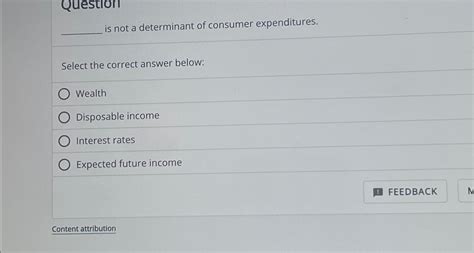

__________ Is Not A Determinant Of Consumer Expenditures.

Holbox

Mar 13, 2025 · 5 min read

Table of Contents

Disposable Income: Not the Sole Determinant of Consumer Expenditures

Consumer expenditure is the cornerstone of economic growth, representing a significant portion of Gross Domestic Product (GDP) in most countries. Understanding what drives consumer spending is crucial for policymakers, businesses, and economists alike. While disposable income, often touted as the primary driver, is undeniably influential, it's not the sole determinant. This article delves into the multifaceted nature of consumer spending, exploring factors beyond disposable income that significantly impact consumer choices and overall expenditure levels.

Beyond the Paycheck: The Limitations of Disposable Income as a Predictor

Disposable income, defined as income remaining after taxes and other deductions, is a key factor influencing how much consumers can spend. A rise in disposable income generally leads to an increase in consumer spending, and vice-versa. However, relying solely on disposable income as a predictor of consumer expenditure overlooks several critical aspects of consumer behavior and economic dynamics.

1. Consumer Confidence and Expectations: The Psychological Factor

Consumer confidence, a measure of how optimistic consumers feel about the future economy, plays a crucial role. Even with high disposable income, pessimistic consumers may delay spending, opting for saving instead. Conversely, confident consumers might increase spending even with relatively low disposable income, fueled by expectations of future income growth or positive economic outlook. This psychological factor significantly influences the relationship between disposable income and actual expenditure.

2. Wealth Effect: The Impact of Assets

The wealth effect highlights the influence of accumulated assets on consumer spending. An increase in the value of assets like houses, stocks, and retirement accounts can boost consumer confidence and encourage spending, even if disposable income remains relatively stable. Conversely, a decline in asset values can lead to a decrease in spending, irrespective of disposable income levels. This underscores the importance of considering broader financial health, not just current income.

3. Interest Rates and Credit Availability: The Cost of Borrowing

Interest rates and credit availability directly impact consumer spending. Low interest rates make borrowing cheaper, encouraging consumers to finance larger purchases, like houses or cars. Conversely, high interest rates can discourage borrowing and reduce spending, even if disposable income is high. Easy access to credit also allows consumers to spend beyond their current income, influencing expenditure patterns independent of their disposable income.

4. Inflation and Price Levels: The Purchasing Power Paradox

Inflation erodes the purchasing power of money. Even if disposable income increases, if inflation rises at a faster rate, consumers may find their purchasing power diminished. This can lead to a situation where disposable income grows, but real consumer expenditure remains stagnant or even falls. Understanding the interplay between disposable income and inflation is crucial for accurate predictions.

5. Consumer Debt Levels: The Burden of Past Spending

High levels of consumer debt can significantly constrain future spending. Consumers burdened with credit card debt, mortgages, or student loans may prioritize debt repayment over discretionary spending, regardless of their current disposable income. This highlights the importance of considering past financial decisions and their lingering impact on current spending behavior.

6. Demographic Factors: Age, Family Size, and Lifestyle

Demographic factors significantly influence consumer spending patterns. Younger individuals may have lower disposable income but higher spending on experiences and entertainment. Older individuals with higher disposable income might prioritize saving for retirement or healthcare over consumption. Family size also plays a role, with larger families typically having higher expenditure on necessities like food and housing. These demographic variations demonstrate that a blanket application of disposable income as the sole determinant is inaccurate.

7. Technological Advancements and Innovation: Shifting Spending Priorities

Technological advancements can shift consumer spending priorities. The advent of smartphones, streaming services, and other technologies has led to new avenues for expenditure, diverting funds away from traditional goods and services. This highlights the dynamic nature of consumer behavior and the need to account for evolving technological influences on spending patterns.

8. Government Policies and Regulations: Fiscal and Monetary Interventions

Government policies, including fiscal and monetary policies, play a substantial role in shaping consumer spending. Tax cuts can boost disposable income and stimulate spending, while tax increases can have the opposite effect. Government regulations impacting credit markets or consumer protection can also influence spending patterns. Therefore, analyzing consumer expenditure requires considering the broader economic and political landscape.

9. Global Economic Conditions: International Trade and Currency Fluctuations

Global economic conditions can indirectly impact consumer spending. Fluctuations in exchange rates can affect the price of imported goods, impacting consumer purchasing power. Recessions or economic downturns in other countries can disrupt supply chains and affect the availability and price of goods, impacting consumer expenditure in various markets. This international dimension necessitates a global perspective when analyzing consumer spending dynamics.

10. Social and Cultural Influences: Trends and Peer Pressure

Social and cultural influences, including trends, advertising, and peer pressure, significantly shape consumer preferences and spending habits. Fashion trends, social media influencers, and marketing campaigns can all drive consumer demand, irrespective of disposable income levels. This demonstrates the power of social and cultural factors in shaping expenditure patterns.

A Holistic Approach: Understanding the Complexities of Consumer Spending

Analyzing consumer expenditure requires a holistic approach, going beyond the simplistic view of disposable income as the sole determinant. It involves considering a complex interplay of psychological, economic, social, and technological factors. Economists and policymakers need to adopt sophisticated models and data analysis techniques to accurately predict and understand consumer spending behavior. This requires incorporating variables such as consumer confidence, wealth effects, interest rates, inflation, debt levels, demographic factors, technological advancements, government policies, global economic conditions, and social influences.

Conclusion: A Multifaceted Perspective is Essential

In conclusion, while disposable income undeniably influences consumer expenditures, it is far from being the sole determinant. A comprehensive understanding of consumer behavior requires a multifaceted approach, considering a wide array of interacting factors. By acknowledging the limitations of using disposable income as the single predictor and incorporating the other factors discussed in this article, we can develop a more accurate and nuanced understanding of the dynamics driving consumer spending and its implications for economic growth and policymaking. This holistic approach is crucial for businesses in strategic planning, for economists in building accurate models, and for policymakers in designing effective economic policies that promote sustainable and inclusive growth.

Latest Posts

Latest Posts

-

Find Leqv For Each Of The Given Circuits

Mar 13, 2025

-

Under The Corporate Form Of Business Organization

Mar 13, 2025

-

This Graph Which Combines The Characteristics

Mar 13, 2025

-

The Appropriate Gown To Wear When Administering Chemotherapy Is

Mar 13, 2025

-

Draw The Major Organic Product Of The Reaction Shown

Mar 13, 2025

Related Post

Thank you for visiting our website which covers about __________ Is Not A Determinant Of Consumer Expenditures. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.