In A Perfectly Competitive Market All Producers Sell

Holbox

Mar 16, 2025 · 7 min read

Table of Contents

In a Perfectly Competitive Market, All Producers Sell at the Same Price: A Deep Dive

The statement "in a perfectly competitive market, all producers sell at the same price" is a cornerstone of economic theory. Understanding why this is true, and the implications of this principle, is crucial to grasping the dynamics of market forces and the behavior of firms within a competitive landscape. This article will delve deep into this principle, exploring the characteristics of perfect competition, the mechanisms driving price uniformity, and the implications for producers and consumers alike.

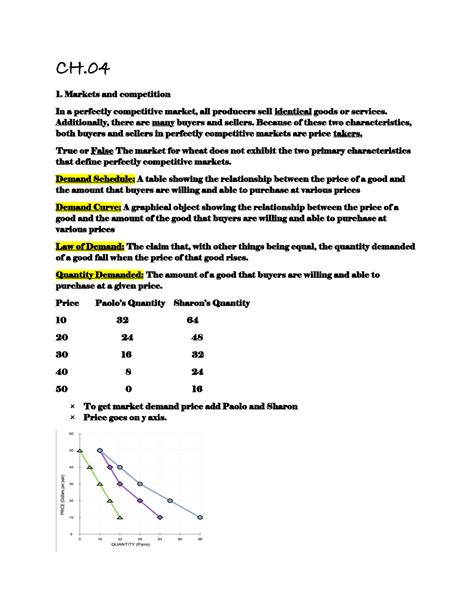

The Defining Characteristics of Perfect Competition

Before examining the price uniformity aspect, we need to understand the defining characteristics of a perfectly competitive market. These characteristics, while rarely perfectly manifested in the real world, provide a useful theoretical benchmark for analyzing market structures and behavior. These characteristics include:

1. Numerous Buyers and Sellers:

In a perfectly competitive market, there are a large number of buyers and sellers, none of whom individually has a significant impact on the market price. This means no single buyer or seller can dictate the price; they are all price takers. The actions of any single entity are too small to noticeably affect the overall market supply or demand.

2. Homogenous Products:

The goods or services offered by different producers are identical or nearly so. Consumers perceive no difference between the products offered by different firms. This lack of product differentiation prevents firms from charging higher prices based on brand loyalty or perceived quality differences. Think of agricultural commodities like wheat or corn – one bushel of wheat is essentially the same as another.

3. Free Entry and Exit:

Firms can easily enter or exit the market without facing significant barriers. There are no significant costs associated with starting or shutting down a business. This ensures that the market adjusts quickly to changes in supply and demand. High startup costs, government regulations, or control over key resources all act as barriers to entry and prevent perfect competition.

4. Perfect Information:

Buyers and sellers have complete knowledge of the market, including prices, product quality, and production technologies. This eliminates information asymmetry, where some participants have more knowledge than others. In reality, perfect information is rarely achieved, but the assumption helps to simplify the model.

5. No Externalities:

The production or consumption of the good does not impose costs or benefits on third parties. Externalities, such as pollution from a factory, are not considered in this idealized market structure. The presence of externalities distorts market prices and leads to inefficient outcomes.

The Mechanism Driving Price Uniformity

Given these characteristics, the price uniformity in a perfectly competitive market emerges naturally. Imagine a scenario where one producer attempts to charge a higher price than the market price. Because the products are homogeneous and consumers have perfect information, they would simply buy the identical product from another producer at the lower price. The producer charging the higher price would lose all its customers and would be forced to lower its price to remain competitive.

Conversely, if a producer attempts to charge a price lower than the market price, they might experience increased demand. However, this increased demand is unlikely to significantly impact the overall market price. More importantly, selling at a lower price than the market price reduces their profit margin. While increasing market share might seem beneficial, it won't compensate for lower profit per unit unless they can achieve significantly higher sales volume, which is unlikely in a perfectly competitive market with numerous other sellers.

Therefore, the only sustainable price for a producer in a perfectly competitive market is the market price. Any deviation from this price will lead to either a loss of customers or reduced profitability. This self-regulating mechanism ensures price uniformity across all producers.

Implications of Price Uniformity in Perfectly Competitive Markets

The uniformity of prices in perfectly competitive markets has several important implications:

1. Allocative Efficiency:

Resources are allocated efficiently. Goods and services are produced up to the point where the marginal benefit to consumers equals the marginal cost of production. This means that society is getting the most it can from its limited resources. This is a key consequence of the price mechanism accurately reflecting both consumer demand and producer costs.

2. Productive Efficiency:

Firms operate at the lowest possible cost per unit of output. Because they are price takers, they have to minimize their costs to maximize profits. This efficiency pressures firms to innovate and become as efficient as possible to maintain their position in the market. This constant pressure to minimize cost leads to overall market efficiency.

3. Zero Economic Profit in the Long Run:

While firms can earn economic profits in the short run, in the long run, economic profits are driven to zero. The reason for this is the free entry and exit condition. If firms are earning positive economic profits, new firms will enter the market, increasing supply and driving down the price until profits are eliminated. Conversely, if firms are incurring losses, some will exit the market, reducing supply and increasing the price until losses are minimized or eliminated. This dynamic ensures that long-run profits are only normal profits (covering the opportunity cost of resources employed).

4. Consumer Surplus Maximization:

Consumers benefit from the low prices and efficient allocation of resources. The market price reflects the true value of the goods and services, leading to maximal consumer surplus (the difference between what consumers are willing to pay and what they actually pay). This outcome is an ideal situation for consumers.

Deviations from Perfect Competition and Their Impact on Price

While perfect competition serves as a valuable theoretical model, it's important to acknowledge that few real-world markets perfectly embody these conditions. Several factors can lead to deviations from perfect competition and affect price uniformity:

1. Imperfect Information:

Asymmetric information, where some market participants possess more knowledge than others, can lead to price discrepancies. For example, if consumers are unaware of the prices offered by different producers, a producer might be able to charge a higher price than the market average.

2. Product Differentiation:

If products are not homogenous, producers can charge different prices based on perceived differences in quality, branding, or features. This is common in many industries, where branding and marketing play significant roles in consumer perception and purchasing decisions. The presence of brand loyalty allows companies to command premium prices, a feature absent in perfectly competitive markets.

3. Barriers to Entry:

High start-up costs, government regulations, or control over key resources can create barriers to entry, limiting the number of competitors and reducing price competition. This leads to markets that are more oligopolistic or monopolistic, where prices are often significantly higher than in a perfectly competitive market.

4. Externalities:

The presence of externalities, such as pollution, distorts market prices. If a firm's production generates negative externalities, the true cost of production is not reflected in the market price. This necessitates government intervention to address externalities and achieve efficient allocation of resources.

Conclusion: The Importance of the Perfectly Competitive Model

While the perfectly competitive market model is a simplification of reality, its study remains vital. It provides a benchmark against which to compare real-world markets and understand how deviations from perfect competition lead to less efficient and potentially unfair outcomes. Understanding the conditions that foster price uniformity highlights the importance of factors like free entry and exit, homogeneous products, and perfect information in driving economic efficiency and benefiting both consumers and society. The idealized model allows us to analyze the impacts of various market imperfections and provides a framework for considering policy interventions aimed at enhancing market efficiency and equity. The principle that "in a perfectly competitive market, all producers sell at the same price" therefore serves as a fundamental building block for a deeper understanding of market economics.

Latest Posts

Latest Posts

-

For The Hr Planning Process How Should Goals Be Determined

Mar 17, 2025

-

How Does A Shortcut Link To Another File

Mar 17, 2025

-

Cash Flows From Financing Activities Do Not Include

Mar 17, 2025

-

A Positive Return On Investment For Education Happens When

Mar 17, 2025

-

What Is The Value Of I

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about In A Perfectly Competitive Market All Producers Sell . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.