An Account Is Said To Have A Debit Balance If

Holbox

Mar 21, 2025 · 7 min read

Table of Contents

- An Account Is Said To Have A Debit Balance If

- Table of Contents

- An Account is Said to Have a Debit Balance If… Understanding Debits and Credits

- What is a Debit Balance?

- Debits and Credits: The Fundamental Accounting Equation

- 1. Asset Accounts

- 2. Liability Accounts

- 3. Equity Accounts

- 4. Revenue Accounts

- 5. Expense Accounts

- When Does an Account Have a Debit Balance?

- Analyzing Debit Balances: What to Look For

- Interpreting Debit Balances in Different Contexts

- Conclusion: The Importance of Understanding Debit Balances

- Latest Posts

- Latest Posts

- Related Post

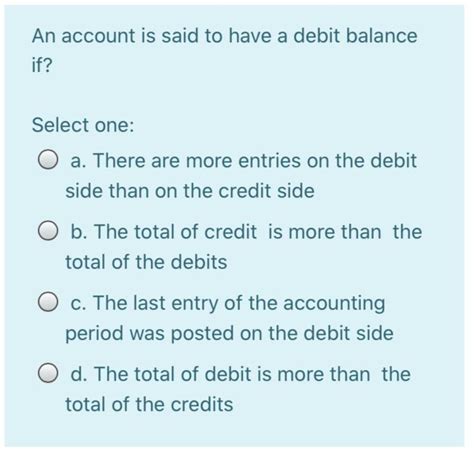

An Account is Said to Have a Debit Balance If… Understanding Debits and Credits

Understanding debit and credit balances is fundamental to accounting and finance. While the terms might seem intimidating, grasping their core principles unlocks a deeper comprehension of financial statements and overall financial health. This comprehensive guide will delve into the intricacies of debit balances, explaining when an account possesses one and its implications. We'll explore various account types, providing clear examples to solidify your understanding.

What is a Debit Balance?

Simply put, an account has a debit balance when the total debits exceed the total credits. Debits and credits are entries made to record financial transactions. They are essentially bookkeeping mechanisms used to track increases and decreases in different account types. Think of them as a system of double-entry bookkeeping, ensuring that the accounting equation (Assets = Liabilities + Equity) always remains balanced.

The crucial takeaway here is that the meaning of a debit or credit depends entirely on the type of account. This is where many beginners stumble. A debit isn't inherently "good" or "bad," nor is a credit. Their impact is context-dependent.

Debits and Credits: The Fundamental Accounting Equation

The accounting equation serves as the bedrock of double-entry bookkeeping:

Assets = Liabilities + Equity

Every transaction affects at least two accounts to maintain this balance. Let's break down how debits and credits interact with each account type:

1. Asset Accounts

Asset accounts represent what a company owns. Examples include cash, accounts receivable (money owed to the company), inventory, and equipment. For asset accounts, a debit increases the balance, and a credit decreases the balance.

- Example: If a company receives $1,000 in cash, a debit of $1,000 is recorded in the cash account (increasing the cash balance). Conversely, if the company sells equipment for $500, a credit of $500 is recorded in the equipment account (decreasing its value).

2. Liability Accounts

Liability accounts represent what a company owes to others. Examples include accounts payable (money owed to suppliers), loans payable, and salaries payable. For liability accounts, a debit decreases the balance, and a credit increases the balance.

- Example: If a company pays off $500 of its accounts payable, a debit of $500 is recorded in the accounts payable account (decreasing the amount owed). If the company takes out a $10,000 loan, a credit of $10,000 is recorded in the loan payable account (increasing the amount owed).

3. Equity Accounts

Equity accounts represent the owners' stake in the company. Examples include common stock, retained earnings, and dividends. For equity accounts, a debit decreases the balance, and a credit increases the balance.

- Example: If a company pays out dividends of $2,000, a debit of $2,000 is recorded in the retained earnings account (decreasing retained earnings). If the company issues new shares of stock for $50,000, a credit of $50,000 is recorded in the common stock account (increasing equity).

4. Revenue Accounts

Revenue accounts record the income generated by a company's operations. Examples include sales revenue, service revenue, and interest revenue. For revenue accounts, a debit decreases the balance, and a credit increases the balance.

- Example: A company provides services and earns $3,000. A credit of $3,000 is recorded in the service revenue account.

5. Expense Accounts

Expense accounts record the costs incurred by a company in generating revenue. Examples include rent expense, salaries expense, and utilities expense. For expense accounts, a debit increases the balance, and a credit decreases the balance.

- Example: A company pays $1,000 in rent. A debit of $1,000 is recorded in the rent expense account.

When Does an Account Have a Debit Balance?

An account will have a debit balance when the sum of all debit entries exceeds the sum of all credit entries. This is perfectly normal and expected for certain account types. Here's a breakdown:

-

Asset Accounts: A debit balance in an asset account signifies that the company possesses a particular asset. A healthy positive balance in accounts like cash, accounts receivable, and inventory indicates financial strength. However, an unusually high balance might warrant further investigation to ensure efficient management of assets.

-

Expense Accounts: A debit balance in an expense account is also expected. Expenses are recorded as debits, and credits to expense accounts are typically used for correcting entries or adjustments. A significant debit balance indicates operational costs, and comparing this balance against revenue helps determine profitability.

-

Drawing Account (Proprietorship): In sole proprietorship accounting, the drawing account shows the owner’s withdrawals from the business. Debits increase this account, reflecting withdrawals of assets for personal use.

-

Dividend Account (Corporations): Similar to the drawing account, debits to the dividend account reflect payments made to shareholders, decreasing retained earnings and equity.

Analyzing Debit Balances: What to Look For

While a debit balance is normal for certain accounts, it's crucial to analyze the context. Here are some key considerations:

-

Unusually High Balances: An unexpectedly large debit balance in an asset account might indicate inefficient asset management, excess inventory, or slow collection of receivables. Similarly, a significantly high expense balance could signal areas for cost control improvements.

-

Unexpected Debit Balances: A debit balance in a liability, equity, or revenue account is typically a sign of an error. This requires careful examination of the transactions to identify and correct the mistake.

-

Comparative Analysis: Comparing debit balances across different periods (e.g., comparing this year's balance to last year's) reveals trends and helps in identifying potential problems or improvements.

-

Industry Benchmarks: Comparing a company's debit balances to industry averages provides valuable insights into performance relative to competitors.

Interpreting Debit Balances in Different Contexts

Let's illustrate the significance of debit balances with some specific examples:

Example 1: Cash Account

A company has a cash account with a debit balance of $50,000. This is a positive sign, showing that the company possesses $50,000 in readily available funds. However, if this balance is significantly lower than expected or has been declining steadily, it may signal potential cash flow problems.

Example 2: Accounts Receivable Account

An accounts receivable account with a debit balance of $20,000 indicates that the company is owed $20,000 by its customers. A high and consistently increasing balance might point to inefficient credit collection procedures.

Example 3: Rent Expense Account

A rent expense account with a debit balance of $12,000 reflects the company's rent costs for a given period. This is a typical scenario; however, a disproportionately large rent expense compared to revenue could indicate the need for a more cost-effective location.

Example 4: Accounts Payable Account

A debit balance in the accounts payable account signals a decrease in the amount owed to suppliers. A credit balance, on the other hand, represents the opposite – money still owed to suppliers. A debit balance here is generally positive. However, if it's surprisingly high, it might suggest overpayment or accounting errors that require investigation.

Example 5: Retained Earnings Account

A debit balance in the retained earnings account suggests a net loss accumulated over time. While perfectly possible (and common during a business's startup phase), a persistent and growing deficit demands urgent attention. It necessitates an analysis of revenue streams, expense control, and overall business strategy.

Conclusion: The Importance of Understanding Debit Balances

Mastering the concept of debit and credit balances is essential for anyone involved in accounting or finance. Understanding when an account holds a debit balance, and what that implies in different contexts, empowers you to analyze financial statements effectively, pinpoint areas needing improvement, and ultimately, make informed business decisions. Remember, debits and credits are simply tools – the key is understanding how to use them correctly to interpret the financial health of a business. Regularly reviewing and analyzing debit and credit balances is a crucial step in proactive financial management. By understanding the implications of debit balances, businesses can stay ahead of potential problems and make well-informed choices for their financial future.

Latest Posts

Latest Posts

-

Which Arrow Represents The Flow Of Goods And Services

Mar 28, 2025

-

What Escape Planning Factors Can Facilitate Or Hinder Your Escape

Mar 28, 2025

-

The Illusion Of Invulnerability Is Best Defined By The Phrase

Mar 28, 2025

-

What Restriction Would The Government Impose In A Closed Economy

Mar 28, 2025

-

How Much Force Is Needed To Balance This System

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about An Account Is Said To Have A Debit Balance If . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.