Cynthia Needs To Share A Financial Snapshot

Holbox

Mar 24, 2025 · 7 min read

Table of Contents

- Cynthia Needs To Share A Financial Snapshot

- Table of Contents

- Cynthia Needs to Share a Financial Snapshot: A Comprehensive Guide

- Understanding the Purpose: Why Share a Financial Snapshot?

- 1. Securing a Loan:

- 2. Attracting Investors:

- 3. Seeking a Promotion:

- 4. Personal Financial Management:

- Components of a Financial Snapshot: The Essential Elements

- 1. Summary of Key Financial Metrics:

- 2. Detailed Breakdown of Assets and Liabilities:

- 3. Cash Flow Statement:

- 4. Income Statement (if applicable):

- 5. Balance Sheet (if applicable):

- Presenting the Financial Snapshot: Tips for Effective Communication

- Tools and Resources for Creating a Financial Snapshot

- Conclusion: A Powerful Tool for Financial Success

- Latest Posts

- Latest Posts

- Related Post

Cynthia Needs to Share a Financial Snapshot: A Comprehensive Guide

Cynthia, like many individuals and businesses, faces the challenge of presenting a clear and concise financial snapshot. This isn't just about numbers; it's about storytelling – conveying a compelling narrative that informs, persuades, and ultimately, achieves its intended purpose. Whether Cynthia needs this snapshot for securing a loan, attracting investors, seeking a promotion, or simply improving personal financial management, understanding the key components and tailoring the presentation is crucial. This comprehensive guide will walk Cynthia (and you!) through every step of the process.

Understanding the Purpose: Why Share a Financial Snapshot?

Before diving into the specifics of what to include, it's essential to understand why Cynthia needs to share her financial information. The purpose dictates the content, tone, and level of detail. Some common reasons include:

1. Securing a Loan:

For loan applications, lenders require a detailed financial snapshot to assess Cynthia's creditworthiness and ability to repay the loan. This usually involves:

- Credit history: A comprehensive review of past borrowing and repayment behaviour. A strong credit score is essential.

- Income verification: Proof of consistent and sufficient income to cover loan repayments. Pay stubs, tax returns, and bank statements are frequently required.

- Debt-to-income ratio (DTI): A calculation showing the percentage of Cynthia's monthly income dedicated to debt payments. A lower DTI is generally preferred by lenders.

- Assets and liabilities: A complete listing of Cynthia's owned assets (e.g., property, investments) and outstanding debts (e.g., mortgages, credit card balances).

2. Attracting Investors:

Seeking investment requires a more sophisticated financial snapshot. Investors focus on growth potential and financial health. Cynthia will need to demonstrate:

- Projected financial statements: Detailed forecasts of future revenue, expenses, and profits. This demonstrates an understanding of market trends and business viability.

- Key performance indicators (KPIs): Metrics that track the progress of the business and indicate its overall health. Examples include customer acquisition cost, customer lifetime value, and return on investment (ROI).

- Market analysis: Evidence of market research and understanding of the competitive landscape. Investors want to see that Cynthia has a clear strategy for success.

- Management team: Highlights of the experience and expertise of the management team, demonstrating their ability to execute the business plan.

3. Seeking a Promotion:

Within a company, a financial snapshot might demonstrate Cynthia's contributions to the company's bottom line. This could include:

- Sales figures: Quantifiable evidence of Cynthia's impact on revenue generation.

- Cost savings: Demonstrating how Cynthia has contributed to efficiency and cost reduction.

- Project success: Highlights of successful projects that Cynthia has managed, showing her ability to deliver results.

- Performance reviews: A summary of positive performance reviews showcasing her consistent achievements.

4. Personal Financial Management:

Even without a specific need to share the information, creating a personal financial snapshot is crucial for effective financial management. This allows Cynthia to:

- Track income and expenses: Gain a clear understanding of her spending habits and identify areas for improvement.

- Monitor net worth: Assess her overall financial health by calculating the difference between her assets and liabilities.

- Plan for the future: Set financial goals and develop strategies to achieve them, such as saving for retirement or buying a house.

- Identify areas for improvement: Recognize areas where she can reduce spending or increase savings.

Components of a Financial Snapshot: The Essential Elements

Regardless of the purpose, a comprehensive financial snapshot should include certain key elements:

1. Summary of Key Financial Metrics:

This section provides a high-level overview of Cynthia's financial situation. It should include:

- Net worth: The difference between total assets and total liabilities. This provides a quick indication of Cynthia's overall financial health.

- Total assets: A summary of all assets owned, including cash, investments, property, and other valuable possessions.

- Total liabilities: A summary of all outstanding debts, including loans, credit card balances, and other obligations.

- Income: A summary of Cynthia's total income from all sources.

- Expenses: A summary of Cynthia's total expenses, categorized for clarity.

2. Detailed Breakdown of Assets and Liabilities:

This section provides a more granular view of Cynthia's financial holdings and debts. It should include:

- Asset detail: A detailed list of each asset, including its value and any associated documentation.

- Liability detail: A detailed list of each liability, including the amount owed, interest rate, and repayment schedule.

- Supporting documentation: Copies of bank statements, tax returns, loan agreements, and other relevant documents to support the information presented.

3. Cash Flow Statement:

This statement shows the movement of cash in and out of Cynthia's accounts over a specific period. It helps to illustrate:

- Cash inflows: Sources of cash coming into Cynthia's accounts, such as income, investments, and loans.

- Cash outflows: Uses of cash leaving Cynthia's accounts, such as expenses, debt repayments, and investments.

- Net cash flow: The difference between cash inflows and cash outflows, indicating whether Cynthia has a surplus or deficit.

4. Income Statement (if applicable):

If Cynthia is presenting a financial snapshot for a business or investment purpose, an income statement is crucial. This shows:

- Revenue: The total income generated during a specific period.

- Cost of goods sold (COGS): The direct costs associated with producing goods or services.

- Gross profit: The difference between revenue and COGS.

- Operating expenses: The expenses incurred in running the business, such as salaries, rent, and utilities.

- Net income (or loss): The bottom line, showing the overall profit or loss after all expenses are deducted.

5. Balance Sheet (if applicable):

Similar to the income statement, a balance sheet is essential for businesses. It provides a snapshot of Cynthia's financial position at a specific point in time, showing:

- Assets: What Cynthia owns (e.g., cash, accounts receivable, inventory, equipment).

- Liabilities: What Cynthia owes (e.g., accounts payable, loans, mortgages).

- Equity: The difference between assets and liabilities, representing the owner's stake in the business.

Presenting the Financial Snapshot: Tips for Effective Communication

The way Cynthia presents her financial snapshot is just as important as the information it contains. Here are some key tips:

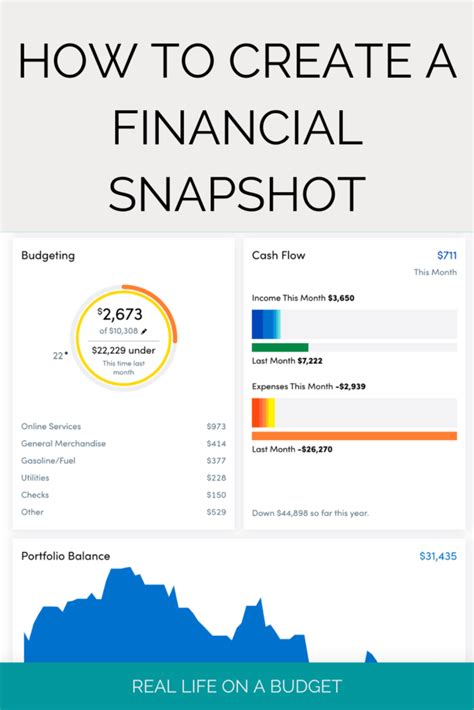

- Keep it concise and clear: Avoid overwhelming the recipient with unnecessary details. Use bullet points, charts, and graphs to present information visually.

- Use plain language: Avoid technical jargon that the recipient may not understand. Explain complex concepts in simple terms.

- Tailor the presentation to the audience: Adjust the level of detail and the tone of the presentation to suit the recipient's needs and understanding. For example, a loan application requires more detail than a personal financial overview.

- Proofread carefully: Ensure the snapshot is free of errors and inconsistencies. A well-presented document shows attention to detail and professionalism.

- Use visual aids: Charts, graphs, and tables can make complex financial data easier to understand. A visually appealing presentation can enhance comprehension and engagement.

- Provide context: Explain the significance of the numbers and how they relate to Cynthia's goals. Don't just present data; tell a story.

Tools and Resources for Creating a Financial Snapshot

Several tools can assist Cynthia in creating a professional and effective financial snapshot:

- Spreadsheet software: Programs like Microsoft Excel or Google Sheets are ideal for organizing and calculating financial data.

- Financial planning software: Dedicated software packages can automate calculations and provide insights into financial health.

- Accounting software: For businesses, accounting software can track income, expenses, and assets automatically, simplifying the process of creating financial reports.

Conclusion: A Powerful Tool for Financial Success

Creating and sharing a financial snapshot is a powerful tool for achieving various financial goals. By understanding the purpose, including the essential elements, and presenting the information clearly and concisely, Cynthia can effectively communicate her financial position and increase her chances of success. Remember, a well-crafted financial snapshot isn't just a collection of numbers; it's a compelling story that showcases financial strength and potential. By following this guide, Cynthia can confidently share her financial story and achieve her objectives.

Latest Posts

Latest Posts

-

Leos Supervisor Gives Him A Big And Boring

Mar 26, 2025

-

What Is 0 885 To The Nearest Tenth

Mar 26, 2025

-

What Is The Period Of The Voltage Source

Mar 26, 2025

-

True False Genetic Drift Can Change Allele Frequencies In A Population

Mar 26, 2025

-

What Challenges Does Generative Face With Respect To Data

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about Cynthia Needs To Share A Financial Snapshot . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.