Gideon Company Uses The Allowance Method Of Accounting

Holbox

Mar 30, 2025 · 6 min read

Table of Contents

- Gideon Company Uses The Allowance Method Of Accounting

- Table of Contents

- Gideon Company Uses the Allowance Method of Accounting: A Comprehensive Guide

- Understanding the Allowance Method

- 1. Percentage of Sales Method

- 2. Percentage of Accounts Receivable Method (Aging Method)

- Writing Off Uncollectible Accounts

- Recovering Accounts Previously Written Off

- Impact on Gideon Company's Financial Statements

- Choosing the Right Method for Gideon Company

- Advantages of the Allowance Method for Gideon Company

- Disadvantages of the Allowance Method for Gideon Company

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

Gideon Company Uses the Allowance Method of Accounting: A Comprehensive Guide

The allowance method of accounting for bad debts is a crucial aspect of financial reporting for businesses like Gideon Company that extend credit to customers. This method reflects a more realistic and conservative approach to accounting for potential losses from uncollectible accounts receivable. Unlike the direct write-off method, which only recognizes bad debts when they are deemed absolutely uncollectible, the allowance method anticipates potential losses and sets aside funds accordingly. This article delves deep into the allowance method, focusing on its application within the context of Gideon Company’s operations and highlighting its advantages and implications.

Understanding the Allowance Method

The allowance method operates on the principle of matching revenues with expenses. When Gideon Company makes a sale on credit, it recognizes revenue immediately. However, the company also acknowledges that there's a possibility some of these receivables might become uncollectible. To account for this risk, Gideon Company creates a contra-asset account called the Allowance for Doubtful Accounts. This account reduces the value of accounts receivable on the balance sheet, providing a more accurate representation of the net realizable value (the amount expected to be collected).

The allowance for doubtful accounts is established through two primary methods:

1. Percentage of Sales Method

This method estimates bad debt expense as a percentage of net credit sales. Gideon Company would analyze historical data and industry trends to determine an appropriate percentage. For example, if Gideon Company's historical data suggests that 2% of credit sales become uncollectible, and their net credit sales for the year are $1,000,000, the bad debt expense would be estimated at $20,000 ($1,000,000 x 0.02). This expense is then debited to Bad Debt Expense and credited to Allowance for Doubtful Accounts.

Advantages: Simple to apply and requires minimal historical data analysis.

Disadvantages: Doesn't consider the aging of receivables; some accounts might be older and have a higher risk of becoming uncollectible than newer accounts. This method is less precise than the aging method.

2. Percentage of Accounts Receivable Method (Aging Method)

This method considers the age of outstanding receivables. Gideon Company would analyze its accounts receivable and categorize them based on their age (e.g., 0-30 days, 31-60 days, 61-90 days, over 90 days). Each age category is assigned a different percentage representing the likelihood of becoming uncollectible. Older receivables are assigned higher percentages because they pose a greater risk.

For example, Gideon Company might use the following percentages:

- 0-30 days: 1%

- 31-60 days: 5%

- 61-90 days: 10%

- Over 90 days: 20%

Let's assume Gideon Company has the following receivables aged:

- 0-30 days: $500,000

- 31-60 days: $200,000

- 61-90 days: $100,000

- Over 90 days: $50,000

The calculation for the allowance for doubtful accounts would be:

- 0-30 days: $500,000 x 0.01 = $5,000

- 31-60 days: $200,000 x 0.05 = $10,000

- 61-90 days: $100,000 x 0.10 = $10,000

- Over 90 days: $50,000 x 0.20 = $10,000

Total Allowance for Doubtful Accounts = $35,000

If the current balance in the Allowance for Doubtful Accounts is $20,000, Gideon Company would need to increase it by $15,000. This would be recorded as a debit to Bad Debt Expense and a credit to Allowance for Doubtful Accounts.

Advantages: More accurate than the percentage of sales method as it considers the age of receivables.

Disadvantages: More complex to implement and requires more detailed analysis of receivables.

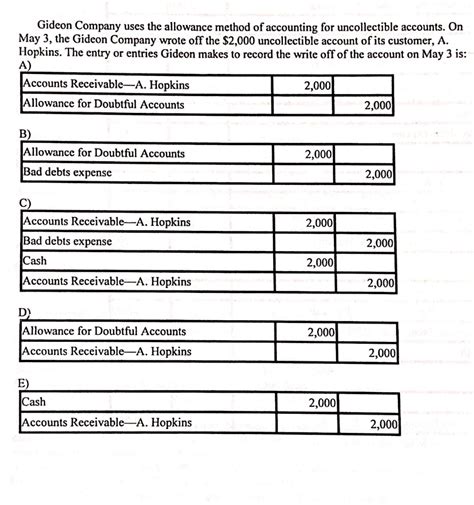

Writing Off Uncollectible Accounts

Once Gideon Company determines that an account is uncollectible, it writes it off. This involves debiting the Allowance for Doubtful Accounts and crediting Accounts Receivable. This reduces both the allowance and the accounts receivable balance. The journal entry looks like this:

Debit: Allowance for Doubtful Accounts

Credit: Accounts Receivable

Recovering Accounts Previously Written Off

Sometimes, Gideon Company may recover an account that was previously written off. This happens when a customer unexpectedly makes a payment on an account that was considered uncollectible. In this situation, Gideon Company reverses the write-off and then records the collection.

The journal entries are as follows:

First, reverse the write-off:

Debit: Accounts Receivable

Credit: Allowance for Doubtful Accounts

Second, record the collection:

Debit: Cash

Credit: Accounts Receivable

Impact on Gideon Company's Financial Statements

The allowance method directly impacts Gideon Company’s balance sheet and income statement.

-

Balance Sheet: The net realizable value of accounts receivable (accounts receivable less allowance for doubtful accounts) is reported on the balance sheet. This provides a more accurate picture of the company's assets.

-

Income Statement: Bad debt expense is reported on the income statement, reducing the company's net income. This accurately reflects the cost of extending credit to customers.

Choosing the Right Method for Gideon Company

The choice between the percentage of sales method and the percentage of accounts receivable method depends on several factors, including:

-

Gideon Company's historical data: If Gideon Company has reliable historical data on bad debt losses, the percentage of accounts receivable method may be more accurate.

-

Complexity of Gideon Company's operations: If Gideon Company has a simple credit policy and a relatively small number of accounts receivable, the percentage of sales method might suffice.

-

Gideon Company's industry norms: Industry benchmarks can provide guidance on appropriate bad debt percentages.

-

Materiality: For smaller amounts, the added complexity of the aging method might not be justified.

Regardless of the method chosen, consistent application is key for accurate financial reporting. Gideon Company should document its chosen method and the rationale behind it.

Advantages of the Allowance Method for Gideon Company

The allowance method provides several benefits for Gideon Company:

-

More accurate financial reporting: It presents a more realistic picture of the company's financial position by accurately reflecting the estimated uncollectible accounts.

-

Better matching of revenue and expenses: Bad debt expense is recognized in the same period as the related sales revenue, providing a more accurate representation of profitability.

-

Improved financial planning: The allowance method facilitates better financial planning by allowing Gideon Company to proactively set aside funds for potential bad debts.

-

Compliance with accounting standards: The allowance method aligns with Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS), ensuring compliance and credibility.

Disadvantages of the Allowance Method for Gideon Company

While the allowance method offers numerous benefits, some drawbacks exist:

-

Subjectivity in estimation: Estimating bad debt expense involves some degree of subjectivity, particularly with the percentage of accounts receivable method, as it relies on estimations of uncollectibility percentages.

-

Increased complexity: The allowance method requires more detailed record-keeping and analysis compared to the direct write-off method.

-

Potential for overestimation or underestimation: The chosen method and the percentages applied can lead to either overstating or understating the allowance for doubtful accounts, affecting the accuracy of financial reporting.

Conclusion

The allowance method of accounting for bad debts is a crucial component of sound financial management for companies like Gideon Company. By accurately estimating and accounting for potential uncollectible accounts, Gideon Company can present a more accurate and reliable picture of its financial health. While the method requires careful planning and analysis, the benefits of improved financial reporting, better matching of revenue and expenses, and enhanced financial planning far outweigh the challenges. Gideon Company's choice of method—percentage of sales or percentage of accounts receivable—should align with its specific circumstances, historical data, and operational complexity, ensuring the method chosen provides the most accurate and efficient representation of its financial reality. Consistent application of the chosen method, along with regular review and adjustment of bad debt estimations, is essential for maintaining the integrity and reliability of Gideon Company's financial statements.

Latest Posts

Latest Posts

-

Saltatory Conduction Is Made Possible By

Apr 02, 2025

-

Reference Cell A1 From Alpha Worksheet

Apr 02, 2025

-

Professional Practice Use Of The Theories Concepts Presented In The Article

Apr 02, 2025

-

Ordinary Repairs And Maintenance Costs Should Be

Apr 02, 2025

-

Trina Is Trying To Decide Which Lunch Combination

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about Gideon Company Uses The Allowance Method Of Accounting . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.