Liquidity Preference Theory Is Most Relevant To The

Holbox

Mar 23, 2025 · 6 min read

Table of Contents

- Liquidity Preference Theory Is Most Relevant To The

- Table of Contents

- Liquidity Preference Theory: Most Relevant to Venture Capital and Private Equity

- Understanding Liquidity Preference

- Liquidity Preference in Venture Capital

- Key Implications for VC Investing:

- Liquidity Preference in Private Equity

- Key Implications for PE Investing:

- The Interplay of Liquidity Preference and Investor Behavior

- Mitigating Liquidity Risk in VC and PE

- Conclusion: The Enduring Relevance of Liquidity Preference

- Latest Posts

- Latest Posts

- Related Post

Liquidity Preference Theory: Most Relevant to Venture Capital and Private Equity

The liquidity preference theory, a cornerstone of financial economics, posits that investors generally prefer liquid assets to illiquid ones. This preference stems from the inherent uncertainty associated with illiquid assets, which can be difficult to sell quickly without significant price concessions. While this theory holds true across various investment classes, its relevance is particularly pronounced in the context of venture capital (VC) and private equity (PE) investments. These asset classes are characterized by inherently illiquid assets, longer investment horizons, and higher risk profiles, making the liquidity preference theory a crucial framework for understanding investor behavior and pricing in these markets.

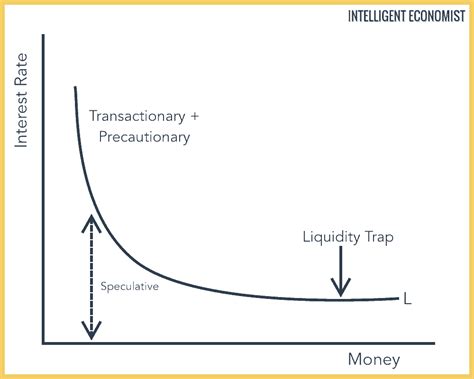

Understanding Liquidity Preference

Before delving into the relevance of liquidity preference theory in VC and PE, let's solidify our understanding of the core concept. Liquidity refers to the ease with which an asset can be converted into cash without significantly impacting its price. Highly liquid assets, such as publicly traded stocks, can be bought and sold quickly with minimal price fluctuations. Conversely, illiquid assets, such as real estate, private company equity, or art, require more time and effort to sell, and their prices can be significantly affected by the urgency of the sale.

Investors demand a premium for holding illiquid assets to compensate for the inherent risks associated with lower liquidity. These risks include:

- Reduced marketability: Finding a buyer for an illiquid asset can take considerable time and effort, potentially delaying access to needed funds.

- Price uncertainty: The price of an illiquid asset can fluctuate significantly depending on market conditions and the urgency of the sale. Forced sales often result in substantial discounts.

- Information asymmetry: Illiquid markets often lack readily available information, making it difficult for investors to accurately assess the true value of an asset.

The liquidity premium is the extra return investors demand to compensate for these risks. The size of this premium varies depending on the degree of illiquidity, the investor's risk aversion, and market conditions.

Liquidity Preference in Venture Capital

Venture capital investments are inherently illiquid. VC firms invest in early-stage companies with high growth potential, but these companies typically lack a readily available public market for their shares. Therefore, VC investors face significant liquidity constraints, meaning they cannot easily exit their investments whenever they desire. This illiquidity necessitates a substantial liquidity premium to incentivize participation.

Key Implications for VC Investing:

- Higher expected returns: To compensate for the illiquidity risk, VC investors demand significantly higher returns compared to investments in publicly traded securities. These returns must not only offset the risk but also the opportunity cost of tying up capital for an extended period.

- Long investment horizons: VC investments typically have longer investment horizons, sometimes spanning 5-10 years or more, reflecting the time required to build a company to a point where an exit (such as an IPO or acquisition) becomes feasible.

- Phased investments: VC investments often occur in phases, allowing investors to assess the progress of the company and potentially adjust their commitment based on performance and market conditions. This staggered approach mitigates some of the liquidity risk.

- Limited Partner (LP) expectations: Venture capital firms typically raise funds from limited partners (LPs), such as pension funds and endowments. LPs also have liquidity preferences, and the VC firm's strategy must align with their expectations for returns and eventual capital distributions. This necessitates careful management of the portfolio and a focus on generating liquidity events.

Liquidity Preference in Private Equity

Similar to venture capital, private equity investments are characterized by illiquidity. PE firms typically invest in more mature companies than VCs, but these companies are often still privately held, limiting the options for quick exits. The illiquidity premium is therefore a significant factor in private equity valuations and investment decisions.

Key Implications for PE Investing:

- Leveraged Buyouts (LBOs): Private equity firms often utilize substantial leverage (debt) in LBOs to acquire companies. The use of debt increases the financial risk, but it can also accelerate returns and help create liquidity through the eventual sale or IPO of the acquired company. However, the debt burden also amplifies the importance of liquidity planning.

- Portfolio diversification: PE firms typically invest in a diversified portfolio of companies to mitigate the risk associated with illiquidity in any single investment. Diversification helps to smooth returns and improve the overall liquidity profile of the portfolio.

- Management buyouts (MBOs): In MBOs, existing management teams acquire the company they manage, often with the assistance of private equity firms. These transactions can present both opportunities and challenges in terms of liquidity, as the success depends heavily on the management team's ability to improve the company's performance and create eventual exit opportunities.

- Mezzanine financing: This hybrid financing instrument combines debt and equity features, often used in private equity transactions. It can provide liquidity to investors while offering a higher return than traditional debt, but also carries a higher level of risk.

The Interplay of Liquidity Preference and Investor Behavior

The liquidity preference theory significantly impacts the behavior of both investors and fund managers in the VC and PE space. Investors demand a substantial risk premium to compensate for illiquidity, leading to higher valuations and hurdle rates for investments. Fund managers, in turn, need to develop strategies that create liquidity events – such as IPOs, acquisitions, or secondary market transactions – to satisfy investor expectations and secure future funding.

The pressure to create liquidity affects investment decisions, portfolio construction, and even the operating strategies of portfolio companies. Managers may prioritize quick exits over long-term value creation, potentially sacrificing long-term growth for short-term liquidity. This underscores the critical balance that needs to be struck between generating returns and managing liquidity effectively.

Mitigating Liquidity Risk in VC and PE

While the inherent illiquidity of VC and PE investments cannot be entirely eliminated, several strategies can be employed to mitigate the associated risks:

- Diversification: Investing in a well-diversified portfolio reduces the impact of any single illiquid investment on the overall portfolio's liquidity.

- Strategic planning: Careful planning of exit strategies, including potential IPOs or acquisitions, can improve the likelihood of successful liquidity events.

- Active portfolio management: Monitoring and actively managing the portfolio companies allows for early identification of potential problems and proactive adjustments to mitigate liquidity risks.

- Negotiating favorable terms: In negotiating deals, ensuring favourable terms, such as preferred stock with liquidation preferences, can help protect investor interests in case of a distressed sale.

- Secondary market transactions: Utilizing secondary markets for private equity and venture capital can provide liquidity before a formal exit event, although this often comes with a discount.

Conclusion: The Enduring Relevance of Liquidity Preference

The liquidity preference theory is not merely an academic concept; it is a fundamental driver of investment decisions and market dynamics in the venture capital and private equity industries. The inherent illiquidity of these asset classes necessitates a substantial liquidity premium, shaping investor expectations, fund manager strategies, and the overall risk-return profile of these investments. Understanding this theory is crucial for navigating the complexities of these markets, making informed investment choices, and effectively managing the inherent liquidity risks. While strategies exist to mitigate these risks, the premium for illiquidity remains a powerful force, emphasizing the need for long-term perspectives and strategic planning within the VC and PE landscape. The ongoing evolution of these markets, including the growth of secondary markets and innovative financing structures, will continue to refine the interplay between liquidity preference and investment strategies, but the core principle of the liquidity premium will remain a vital aspect of this dynamic and challenging investment space.

Latest Posts

Latest Posts

-

Sunn Company Manufactures A Single Product

Mar 27, 2025

-

Convert To Use Only The Metric System

Mar 27, 2025

-

Consider The Chirality Center In The Compound Shown

Mar 27, 2025

-

The Juxtaglomerular Apparatus Regulates The Filtration Rate By

Mar 27, 2025

-

Match The Following Statements To The Appropriate Terms

Mar 27, 2025

Related Post

Thank you for visiting our website which covers about Liquidity Preference Theory Is Most Relevant To The . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.