How Can Firm Specific Risk Be Defined

Holbox

Mar 24, 2025 · 6 min read

Table of Contents

- How Can Firm Specific Risk Be Defined

- Table of Contents

- How Can Firm-Specific Risk Be Defined? A Deep Dive into Business Volatility

- Defining Firm-Specific Risk: Beyond Market Fluctuations

- Sources of Firm-Specific Risk: Identifying the Culprits

- 1. Management and Operational Risks:

- 2. Financial Risks:

- 3. Legal and Regulatory Risks:

- 4. Industry-Specific Risks:

- 5. External Events:

- Measuring Firm-Specific Risk: Quantifying the Uncertainty

- 1. Beta Calculation:

- 2. Standard Deviation of Returns:

- 3. Residual Risk:

- 4. Event Studies:

- Mitigation Strategies: Reducing Exposure to Firm-Specific Risk

- The Interplay of Firm-Specific and Systematic Risk: A Holistic View

- Conclusion: Navigating the Landscape of Firm-Specific Risk

- Latest Posts

- Latest Posts

- Related Post

How Can Firm-Specific Risk Be Defined? A Deep Dive into Business Volatility

Firm-specific risk, also known as unsystematic risk, unique risk, idiosyncratic risk, or diversifiable risk, represents the volatility of an individual company's stock unrelated to overall market movements. Unlike systematic risk, which affects the entire market, firm-specific risk stems from factors unique to a particular company. Understanding this risk is crucial for investors, portfolio managers, and company executives alike, as it directly impacts investment decisions and overall business strategy. This comprehensive guide will delve deep into the definition, sources, measurement, and mitigation of firm-specific risk.

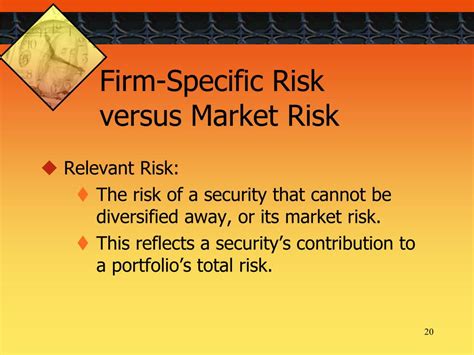

Defining Firm-Specific Risk: Beyond Market Fluctuations

At its core, firm-specific risk encompasses all the factors that can affect a company's performance independent of broader economic trends. This means that even during periods of overall market growth, a company can experience negative returns due to firm-specific issues. Conversely, a company might outperform the market during a downturn if it successfully navigates its unique challenges. The key differentiator is that this risk is diversifiable, meaning that it can be mitigated by holding a well-diversified portfolio of assets.

Think of it this way: systematic risk is like a hurricane hitting a coastal region – it affects all buildings in the area regardless of their individual strengths. Firm-specific risk, however, is like a faulty plumbing system in a single building; it impacts only that specific structure.

In essence, firm-specific risk is the variability in a company's returns that is not explained by market-wide factors. This variability stems from factors within the company's control or from unforeseen events impacting only that specific entity.

Sources of Firm-Specific Risk: Identifying the Culprits

Numerous factors contribute to firm-specific risk. These can be broadly categorized into:

1. Management and Operational Risks:

- Poor management decisions: Incompetent leadership, ineffective strategies, or unethical practices can significantly harm a company's performance. Poor financial management, leading to excessive debt or inadequate cash flow, falls under this category.

- Operational inefficiencies: Ineffective production processes, supply chain disruptions, quality control issues, or high labor costs can all negatively impact profitability and shareholder value. This includes risks related to technology failures or cybersecurity breaches.

- Product obsolescence: Failure to innovate and adapt to changing consumer preferences can lead to declining sales and market share, contributing significantly to firm-specific risk.

- Labor relations: Strikes, lockouts, or high employee turnover can disrupt operations and negatively affect productivity.

2. Financial Risks:

- Leverage: High levels of debt increase financial risk, as the company becomes more vulnerable to economic downturns and interest rate changes. Inability to service debt can lead to bankruptcy.

- Liquidity problems: Insufficient cash flow to meet short-term obligations can create significant financial instability, impacting a company's ability to operate effectively.

- Credit risk: Failure of customers to pay for goods or services can strain a company's cash flow, leading to losses.

3. Legal and Regulatory Risks:

- Lawsuits: Facing legal challenges or regulatory investigations can result in significant financial penalties and reputational damage.

- Changes in regulations: New laws or regulations can negatively impact a company's operations, requiring costly adjustments or even leading to business closures.

4. Industry-Specific Risks:

- Competition: Intense rivalry from competitors can pressure prices and erode profit margins. New entrants into the market can also significantly alter the competitive landscape.

- Technological changes: Rapid technological advancements can render existing products or services obsolete, threatening a company's market position.

5. External Events:

- Natural disasters: Events like earthquakes, floods, or hurricanes can severely damage a company's facilities, disrupting operations and causing significant losses.

- Political instability: Political turmoil or changes in government policy can negatively impact a company's ability to operate, particularly in international markets.

Measuring Firm-Specific Risk: Quantifying the Uncertainty

Measuring firm-specific risk requires separating a company's individual volatility from the overall market volatility. Several methods are employed:

1. Beta Calculation:

While beta primarily measures systematic risk, its limitations allow for an indirect assessment of firm-specific risk. A beta of 1 indicates that the stock moves with the market. However, a company with a high beta that consistently underperforms compared to its peers might reveal high unsystematic risk.

2. Standard Deviation of Returns:

Calculating the standard deviation of a stock's returns over a specific period offers an indication of its overall volatility. A high standard deviation suggests greater risk. However, it doesn't differentiate between systematic and unsystematic risk.

3. Residual Risk:

This method involves analyzing the difference between a stock's actual returns and its expected returns based on a market model. The residual, or unexplained variance, is attributed to firm-specific risk. More sophisticated models, such as regression analysis, are commonly used to determine this residual risk.

4. Event Studies:

Analyzing stock price reactions to specific events, such as product launches, regulatory changes, or lawsuits, can help isolate the impact of firm-specific factors.

Mitigation Strategies: Reducing Exposure to Firm-Specific Risk

Because firm-specific risk is diversifiable, the primary mitigation strategy lies in portfolio diversification. By investing in a range of companies across different industries and sectors, investors can reduce their exposure to the unique risks associated with any single company.

Beyond diversification, companies themselves can actively work to reduce their firm-specific risk through:

- Improving operational efficiency: Streamlining processes, enhancing quality control, and implementing robust supply chain management can reduce operational risks.

- Strengthening financial management: Maintaining healthy levels of cash flow, managing debt responsibly, and actively managing credit risk can improve financial stability.

- Investing in research and development: Continuous innovation and adaptation to market changes can minimize the risk of product obsolescence.

- Building a strong corporate culture: Cultivating a culture of transparency, accountability, and ethical conduct can mitigate risks associated with poor management decisions.

- Implementing robust risk management systems: Developing comprehensive risk assessment and mitigation strategies across all aspects of the business is crucial. This includes comprehensive contingency planning for potential crises.

The Interplay of Firm-Specific and Systematic Risk: A Holistic View

While this article focuses on firm-specific risk, it's crucial to remember that it exists alongside systematic risk. A company might face both types of risk simultaneously. For example, a company might suffer from poor management (firm-specific) while simultaneously experiencing a market downturn (systematic). Therefore, a complete risk assessment requires considering both types of risk and developing strategies to mitigate them accordingly.

Conclusion: Navigating the Landscape of Firm-Specific Risk

Firm-specific risk is an inherent aspect of investing and running a business. While it cannot be entirely eliminated, its impact can be significantly reduced through diversification and proactive risk management strategies. Understanding the sources, measurement, and mitigation techniques of firm-specific risk is essential for investors to build robust portfolios and for companies to ensure long-term sustainability and growth. By employing the strategies outlined above and conducting thorough due diligence, individuals and businesses can effectively navigate the complexities of firm-specific risk and achieve their financial goals. Staying informed about market trends and proactively identifying and addressing potential threats is crucial for long-term success in a dynamic and often unpredictable economic landscape. Continuous monitoring and adaptation are key to successfully mitigating this often overlooked, yet impactful, aspect of financial and operational risk.

Latest Posts

Latest Posts

-

Evaluate The Line Integral Along The Curve C

Mar 27, 2025

-

Blitzer College Algebra 8th Edition Vs 9

Mar 27, 2025

-

Systems That Emphasize Collectivism Tend Toward

Mar 27, 2025

-

New Trade Theory Suggests That Nations

Mar 27, 2025

-

Basic Laboratory Techniques Pre Lab Questions Answers

Mar 27, 2025

Related Post

Thank you for visiting our website which covers about How Can Firm Specific Risk Be Defined . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.