After You Return A Check To A Customer

Holbox

Mar 14, 2025 · 5 min read

Table of Contents

After You Return a Check to a Customer: A Comprehensive Guide

Returning a check to a customer requires careful consideration and precise execution. While seemingly a simple transaction, mishandling the process can lead to financial and reputational damage for your business. This comprehensive guide outlines best practices, legal considerations, and strategies for effectively managing returned checks, ensuring customer satisfaction and minimizing potential risks.

Understanding Why Checks Are Returned

Before delving into the procedures, it's crucial to understand the reasons why a check might be returned. This knowledge helps you proactively address issues and prevent future occurrences. Common reasons include:

Insufficient Funds (NSF)

This is the most frequent reason for check returns. The customer's account doesn't have enough money to cover the check amount. Handling NSF checks requires a delicate balance between recovering funds and maintaining a positive customer relationship.

Account Closed

The customer's account may have been closed, preventing the check from being processed. This often requires contacting the customer to obtain updated payment information.

Stop Payment

The customer may have issued a stop payment order on the check, intentionally preventing its clearance. This usually indicates a dispute or dissatisfaction with the transaction.

Incorrect Account Information

Errors in the account number or other banking details can lead to check returns. Verification of account details before issuing a check is paramount.

Other Reasons

Other reasons for returned checks include forged signatures, altered amounts, or issues with the check itself (e.g., damaged or incomplete).

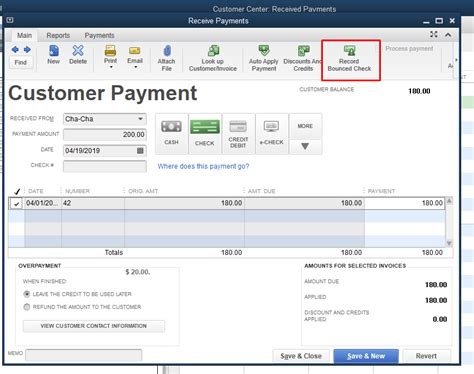

The Procedure for Returning a Check to a Customer

Returning a check to a customer involves more than just sending it back. It requires clear communication, documentation, and a plan for recovering the outstanding payment.

1. Confirmation and Investigation

Upon receiving notification that a check has been returned, immediately confirm the reason for the return with your bank. Gather all relevant documentation, including the returned check, deposit slip, and any associated invoices or records. Investigate whether the reason is a simple oversight (like incorrect account information) or a more serious issue (like insufficient funds or a deliberate stop payment).

2. Contacting the Customer

Contact the customer promptly, explaining the situation clearly and professionally. Avoid accusatory language. Focus on understanding the reason for the return and finding a solution that works for both parties. Document this communication thoroughly, noting the date, time, and details of the conversation.

Example Communication Script:

"Dear [Customer Name],

We are writing to inform you that a check you recently issued for [amount] was returned by your bank due to [reason provided by the bank]. To ensure we can process your payment, could you please contact us at [phone number] or reply to this email at your earliest convenience to discuss alternative payment methods?"

3. Offering Alternative Payment Options

Provide the customer with convenient and flexible payment options. This shows your willingness to work with them and helps prevent further delays. Consider offering options like:

- Online Payment: Provide a link to a secure online payment portal.

- Credit Card Payment: Accept payments via credit or debit cards.

- Cash Payment: If feasible, allow cash payments in person or via mail (with appropriate security measures).

- Payment Plan: For larger amounts, offer a payment plan to ease the financial burden on the customer.

4. Documentation and Record Keeping

Meticulously document every step of the process. This includes the date of the return, the reason for the return, the communication with the customer, the agreed-upon payment method, and the date of the successful payment (or lack thereof). This detailed record-keeping is crucial for legal and financial purposes.

5. Legal Considerations

Depending on the circumstances, returning a check might trigger legal implications. For instance, repeated NSF checks might lead to legal action to recover the debt. Consult with legal counsel to understand your rights and obligations in such situations. Familiarize yourself with your state's laws concerning bad checks.

Preventing Future Returned Checks

Proactive measures can significantly reduce the incidence of returned checks. Implement these strategies to minimize the risk:

Verify Customer Information

Thoroughly verify customer information, including their banking details, before issuing a check. This includes confirming the account number and ensuring that the name on the check matches the account holder's name.

Utilize Electronic Payment Methods

Encourage customers to use electronic payment methods, such as online payments or credit/debit card transactions. These methods reduce the risk of insufficient funds and other check-related issues.

Implement a Robust Credit Check System

For high-value transactions or repeat customers, consider implementing a credit check system to assess the customer's creditworthiness. This can help identify potential risks before issuing a check.

Clearly Defined Payment Terms

Clearly outline your payment terms and conditions on invoices and other documentation. This ensures that customers understand the payment deadlines and consequences of late or non-payment.

Regular Monitoring and Reconciliation

Regularly monitor your bank accounts and reconcile them with your records. This allows you to identify returned checks promptly and take appropriate action.

Employee Training

Train your employees on proper check handling procedures, including verification of customer information, proper endorsement of checks, and communication protocols for returned checks.

Building and Maintaining Customer Relationships

Handling returned checks requires diplomacy and a customer-centric approach. Maintaining a positive relationship with your customer, even when facing payment issues, is crucial for long-term success.

Empathy and Understanding

Approach the situation with empathy and understanding. Many customers who have returned checks do so due to unforeseen circumstances, not necessarily intentional negligence. Offering flexible payment options and avoiding accusatory language can go a long way in preserving the customer relationship.

Clear and Open Communication

Maintain clear and open communication throughout the process. Keep the customer informed of your actions and progress, and promptly respond to their queries. Transparency builds trust and confidence.

Conclusion

Returning a check to a customer is a delicate process that demands careful attention to detail, clear communication, and a proactive approach. By understanding the reasons behind returned checks, implementing preventative measures, and maintaining a customer-centric approach, businesses can effectively manage this situation, minimizing financial losses and preserving valuable customer relationships. Remember that thorough documentation and a knowledge of applicable laws are paramount in navigating the complexities of returned checks. Proactive measures are far more effective and less costly than reactive responses, prioritizing the prevention of returned checks through efficient processes and strong customer relationships.

Latest Posts

Latest Posts

-

Determine Which Is The Larger Species

Mar 14, 2025

-

Modern Real Estate Practice Workbook 5th Edition

Mar 14, 2025

-

Karst Processes And Topography Activity 12 4

Mar 14, 2025

-

Question New York Select All The Reagets

Mar 14, 2025

-

The Media Perform The Signaling Role By

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about After You Return A Check To A Customer . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.