely on accurate cash flow projections for decision-making, budgeting, and financial planning. Ignoring outstanding checks leads to inaccurate projections, potentially impacting strategic decisions.

The Impact of Outstanding Checks on Business Creditworthiness

Outstanding checks, when improperly managed, can negatively affect a business's creditworthiness. Consistent failure to manage outstanding checks may indicate poor financial practices, potentially hindering the business's ability to secure loans or lines of credit.

Internal Controls and Segregation of Duties: Mitigating Risk

Businesses should establish robust internal controls for managing checks, including segregation of duties. Having different individuals responsible for writing checks, signing checks, and reconciling bank statements minimizes the risk of errors and potential fraud.

Outstanding Checks: Implications for Individuals

While the consequences of poorly managed outstanding checks might seem less severe for individuals than for businesses, neglecting them can still lead to significant financial headaches.

Preventing Overdrafts and Fees: A Personal Finance Perspective

Individuals, just like businesses, need to diligently track outstanding checks to avoid overdrafts and associated fees. These fees can quickly accumulate, impacting personal finances.

Accurate Budgeting and Financial Planning: The Importance of Detail

Accurate tracking of outstanding checks is critical for individuals aiming to create and maintain a sound personal budget. Ignoring outstanding checks can lead to inaccurate budget estimates and flawed financial planning.

Maintaining Good Banking Relationships: Avoiding Negative Consequences

Neglecting outstanding checks can damage your relationship with your bank. Repeated overdrafts due to poor check management can result in penalties and even account closure.

Outstanding Checks and Bank Reconciliation: A Step-by-Step Guide

Bank reconciliation is the crucial process of verifying the accuracy of your bank statement. Outstanding checks are a vital component of this process. Here’s a step-by-step guide:

-

Gather your documents: You'll need your bank statement, your check register, and a list of any deposits in transit (deposits made but not yet reflected on the statement).

-

Compare your bank balance to your book balance: Start by comparing the ending balance on your bank statement to the ending balance in your check register. These balances will likely differ due to outstanding checks, deposits in transit, bank charges, and other adjustments.

-

Identify outstanding checks: Carefully review your check register and identify any checks that haven't cleared your bank. Note the check number, date, and amount of each outstanding check.

-

Prepare a reconciliation statement: Create a reconciliation statement, listing all outstanding checks, deposits in transit, bank charges, and other adjustments.

-

Calculate the adjusted balances: Use the reconciliation statement to calculate the adjusted balance for both your bank statement and your check register. Once the adjusted balances match, your reconciliation is complete.

-

Investigate Discrepancies: If the adjusted balances do not match, thoroughly review your records and the bank statement to identify the source of the discrepancy.

Frequently Asked Questions (FAQs)

Q: How long does it typically take for a check to clear?

A: The time it takes for a check to clear varies depending on several factors, including the bank, the location of the payer and payee, and the type of account. It can range from a few days to a couple of weeks.

Q: What should I do if I lose track of an outstanding check?

A: If you lose track of an outstanding check, contact the payee immediately. They can confirm whether they've deposited the check. If it hasn't been deposited, you can void the check and issue a new one.

Q: Can I stop payment on an outstanding check?

A: Yes, you can usually stop payment on an outstanding check, but this should be done promptly before it clears. There are typically fees associated with stopping payment.

Q: What if an outstanding check is returned as NSF (Non-Sufficient Funds)?

A: If an outstanding check is returned NSF, it means the payer didn't have sufficient funds in their account to cover the check. You will likely need to contact the payer and arrange for payment.

Q: How can I prevent outstanding check issues?

A: Maintain accurate records, reconcile your bank statement regularly, and use accounting software to help manage your checks effectively. Avoid writing checks for amounts exceeding your available balance.

Conclusion

Effectively managing outstanding checks is vital for accurate financial record-keeping, preventing overdrafts, and maintaining a healthy cash flow, whether you're an individual or a business. By implementing the strategies outlined in this guide, you can minimize the risk associated with outstanding checks and improve your financial management practices. Remember, proactive and consistent record-keeping is your best defense against the potential headaches of outstanding checks.

Latest Posts

Latest Posts

-

100 Summer Vacation Words Answer Key Pdf

Mar 17, 2025

-

Goal Displacement Satisficing And Groupthink Are

Mar 17, 2025

-

Where Should Glassware Be Stored After It Is Cleaned

Mar 17, 2025

-

A Favorable Labor Rate Variance Indicates That

Mar 17, 2025

-

Split The Worksheet Into Panes At Cell D16

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Outstanding Checks Refer To Checks That Have Been . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.