Managerial Accounting Primarily Provides Information To

Holbox

Mar 19, 2025 · 6 min read

Table of Contents

Managerial Accounting Primarily Provides Information To: Internal Users for Decision-Making

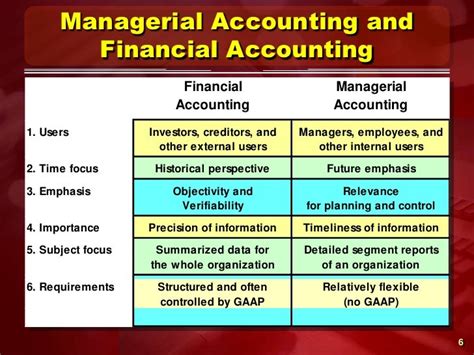

Managerial accounting, unlike financial accounting, doesn't prepare reports for external stakeholders like investors or creditors. Instead, its primary function is to provide information to internal users within an organization to aid in decision-making and operational efficiency. This information is crucial for planning, controlling, and evaluating the organization's performance. This article will delve deep into the various aspects of managerial accounting, exploring the types of information it provides, the users who benefit from it, and its critical role in organizational success.

The Key Internal Users of Managerial Accounting Information

Several key internal users rely heavily on the insights provided by managerial accounting. These include:

1. Managers at All Levels:

From frontline supervisors to top-level executives, managers at all levels utilize managerial accounting information for various purposes. This information allows them to:

- Set realistic goals and budgets: Managerial accounting provides data on past performance, current trends, and anticipated future conditions. This data is instrumental in creating achievable budgets and setting realistic targets for different departments and teams.

- Monitor progress and performance: Regular reports and analyses generated through managerial accounting enable managers to track progress toward goals and identify areas requiring attention or corrective action. Variance analysis, for example, highlights discrepancies between planned and actual results.

- Make informed decisions: Access to relevant cost and revenue data helps managers make informed decisions regarding pricing, product mix, resource allocation, and investment opportunities. This data-driven approach minimizes risks and maximizes the likelihood of success.

- Evaluate the effectiveness of different strategies: By tracking key performance indicators (KPIs) and analyzing various scenarios, managerial accounting helps managers assess the effectiveness of different strategies and make adjustments as needed.

2. Employees:

While not directly involved in preparing managerial accounting reports, employees benefit indirectly from the information generated. Effective management decisions, driven by managerial accounting data, lead to:

- Improved working conditions: Resource allocation decisions, based on managerial accounting insights, can lead to improved working conditions and more efficient processes, benefiting employees.

- Job security: Strong financial performance, monitored and guided by managerial accounting, increases job security for employees.

- Opportunities for growth and development: Data-driven decisions on training and development programs, informed by managerial accounting, can open up growth opportunities for employees.

3. Owners and Shareholders (in privately held companies):

In privately held companies, owners and shareholders are internal users who rely heavily on managerial accounting data to assess the company's performance and financial health. They use this information to:

- Evaluate profitability and efficiency: Managerial accounting reports provide a comprehensive view of the company's profitability, efficiency, and overall financial performance.

- Make strategic decisions: The data provided enables owners and shareholders to make informed decisions regarding future investments, expansion plans, and other strategic initiatives.

- Monitor the management team's performance: Performance evaluations of the management team are often based on the information provided by managerial accounting systems.

Types of Information Provided by Managerial Accounting

Managerial accounting provides a wide range of information, tailored to the specific needs of internal users. This information is typically not standardized in the same way as financial accounting reports. Key types of information include:

1. Cost Accounting Information:

This area focuses on the collection, classification, and analysis of costs. Key aspects include:

- Cost classification: Categorizing costs as direct or indirect, fixed or variable, product or period costs. This classification is essential for accurate costing and pricing decisions.

- Cost allocation: Assigning costs to specific products, services, or departments to accurately assess profitability.

- Cost behavior analysis: Understanding how costs change in response to changes in activity levels. This is crucial for budgeting and forecasting.

- Cost-volume-profit (CVP) analysis: Examining the relationship between costs, volume, and profits to determine break-even points and profit targets.

2. Budgeting and Forecasting:

Managerial accounting plays a crucial role in budgeting and forecasting. This includes:

- Developing budgets: Creating detailed plans for revenue, expenses, and cash flows for a specific period.

- Monitoring budget performance: Tracking actual results against budgeted amounts and identifying variances.

- Forecasting future results: Using historical data and current trends to predict future financial performance.

- Scenario planning: Developing different budget scenarios based on various assumptions about future conditions.

3. Performance Evaluation and Control:

Managerial accounting systems provide tools for evaluating performance and controlling costs. This includes:

- Key performance indicators (KPIs): Tracking metrics that are essential for measuring performance and progress toward goals. Examples include sales growth, customer satisfaction, and employee turnover.

- Variance analysis: Identifying the reasons for discrepancies between planned and actual results.

- Responsibility accounting: Assigning accountability for performance to specific individuals or departments.

- Performance reports: Regular reports summarizing actual results against budgets and targets.

4. Decision-Making Information:

Managerial accounting provides crucial data for making informed business decisions. This includes:

- Make-or-buy decisions: Analyzing whether to manufacture a product internally or outsource it.

- Pricing decisions: Setting prices that are both profitable and competitive.

- Capital budgeting decisions: Evaluating investment opportunities in new equipment, facilities, or projects.

- Product mix decisions: Determining the optimal combination of products to maximize profitability.

- Special order decisions: Analyzing whether to accept a special order at a reduced price.

The Importance of Managerial Accounting in Today's Business Environment

In today's dynamic and competitive business environment, the role of managerial accounting has become even more crucial. Several factors highlight its increasing importance:

- Globalization and increased competition: Businesses need to make faster, more informed decisions in a globalized marketplace characterized by intense competition. Managerial accounting provides the necessary data and analytical tools to support these decisions.

- Technological advancements: Advances in technology, such as enterprise resource planning (ERP) systems, have significantly enhanced the capabilities of managerial accounting systems, allowing for more efficient data collection, analysis, and reporting.

- Emphasis on data-driven decision-making: Organizations are increasingly recognizing the importance of data-driven decision-making, and managerial accounting provides the foundation for this approach.

- Increased regulatory scrutiny: Businesses face increasing regulatory scrutiny, requiring more detailed and accurate financial information. Managerial accounting systems help ensure compliance with regulations.

- Need for improved operational efficiency: In the face of rising costs and economic uncertainty, businesses need to improve their operational efficiency. Managerial accounting provides the tools and insights needed to achieve this.

Conclusion: A Cornerstone of Effective Management

Managerial accounting is not just a set of accounting procedures; it's a crucial cornerstone of effective management. By providing timely and relevant information to internal users, it empowers organizations to make better decisions, improve operational efficiency, and achieve their strategic goals. Its focus on internal decision-making, rather than external reporting, makes it a vital instrument for organizational success in the modern business world. The diverse range of information it offers—from cost accounting to performance evaluation and budgeting—underlines its multifaceted role in helping organizations thrive in increasingly complex environments. Understanding and effectively utilizing managerial accounting is, therefore, essential for any organization aiming for sustained growth and profitability.

Latest Posts

Latest Posts

-

How Many Weeks Will It Take To Complete This Project

Mar 19, 2025

-

Draw The Structural Formula Of Diethylacetylene

Mar 19, 2025

-

What Formula Would Produce The Value In Cell D49

Mar 19, 2025

-

Marias Company Struggles To Keep Good Talent

Mar 19, 2025

-

Benefits To Society From Effective Marketing Include

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about Managerial Accounting Primarily Provides Information To . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.