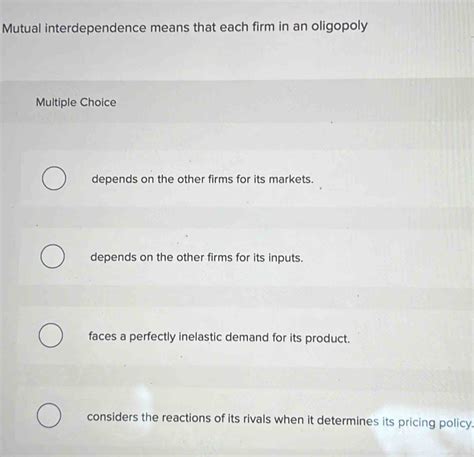

Mutual Interdependence Means That Each Firm In An Oligopoly

Holbox

Mar 20, 2025 · 6 min read

Table of Contents

Mutual Interdependence in Oligopoly: A Deep Dive into Strategic Interactions

Mutual interdependence is a cornerstone of oligopoly, a market structure characterized by a small number of firms dominating the industry. Unlike perfect competition or monopolies, firms in an oligopoly cannot act independently. Their actions, whether regarding pricing, output, advertising, or research and development, directly impact their competitors and vice-versa. This intricate interplay creates a complex environment where strategic decision-making is paramount for success. This article will explore the nuances of mutual interdependence in oligopolies, examining its implications for pricing, output, and overall market dynamics.

Understanding Mutual Interdependence

Mutual interdependence means that each firm's actions significantly affect the profits and market share of its rivals, and, in turn, the rivals' reactions substantially influence the original firm's outcomes. This contrasts sharply with perfect competition where individual firms are too small to influence market prices, and monopolies where a single firm holds complete market power.

In an oligopoly, the interdependence is evident in several ways:

- Price Wars: If one firm lowers its price, competitors are likely to follow suit to maintain their market share, potentially triggering a price war that diminishes profits for all involved.

- Output Decisions: Increasing production by one firm can lead to a surplus in the market, driving down prices and affecting the profitability of all firms.

- Advertising and Marketing Campaigns: A firm's advertising strategy can significantly impact the demand for its products and the market share of its competitors. Aggressive marketing might necessitate a response from rivals, leading to escalating advertising expenses.

- Technological Innovation: Investing in research and development (R&D) to improve products or processes can give a firm a competitive edge. However, competitors might react by investing in their own R&D, leading to a technological arms race.

The Game Theory Perspective

Mutual interdependence is best understood through the lens of game theory, which analyzes strategic interactions between rational decision-makers. Oligopolies are often modeled using game-theoretic frameworks like the Prisoner's Dilemma or Cournot duopoly to illustrate the challenges firms face in coordinating their actions.

The Prisoner's Dilemma

The Prisoner's Dilemma illustrates the tension between cooperation and self-interest. In the context of an oligopoly, each firm has an incentive to cheat (e.g., lower prices or increase output) to maximize its individual profit, even though the collective outcome (a price war or overproduction) is detrimental to all.

The dilemma arises because the best strategy for each firm depends on the actions of its rivals. If competitors cooperate, a firm might benefit from cooperating. However, if competitors defect, a firm's best strategy is also to defect, even if it leads to a worse outcome for all.

Cournot Duopoly

The Cournot duopoly model focuses on the interdependence of output decisions. Two firms simultaneously choose their production levels, taking the other firm's output as given. The market price is then determined by the total quantity produced by both firms. Each firm seeks to maximize its profit by choosing its optimal output level given the anticipated output of its competitor.

This model highlights the strategic nature of output decisions in an oligopoly. A firm's optimal output is not independent of its competitor's actions. Changes in one firm's output will influence the market price and subsequently affect the profits of both firms.

Implications of Mutual Interdependence for Pricing Strategies

Mutual interdependence profoundly influences pricing strategies. Firms must consider how their pricing decisions will affect their competitors and the resulting market reaction. Several pricing strategies emerge in the context of mutual interdependence:

- Price Leadership: One firm (often the largest or most efficient) acts as a price leader, setting the price for the industry. Other firms then follow the leader's price to avoid a price war.

- Price Wars: If firms fail to coordinate their pricing strategies, a price war can erupt, leading to lower prices and reduced profits for all.

- Collusion: Firms might attempt to collude, explicitly or implicitly, to fix prices or output levels. This can lead to higher prices and profits but is often illegal under antitrust laws.

- Predatory Pricing: A dominant firm might engage in predatory pricing, temporarily lowering prices below cost to drive out competitors and then raising prices once the competition is eliminated.

The Role of Information and Expectations

The effectiveness of strategic decision-making in an oligopoly heavily relies on information and expectations.

- Information: Access to accurate information about competitors' costs, production levels, and pricing strategies is crucial for making informed decisions. Market research, industry analysis, and intelligence gathering play a significant role.

- Expectations: Firms must also consider their expectations about competitors' future actions. If a firm anticipates its competitors will react aggressively to a price cut, it might be hesitant to lower its prices. Similarly, if a firm believes its competitors will not respond to an increase in output, it might choose to expand production.

The Impact of Barriers to Entry

High barriers to entry reinforce the characteristics of an oligopoly and amplify the effects of mutual interdependence. These barriers could include:

- Economies of scale: Large firms can produce at lower average costs than smaller firms, making it difficult for new entrants to compete.

- High capital requirements: Significant investment is needed to enter the market, discouraging new entrants.

- Product differentiation: Strong brands and differentiated products can create loyalty, making it challenging for new entrants to gain market share.

- Government regulations: Licenses, permits, or other regulations can restrict entry into the market.

Beyond Price and Output: Other Dimensions of Interdependence

Mutual interdependence extends beyond just price and output decisions. It influences several other aspects of firm behaviour:

- Advertising and Marketing: Advertising strategies are inherently intertwined. A firm's advertising campaign can steal market share from competitors, prompting retaliatory actions.

- Research and Development: Firms in an oligopoly often engage in intense R&D competition, striving to develop superior products or more efficient processes. This competitive pressure can lead to rapid technological innovation but also high R&D expenditure.

- Mergers and Acquisitions: Firms may merge or acquire competitors to reduce the number of players in the market and lessen the intensity of competition.

- Corporate Social Responsibility (CSR): Increasingly, firms are considering their CSR initiatives, including environmental sustainability and ethical labor practices. The actions of one firm in this regard can influence the behavior of its competitors, leading to a diffusion of best practices.

Conclusion: Navigating the Complexities of Mutual Interdependence

Mutual interdependence presents both challenges and opportunities for firms in an oligopoly. The need to anticipate and react to competitors' actions necessitates careful strategic planning and a deep understanding of the market. Firms must be adept at assessing the risks and rewards associated with various strategies, from price leadership to aggressive competition. While cooperation can lead to higher profits, the inherent temptation to defect and the risk of antitrust scrutiny make coordination challenging. Ultimately, success in an oligopolistic market depends on a firm's ability to effectively navigate this complex landscape of strategic interactions, leveraging information, anticipating rivals' moves, and adapting to a constantly evolving competitive environment. The dynamics described above underscore the importance of robust market analysis, informed decision-making, and a keen understanding of game theory principles for firms operating within oligopolistic market structures. The constant push and pull of interdependence shapes not just individual firm performance but also the broader market dynamics, creating a compelling and often unpredictable business environment.

Latest Posts

Latest Posts

-

Focus Forecasting Is Based On The Principle That

Mar 21, 2025

-

Will Jill And Phil Are All Wheat Farmers

Mar 21, 2025

-

Managers Who Advocate Job Enrichment Focus On Creating Jobs With

Mar 21, 2025

-

A Patient Is Put On Medication At 20 Mg

Mar 21, 2025

-

An Account Is Said To Have A Debit Balance If

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about Mutual Interdependence Means That Each Firm In An Oligopoly . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.