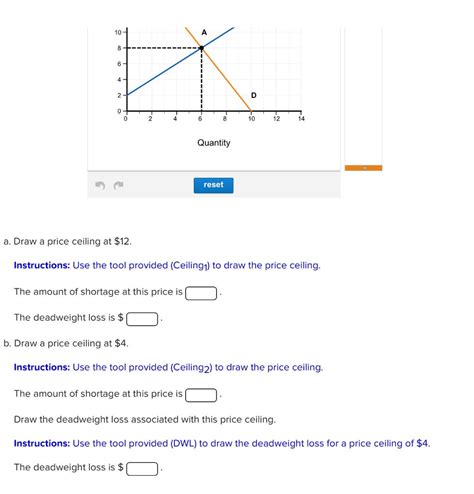

Draw A Price Ceiling At $12

Holbox

Mar 29, 2025 · 5 min read

Table of Contents

- Draw A Price Ceiling At $12

- Table of Contents

- Draw a Price Ceiling at $12: A Comprehensive Guide to Price Controls

- Understanding Price Ceilings and Market Equilibrium

- The Mechanics of a $12 Price Ceiling

- The Impacts of a $12 Price Ceiling: A Detailed Analysis

- Impacts on Consumers

- Impacts on Producers (Landlords in this example)

- Societal Impacts and Long-Term Consequences

- Alternatives to Price Ceilings: A More Effective Approach

- Conclusion: The Case Against a $12 Price Ceiling

- Latest Posts

- Latest Posts

- Related Post

Draw a Price Ceiling at $12: A Comprehensive Guide to Price Controls

Price ceilings, a crucial concept in economics, represent government-mandated maximum prices for goods or services. Understanding their implications is vital for businesses, consumers, and policymakers alike. This article delves deep into the effects of imposing a price ceiling at $12, analyzing its impact on various market participants and exploring potential consequences. We’ll cover the mechanics, the benefits (if any), the drawbacks, and ultimately, whether such a policy is truly effective.

Understanding Price Ceilings and Market Equilibrium

Before diving into the specifics of a $12 price ceiling, let's establish a foundational understanding. A market's equilibrium point is where supply and demand intersect, creating a price and quantity that clear the market – meaning all goods supplied are purchased at the prevailing price. A price ceiling, by definition, sets a maximum price below the equilibrium price. This intervention artificially lowers the price, leading to predictable – yet often unintended – consequences.

The Mechanics of a $12 Price Ceiling

Imagine a market for a particular good (let's say, apartments in a city). The market equilibrium price is, say, $15 per month, with a corresponding equilibrium quantity of apartments rented. If the government imposes a price ceiling at $12, the legal maximum price is now below the equilibrium price. This creates an immediate imbalance:

-

Increased Demand: At $12, the quantity demanded surges. Renters who previously couldn't afford $15 are now willing to rent, driving up demand significantly.

-

Decreased Supply: Landlords, facing a lower price, reduce the supply of apartments. Some may choose not to rent their units at a loss-making price, while others may shift their properties to other markets or engage in alternative strategies (detailed below).

This leads to a shortage: the quantity demanded exceeds the quantity supplied at the artificially low price. This shortage is the defining characteristic of a binding price ceiling.

The Impacts of a $12 Price Ceiling: A Detailed Analysis

The consequences of a $12 price ceiling ripple throughout the market, affecting consumers, producers, and the overall efficiency of resource allocation.

Impacts on Consumers

While the intention of a price ceiling is to benefit consumers by making goods more affordable, the reality is more nuanced.

-

Increased Demand, Limited Supply: The most immediate impact is the aforementioned shortage. Competition for the limited number of apartments intensifies, leading to long waiting lists, increased search costs (time and effort spent finding an apartment), and potentially discriminatory practices by landlords.

-

Reduced Quality: Landlords, facing reduced revenue, may be incentivized to cut corners on maintenance and upkeep, leading to a deterioration of the quality of apartments.

-

Black Markets: When the official price is significantly below the market clearing price, black markets may emerge. Landlords might engage in illicit practices, charging above the ceiling price “under the table.” This undermines the legitimacy of the price control and creates opportunities for exploitation.

-

Rationing: Because the demand exceeds the supply, some form of rationing becomes necessary. This could be first-come, first-served, favoritism towards certain groups, or lottery systems. Such methods can be inefficient and unfair.

Impacts on Producers (Landlords in this example)

The price ceiling also significantly impacts landlords:

-

Reduced Revenue: The most direct effect is lower revenue due to the artificially lowered rent. This can lead to financial strain and limit the ability of landlords to invest in property maintenance or improvements.

-

Decreased Incentive to Supply: With reduced profitability, landlords may remove units from the rental market. They might choose to sell their properties, convert them to other uses (e.g., short-term rentals or Airbnbs), or simply let them sit vacant. This further exacerbates the housing shortage.

-

Difficulty Attracting Investment: The price ceiling discourages investment in new housing construction. Developers will be hesitant to invest in projects that offer limited returns due to the price cap.

Societal Impacts and Long-Term Consequences

The effects of a $12 price ceiling extend beyond the immediate participants:

-

Reduced Efficiency: The price ceiling distorts market signals and prevents efficient resource allocation. The shortage prevents the market from clearing, leading to wasted resources and unmet needs.

-

Inequality: While intended to assist low-income renters, price ceilings can actually exacerbate inequality. Those with greater resources (e.g., better connections, higher incomes) may still manage to secure housing, leaving the most vulnerable worse off. The black market often disproportionately affects the poor who lack the resources to navigate illicit arrangements.

-

Administrative Costs: Enforcing a price ceiling requires significant government resources to monitor compliance, investigate violations, and prosecute offenders. These costs can be substantial.

-

Innovation Stifling: With reduced profitability, landlords may have less incentive to innovate or improve their services. This can lead to stagnation and less choice for renters.

Alternatives to Price Ceilings: A More Effective Approach

Instead of imposing a price ceiling, which often creates more problems than it solves, alternative approaches can be more effective in addressing affordability concerns:

-

Rent Subsidies: Directly subsidizing low-income renters allows them to afford higher-priced apartments without distorting the market. This addresses the affordability issue without causing shortages.

-

Housing Vouchers: Similar to rent subsidies, vouchers provide a fixed amount that renters can use to pay rent in the private market.

-

Increased Housing Supply: Addressing the root cause of affordability issues – a shortage of housing – through zoning reforms, streamlining building permits, and incentivizing construction can be far more effective.

-

Tax Credits for Affordable Housing Developers: Providing tax incentives to developers focused on building affordable housing encourages the construction of more units.

-

Investing in Public Transportation: Improving public transport makes living further from city centers more viable, increasing the supply of affordable housing options.

Conclusion: The Case Against a $12 Price Ceiling

Imposing a price ceiling at $12, or any level significantly below the market equilibrium, is likely to result in more negative consequences than benefits. While the intention is to make goods more affordable, the reality is often a shortage, reduced quality, black markets, and inefficient resource allocation. Alternatives like rent subsidies, housing vouchers, and increased housing supply offer more sustainable and effective solutions to affordability issues without the unintended and often harmful side effects of price controls. A comprehensive approach that addresses the underlying causes of high prices, rather than simply imposing artificial constraints, is ultimately a more responsible and beneficial strategy for both consumers and the broader economy. Understanding the complexities of price ceilings is crucial for creating well-informed policies that truly address societal needs.

Latest Posts

Latest Posts

-

Mrs Roswell Is A New Medicare Beneficiary

Apr 01, 2025

-

Match Each Description With An Appropriate Ip Address

Apr 01, 2025

-

Advantages Of The Activity Based Costing Include Check All That Apply

Apr 01, 2025

-

Determine The Remaining Sides And Angles Of The Triangle Abc

Apr 01, 2025

-

Correctly Label The Following Internal Anatomy Of The Heart

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Draw A Price Ceiling At $12 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.