Entries Are Made To The Petty Cash Account When

Holbox

Mar 19, 2025 · 6 min read

Table of Contents

Entries are Made to the Petty Cash Account When… A Comprehensive Guide

Petty cash is a crucial aspect of financial management for small businesses and even larger organizations. It represents a small amount of cash kept on hand for minor, day-to-day expenses. Understanding when and how to make entries to the petty cash account is essential for maintaining accurate financial records and preventing discrepancies. This comprehensive guide will delve into the intricacies of petty cash accounting, explaining the situations that warrant petty cash entries and demonstrating best practices for record-keeping.

What is Petty Cash?

Petty cash is a small fund of money kept readily available for small, unplanned expenses that are impractical to process through standard accounting procedures. These expenses typically include things like office supplies, postage stamps, minor repairs, or small employee reimbursements. Maintaining a petty cash fund offers convenience and efficiency in handling these minor expenditures. However, it's vital to manage it carefully to ensure accountability and prevent misuse.

When are Entries Made to the Petty Cash Account?

Entries are made to the petty cash account whenever a petty cash transaction occurs. This means whenever money is taken out from the petty cash fund or when the fund is replenished. Let's examine these scenarios in detail:

1. Disbursements from the Petty Cash Fund:

This is the most frequent reason for making an entry. Every time money is spent from the petty cash, a detailed record must be made. This record typically includes:

- Date: The date of the transaction.

- Description: A clear and concise description of the expense (e.g., "Office supplies – Staples," "Taxi fare to client meeting," "Reimbursement for John Doe – mileage").

- Amount: The specific amount spent.

- Supporting Documentation: This is crucial for auditing and verification. Keep receipts or invoices for every petty cash disbursement.

Example:

Let's say you spent $15 on office supplies. Your petty cash record would look like this:

| Date | Description | Amount | Supporting Document |

|---|---|---|---|

| 2024-10-26 | Office supplies – Staples | $15 | Receipt |

2. Replenishing the Petty Cash Fund:

As money is spent from the petty cash fund, the balance decreases. When the fund reaches a low level (determined by your company's policy), it needs to be replenished. This involves adding money to bring the fund back to its established limit. Replenishing the petty cash account requires a journal entry. This involves debiting the various expense accounts and crediting the cash account.

Example:

Suppose your petty cash fund started at $100 and you've made the following disbursements:

- Office supplies: $15

- Postage stamps: $8

- Taxi fare: $22

The total disbursement is $45 ($15 + $8 + $22). To replenish the fund, you'll need to add $45. The journal entry would be:

- Debit:

- Office Supplies Expense: $15

- Postage Expense: $8

- Travel Expense: $22

- Credit: Cash: $45

This entry reflects the expenses incurred and the replenishment of the cash fund. The petty cash account itself remains unchanged in the general ledger (it will remain at $100).

3. Establishing the Petty Cash Fund:

The initial establishment of a petty cash fund also requires a journal entry. This involves debiting the petty cash account and crediting the cash account for the amount of the initial fund.

Example:

If you're setting up a $100 petty cash fund, the initial journal entry would be:

- Debit: Petty Cash: $100

- Credit: Cash: $100

4. Adjusting the Petty Cash Fund:

Occasionally, you might need to adjust the petty cash fund's limit. Increasing the limit requires a debit to Petty Cash and a credit to Cash. Decreasing the limit involves the opposite—debiting Cash and crediting Petty Cash.

Maintaining Accurate Petty Cash Records:

Maintaining meticulous petty cash records is paramount. Inaccurate records can lead to financial discrepancies, internal control weaknesses, and potential fraud. Here are some key best practices:

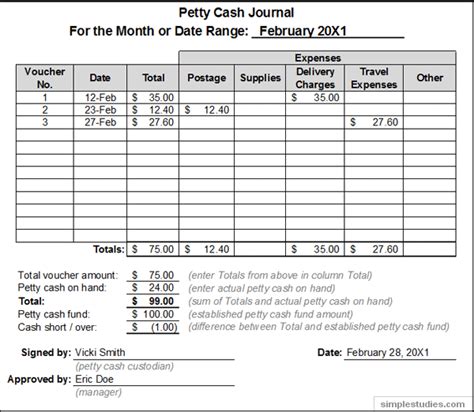

- Use a Petty Cash Book: Maintain a dedicated petty cash book or spreadsheet to record all transactions. This should be easily accessible and kept secure.

- Numbered Receipts: Ensure all receipts are numbered sequentially for better tracking and to prevent duplication.

- Regular Reconciliation: Regularly reconcile the petty cash fund with the petty cash book. This involves counting the physical cash on hand and comparing it to the recorded balance in the petty cash book. Any discrepancies should be investigated immediately.

- Designated Custodian: Assign a responsible individual to manage the petty cash fund. This promotes accountability.

- Regular Audits: Conduct periodic audits of the petty cash fund to verify accuracy and detect any irregularities.

- Clear Policies and Procedures: Establish clear policies and procedures for petty cash management, including limits, reimbursement processes, and record-keeping requirements.

- Use of Software: Many accounting software packages have features that allow for easy tracking of petty cash transactions.

Common Mistakes to Avoid in Petty Cash Management:

- Lack of Proper Documentation: Failing to obtain and retain receipts for all expenses is a serious oversight. This makes it difficult to track expenses and can lead to inaccurate financial reporting.

- Insufficient Controls: Weak internal controls, such as a lack of designated custodians or infrequent reconciliation, create opportunities for misuse or theft.

- Inconsistent Record Keeping: Inconsistent or incomplete records make it challenging to track expenses and identify patterns or anomalies.

- Ignoring Discrepancies: Ignoring discrepancies between the physical cash and the recorded balance can mask serious problems.

Petty Cash and Internal Controls:

Effective petty cash management is a critical component of a strong internal control system. A well-designed petty cash system helps prevent fraud, improves accuracy in financial reporting, and ensures accountability. Key internal controls include:

- Segregation of Duties: The person handling petty cash should not be the same person responsible for reconciling the account or authorizing payments.

- Authorization Limits: Establish clear limits on the amount that can be spent from the petty cash fund without prior authorization.

- Regular Reviews: Regular reviews of the petty cash procedures and records help identify weaknesses and improve the system's effectiveness.

Conclusion:

Petty cash, while seemingly insignificant, plays a vital role in a company's financial health. Understanding when and how to make entries to the petty cash account, coupled with diligent record-keeping and strong internal controls, is essential for ensuring accurate financial reporting, preventing fraud, and maintaining efficient financial operations. By following the best practices outlined in this guide, businesses can effectively manage their petty cash funds and minimize the risks associated with this crucial aspect of financial management. Remember, the key to successful petty cash management is accuracy, accountability, and adherence to established procedures. Regular monitoring and reconciliation will ensure your petty cash remains a streamlined and effective tool for handling minor expenses.

Latest Posts

Latest Posts

-

An Aircraft Component Is Fabricated From An Aluminum Alloy

Mar 19, 2025

-

A Business Plan Is A Document That Outlines

Mar 19, 2025

-

What Is The Difference Between Tough And Tuff

Mar 19, 2025

-

Locking Out Tagging Out Refers To The Practice Of

Mar 19, 2025

-

John Is Rollerblading Down A Long

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about Entries Are Made To The Petty Cash Account When . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.