Corrine Needs To Record A Customers Payment

Holbox

Mar 18, 2025 · 6 min read

Table of Contents

Corinne Needs to Record a Customer's Payment: A Deep Dive into Efficient Payment Processing

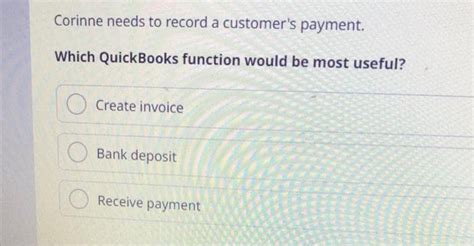

Corinne, a diligent employee at a bustling small business, faces a common yet crucial task: recording a customer's payment. This seemingly simple action is the cornerstone of sound financial management and can significantly impact a business's success. This article explores the various aspects of recording customer payments, offering Corinne (and other business owners and employees) a comprehensive guide to efficient and accurate payment processing. We'll cover everything from choosing the right payment methods to implementing robust record-keeping systems and addressing potential challenges.

Understanding the Importance of Accurate Payment Recording

Accurate and timely payment recording isn't just about balancing the books; it's fundamental to the health of any business. Here's why:

Maintaining Accurate Financial Records: This is the most obvious benefit. Accurate records are essential for generating financial statements, filing taxes, and securing loans. Inaccuracies can lead to penalties, audits, and even legal issues.

Improved Cash Flow Management: Knowing exactly when and how much money is coming in allows businesses to effectively manage cash flow, predict future needs, and make informed financial decisions. This is crucial for avoiding cash shortages and ensuring smooth operations.

Enhanced Customer Relationships: Prompt and accurate payment processing enhances customer satisfaction. Clear and efficient transactions build trust and encourage repeat business.

Fraud Prevention: A well-organized payment system helps identify and prevent fraudulent transactions. Regular reconciliation and proper documentation are vital in detecting anomalies.

Meeting Legal and Regulatory Compliance: Businesses are legally obligated to maintain accurate financial records and comply with tax regulations. Accurate payment recording ensures compliance and avoids legal repercussions.

Choosing the Right Payment Methods for Your Business

The payment methods a business accepts significantly impact its efficiency and customer experience. The optimal choice depends on factors such as the business's size, industry, target market, and technological capabilities.

Cash: While simple and universally accepted, cash presents challenges in terms of security, tracking, and reconciliation. It's susceptible to theft and requires meticulous counting and recording.

Checks: Checks offer a paper trail but are slow to process and can bounce. They require manual processing and reconciliation, adding administrative overhead.

Credit and Debit Cards: These are widely preferred by customers and offer convenience and security. However, they involve processing fees charged by payment processors.

Electronic Funds Transfer (EFT): EFT, including online banking transfers and ACH payments, is efficient and cost-effective. It requires less manual intervention and reduces the risk of errors.

Mobile Payments: Mobile payment apps like Apple Pay and Google Pay provide seamless and secure transactions. They are becoming increasingly popular, especially among younger demographics.

Digital Wallets: Digital wallets, such as PayPal and Venmo, offer convenient online payment options, streamlining transactions and eliminating the need for physical cards.

Implementing a Robust Payment Recording System

Irrespective of the chosen payment method, a robust payment recording system is critical. This system should include:

Dedicated Payment Processing Software: Software solutions automate many aspects of payment processing, including invoice generation, payment tracking, and reconciliation. They often integrate with accounting software, simplifying the process further.

Point of Sale (POS) Systems: For businesses with physical stores, POS systems streamline transactions, automatically recording payments and generating receipts.

Secure Payment Gateway: For online businesses, a secure payment gateway is essential for processing credit and debit card payments safely and efficiently. This ensures compliance with Payment Card Industry Data Security Standard (PCI DSS).

Clear and Consistent Documentation: Every transaction should be documented accurately, including the date, amount, payment method, customer information, and any relevant notes.

Regular Reconciliation: Regularly reconciling bank statements with payment records helps identify discrepancies and prevents errors from accumulating.

Recording Customer Payments: A Step-by-Step Guide for Corinne

Let's walk Corinne through the process of recording a customer payment using different methods:

Recording a Cash Payment:

- Count the cash: Carefully count the cash received from the customer.

- Issue a receipt: Provide the customer with a detailed receipt indicating the date, amount, payment method, and a brief description of the goods or services purchased.

- Record the payment: Enter the payment details into the business's accounting software or a dedicated payment log, including the date, amount, customer name, and transaction reference number.

- Deposit the cash: Deposit the cash into the business's bank account promptly.

Recording a Check Payment:

- Endorse the check: Have the customer endorse the check, making it payable to the business.

- Record the check details: Note the check number, date, amount, and customer information in the accounting software or payment log.

- Deposit the check: Deposit the check into the business's bank account.

- Reconcile the check: Match the deposited check against the bank statement to ensure accuracy.

Recording a Credit/Debit Card Payment:

- Process the transaction: Use a POS system or payment gateway to process the payment.

- Obtain authorization: Ensure the transaction is authorized by the customer's bank.

- Issue a receipt: Provide the customer with a receipt detailing the transaction.

- Record the payment: The payment details will automatically be recorded in the business's accounting software or payment system. Review and confirm accuracy.

Recording an EFT Payment:

- Receive the payment: Receive the EFT payment in the business's bank account.

- Identify the payment: Identify the payment by referencing the customer's name or transaction ID.

- Record the payment: Record the payment date, amount, and customer information in the accounting system.

- Reconcile the payment: Ensure the payment is correctly reconciled with the bank statement.

Recording a Mobile or Digital Wallet Payment:

- Process the transaction: Use the relevant app to process the payment.

- Obtain confirmation: Receive confirmation of the transaction from the payment app.

- Issue a receipt: Provide the customer with a digital receipt.

- Record the payment: The payment should automatically be recorded in the connected accounting system.

Addressing Potential Challenges in Payment Recording

Despite the best efforts, challenges can arise during payment recording. Addressing them proactively is crucial for maintaining accuracy and efficiency:

Dealing with Payment Discrepancies: When discrepancies occur between the recorded payment and the bank statement, thoroughly investigate the cause. This might involve reviewing transaction details, contacting the customer, or checking for errors in data entry.

Handling Returned Checks or Chargebacks: If a check bounces or a credit card payment is charged back, immediately investigate the reason and take appropriate action, such as contacting the customer or issuing a new invoice.

Managing Multiple Payment Methods: Businesses that accept multiple payment methods may need to implement a more complex payment recording system to ensure accuracy. Consider using software that integrates all payment channels into a single system.

Ensuring Data Security: Protecting customer payment information is vital. Businesses must comply with relevant regulations, such as PCI DSS, to prevent data breaches.

Staying Updated with Payment Processing Trends: The payment landscape is constantly evolving. Businesses must stay updated with new technologies and payment methods to remain competitive and efficient.

Conclusion: Mastering Payment Recording for Business Success

For Corinne, and any business owner or employee responsible for payment processing, mastering this crucial task is paramount for success. By choosing the right payment methods, implementing a robust recording system, following best practices, and addressing potential challenges proactively, businesses can ensure accurate financial records, enhance customer relationships, and build a solid foundation for growth. Remember, accurate payment recording isn't just a task; it's a strategic investment in the long-term health and prosperity of any business.

Latest Posts

Latest Posts

-

Management Is More Progressive Today There Is More Emphasis On

Mar 18, 2025

-

In Economics The Term Capital Refers To

Mar 18, 2025

-

Floating Vinyl Plank Floor Final Step

Mar 18, 2025

-

Which Point Would Be Located In Quadrant 3

Mar 18, 2025

-

Identify The Differential Equation Solved By

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Corrine Needs To Record A Customers Payment . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.