Here Is The Capital Structure Of Microsoft

Holbox

Mar 16, 2025 · 6 min read

Table of Contents

Decoding Microsoft's Capital Structure: A Deep Dive

Microsoft, a technological titan, boasts a capital structure that's as intricate as its software. Understanding this structure is crucial for investors, analysts, and anyone interested in the financial health and future prospects of the company. This in-depth analysis will dissect Microsoft's capital structure, exploring its components, evolution, implications, and future outlook.

Understanding Capital Structure Fundamentals

Before diving into Microsoft's specifics, let's establish a foundational understanding of capital structure. It refers to the way a company finances its assets through a combination of debt and equity. The optimal capital structure balances the benefits and risks associated with each financing source.

-

Debt Financing: This involves borrowing money, typically through bonds, loans, or lines of credit. Debt comes with interest payments and maturity dates but offers tax benefits as interest is deductible. However, excessive debt increases financial risk and can lead to bankruptcy.

-

Equity Financing: This involves selling ownership stakes in the company, typically through issuing common stock or preferred stock. Equity financing doesn't require repayment but dilutes ownership and can reduce earnings per share.

The optimal balance between debt and equity depends on several factors, including the company's industry, risk tolerance, growth prospects, and tax situation. A company's capital structure is constantly evolving as its financial needs and market conditions change.

Key Components of Microsoft's Capital Structure

Microsoft's capital structure is primarily composed of the following:

1. Equity

Microsoft's equity is largely constituted by its common stock, held by a diverse range of institutional and individual investors. The company's market capitalization, a reflection of its equity value, is immense, placing it among the world's most valuable companies. The share price fluctuates based on market sentiment, financial performance, and future expectations. Understanding shareholder composition provides insights into the diverse interests influencing the company's strategic decisions.

2. Debt

While Microsoft is known for its strong cash position, it does utilize debt financing strategically. This debt is typically comprised of:

-

Long-term debt: This represents borrowings with maturities exceeding one year. Microsoft employs long-term debt to fund acquisitions, large-scale projects, and manage its working capital. The terms and conditions of this debt reflect Microsoft's strong creditworthiness, resulting in favorable interest rates. Analyzing the maturity schedule provides insights into potential refinancing needs and the company's long-term financial planning.

-

Short-term debt: This encompasses borrowings with maturities less than a year. Microsoft's utilization of short-term debt is relatively limited, suggesting a preference for maintaining a robust liquidity position. This strategy minimizes interest rate risk associated with short-term fluctuations.

3. Cash and Cash Equivalents

Microsoft's enormous cash reserves are a significant component of its capital structure. This substantial liquidity provides financial flexibility, enabling the company to pursue strategic investments, acquisitions, share buybacks, and navigate unforeseen economic downturns. The management of these reserves is a key factor in determining the company's financial strength and future growth trajectory. The allocation of cash reserves also reflects Microsoft’s strategic priorities and long-term vision.

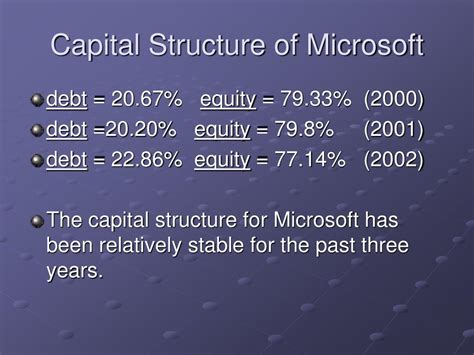

Evolution of Microsoft's Capital Structure

Microsoft's capital structure has evolved significantly over the years. Initially, it relied heavily on equity financing as it grew from a startup. As the company matured and generated substantial cash flows, its capital structure shifted towards a greater reliance on cash reserves and strategic debt utilization.

Analyzing historical financial statements reveals a trend of increasing cash balances and a measured approach to debt issuance. The company has demonstrated discipline in managing its financial leverage, ensuring its debt levels remain manageable relative to its equity and cash holdings. This balanced approach has contributed significantly to Microsoft's financial stability and its ability to weather economic uncertainties.

Implications of Microsoft's Capital Structure

The implications of Microsoft's capital structure are multifaceted:

1. Financial Flexibility

Microsoft's substantial cash reserves and prudent debt management offer significant financial flexibility. The company can seize opportunistic acquisitions, invest in R&D, and respond to shifting market dynamics without facing undue financial constraints. This flexibility enhances its competitive advantage and enables it to capitalize on emerging market opportunities.

2. Creditworthiness

Microsoft's strong balance sheet and consistent profitability have established a high level of creditworthiness. This allows it to access debt financing at favorable rates and terms, further enhancing its financial flexibility. Maintaining this high credit rating is a crucial element of Microsoft’s long-term financial strategy.

3. Shareholder Returns

Microsoft regularly returns capital to shareholders through dividends and share buybacks. Its substantial cash reserves enable these shareholder-friendly actions, contributing positively to investor sentiment and returns. This strategic approach to shareholder returns is a key component of Microsoft's investor relations strategy.

4. Risk Management

Microsoft's capital structure demonstrates a conservative risk management approach. The substantial cash reserves act as a buffer against economic downturns and unexpected financial challenges. The measured use of debt limits financial leverage and reduces the risk of financial distress. This risk-averse approach contributes to the stability and long-term sustainability of the company.

Future Outlook and Potential Changes

While Microsoft's current capital structure is robust, several factors could influence its future evolution:

-

Large-scale acquisitions: Significant acquisitions could lead to an increase in debt financing to fund the deals. However, Microsoft's preference for strategic and value-creating acquisitions suggests it will continue to be disciplined in its approach.

-

Market conditions: Changes in interest rates and economic conditions could influence Microsoft's debt management strategy. Adapting to these changes will be essential in maintaining its financial stability and optimizing its capital structure.

-

Technological advancements: Investment in new technologies could necessitate increased capital expenditures, potentially affecting the company's cash reserves and debt levels. Strategic allocation of resources will be crucial to balance innovation and financial prudence.

Comparison with Competitors

A comparative analysis of Microsoft's capital structure against its key competitors (e.g., Apple, Amazon, Google) would provide valuable insights. Factors such as debt-to-equity ratios, cash holdings, and return on equity can be used to assess the relative financial strengths and weaknesses of these technology giants. Understanding these differences provides a broader perspective on industry trends and optimal capital structure strategies within the technology sector.

Conclusion

Microsoft's capital structure represents a carefully constructed balance between debt and equity, supported by significant cash reserves. This structure reflects the company's financial strength, conservative risk management approach, and commitment to shareholder returns. While the future may bring changes based on market dynamics and strategic decisions, the company's disciplined approach to financial management will likely ensure its continued success. Continuous monitoring of its financial statements and industry analysis will provide critical insights into its future capital structure evolution and its overall financial health. Analyzing Microsoft's capital structure offers a valuable lens through which to understand the company's financial strategy, risk profile, and future potential. The insights derived can benefit investors, analysts, and anyone seeking a deeper understanding of this technology giant's financial prowess.

Latest Posts

Latest Posts

-

A Customer Arrives At A Customer Service Desk

Mar 17, 2025

-

Which Of The Following Best Describes How Deviance Is Defined

Mar 17, 2025

-

What Products Are Expected In The Ethoxide Promoted

Mar 17, 2025

-

Cups And Glasses Are Taking Too Long

Mar 17, 2025

-

The Most Significant Hazard Associated With Splinting Is

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Here Is The Capital Structure Of Microsoft . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.