Gideon Company Uses The Allowance Method

Holbox

Mar 14, 2025 · 7 min read

Table of Contents

Gideon Company Uses the Allowance Method: A Comprehensive Guide to Accounting for Bad Debts

The allowance method is a crucial accounting technique used to estimate and account for potential bad debts. It's a more sophisticated approach than the direct write-off method, offering a more accurate reflection of a company's financial position. This article will delve into the allowance method, using the fictional Gideon Company as a case study to illustrate its application and importance. We'll explore the different aspects, from setting up the allowance account to analyzing its impact on the financial statements.

Understanding the Allowance Method

The allowance method anticipates potential bad debts—accounts receivable that are unlikely to be collected—by creating a contra-asset account called the Allowance for Doubtful Accounts. This account reduces the balance of Accounts Receivable, presenting a more realistic view of the amount the company expects to actually collect. Instead of waiting for a specific account to become uncollectible, the allowance method proactively estimates potential losses. This improves the accuracy and reliability of the financial statements.

Key Advantages of the Allowance Method

- More Accurate Financial Statements: By estimating bad debts, the allowance method provides a more accurate picture of the company's financial health. This is crucial for making informed business decisions and attracting investors.

- Better Matching of Revenues and Expenses: The allowance method aligns bad debt expense with the revenue generated in the same period, following the accrual accounting principle.

- Improved Credit Risk Management: The process of estimating bad debts encourages businesses to regularly review their credit policies and customer creditworthiness, leading to better risk management.

- Compliance with GAAP: The allowance method is generally required under Generally Accepted Accounting Principles (GAAP) for companies with significant accounts receivable.

Gideon Company's Implementation of the Allowance Method

Let's assume Gideon Company, a mid-sized retailer, uses the allowance method to account for its bad debts. We'll follow their process through a hypothetical scenario.

1. Estimating Bad Debts: The Percentage of Sales Method

Gideon Company decides to use the percentage of sales method to estimate bad debts. This method bases the estimate on a percentage of credit sales for a given period. Let's say Gideon Company's credit sales for the year were $1,000,000, and their historical data suggests a 2% bad debt rate.

- Calculation: $1,000,000 (Credit Sales) * 0.02 (Bad Debt Rate) = $20,000 (Estimated Bad Debt Expense)

This $20,000 represents the expense Gideon Company expects to incur due to uncollectible accounts. The journal entry to record this expense would be:

Debit: Bad Debt Expense $20,000

Credit: Allowance for Doubtful Accounts $20,000

This entry increases the bad debt expense and increases the allowance for doubtful accounts, reducing the net realizable value of accounts receivable.

2. Estimating Bad Debts: The Aging of Receivables Method

Another common method is the aging of receivables method. This method categorizes accounts receivable based on how long they've been outstanding. Older accounts are considered more likely to be uncollectible. Let's assume Gideon Company uses this method in conjunction with, or as an alternative to, the percentage of sales method.

| Age of Receivable | Amount | Percentage Uncollectible | Estimated Uncollectible Amount |

|---|---|---|---|

| 0-30 days | $500,000 | 1% | $5,000 |

| 31-60 days | $200,000 | 5% | $10,000 |

| 61-90 days | $100,000 | 10% | $10,000 |

| Over 90 days | $50,000 | 25% | $12,500 |

| Total | $850,000 | $37,500 |

The total estimated uncollectible amount is $37,500. If the existing balance in the Allowance for Doubtful Accounts is $15,000 (a credit balance), then the adjustment needed would be:

- Calculation: $37,500 (Estimated Uncollectible) - $15,000 (Existing Balance) = $22,500

The journal entry would be:

Debit: Bad Debt Expense $22,500

Credit: Allowance for Doubtful Accounts $22,500

This entry reflects the necessary adjustment to bring the allowance account to its desired balance.

3. Writing Off Uncollectible Accounts

When Gideon Company determines an account is truly uncollectible, it writes off the amount. Let's say a $5,000 account is deemed uncollectible. The journal entry would be:

Debit: Allowance for Doubtful Accounts $5,000

Credit: Accounts Receivable $5,000

This reduces both the allowance account and the accounts receivable balance. Note that this entry does not affect the income statement; it simply removes the uncollectible account from the books.

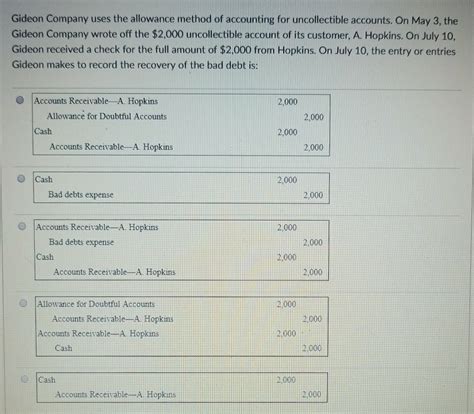

4. Recovering Previously Written-Off Accounts

Sometimes, a previously written-off account is unexpectedly recovered. Let's say Gideon Company recovers $2,000 from a previously written-off account. The entries would be:

Debit: Accounts Receivable $2,000

Credit: Allowance for Doubtful Accounts $2,000

Followed by:

Debit: Cash $2,000

Credit: Accounts Receivable $2,000

This reverses the initial write-off and records the cash collection.

Analyzing the Impact on Financial Statements

The allowance method directly impacts Gideon Company's balance sheet and income statement.

Balance Sheet

The Allowance for Doubtful Accounts appears as a deduction from Accounts Receivable. This provides a more realistic view of the net realizable value of receivables—the amount the company expects to collect.

- Example: If Accounts Receivable is $850,000 and the Allowance for Doubtful Accounts is $37,500 (using the aging method example), the net realizable value would be $812,500 ($850,000 - $37,500).

Income Statement

Bad Debt Expense appears on the income statement, reflecting the estimated losses from uncollectible accounts. This expense reduces net income, accurately representing the company's profitability after considering potential losses.

Choosing the Right Method for Gideon Company

The choice between the percentage of sales method and the aging of receivables method depends on Gideon Company's specific circumstances. The percentage of sales method is simpler to implement but may be less accurate. The aging of receivables method is more complex but generally provides a more precise estimate of bad debts. Gideon Company might even use a combination of both methods for a more comprehensive approach. Regular review and adjustment of the allowance account are crucial to maintain its accuracy.

Beyond the Basics: Advanced Considerations for Gideon Company

Gideon Company might consider these advanced aspects of bad debt accounting as their business grows and their operations become more complex:

1. Factor in Economic Conditions:

External factors like economic downturns or industry-specific challenges can significantly impact the rate of uncollectible debts. Gideon Company should adjust its bad debt estimation methods to account for these fluctuations. This could involve using a higher percentage in periods of economic uncertainty.

2. Customer Segmentation:

Analyzing customer data and segmenting customers based on creditworthiness allows for more precise bad debt estimations. Gideon might categorize customers into different risk profiles (low, medium, high risk), applying different percentages to each segment. This granular approach improves the accuracy of the allowance account.

3. Regular Review and Adjustments:

The allowance for doubtful accounts isn't a static number. Gideon Company needs to review and adjust the allowance regularly. This could involve quarterly or even monthly reviews, especially if significant changes occur in sales volume, credit policies, or the overall economic environment.

4. Internal Controls:

Strong internal controls are essential to minimize the risk of bad debts. This includes careful credit checks before extending credit, efficient billing and collection procedures, and regular monitoring of outstanding receivables. Regular training for staff on credit procedures is also crucial.

5. Software and Technology:

Utilizing accounting software with built-in features for managing accounts receivable and calculating bad debts can streamline the process and improve accuracy. Many accounting systems automate the aging of receivables process, making it easier to estimate bad debt expense.

Conclusion: Effective Bad Debt Management for Gideon Company

Implementing the allowance method is crucial for Gideon Company's accurate financial reporting and effective management of credit risk. By carefully estimating bad debts and regularly reviewing the allowance account, Gideon can ensure its financial statements present a realistic picture of its financial health. Choosing the appropriate method, incorporating external factors, segmenting customers, and utilizing technology are all critical steps towards robust bad debt management, ultimately contributing to Gideon Company's long-term financial success. Consistent monitoring and adaptation of strategies will ensure the company stays ahead of potential losses and maintains a strong financial position.

Latest Posts

Latest Posts

-

If Intermediate Goods And Services Were Included In Gdp

Mar 14, 2025

-

After You Return A Check To A Customer

Mar 14, 2025

-

The Internet Is A Collection Of

Mar 14, 2025

-

Consider The Following Reaction At Equilibrium

Mar 14, 2025

-

Think About Consumer Complaints Which Of The Following Is Correct

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about Gideon Company Uses The Allowance Method . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.