Compute Gross Profit On The Sale Of Job 201.

Holbox

Mar 29, 2025 · 6 min read

Table of Contents

- Compute Gross Profit On The Sale Of Job 201.

- Table of Contents

- Computing Gross Profit on the Sale of Job 201: A Comprehensive Guide

- Understanding Job-Order Costing and Gross Profit

- Identifying Relevant Costs for Job 201

- 1. Direct Costs:

- 2. Indirect Costs (Overhead):

- Calculating the Predetermined Overhead Rate

- Allocating Overhead Costs to Job 201

- Calculating the Cost of Goods Sold (COGS) for Job 201

- Determining Sales Revenue for Job 201

- Computing the Gross Profit for Job 201

- Analyzing Gross Profit and Identifying Potential Issues

- Handling Complex Scenarios

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

Computing Gross Profit on the Sale of Job 201: A Comprehensive Guide

Calculating gross profit is a fundamental aspect of project costing and profitability analysis, especially crucial in job-order costing systems. This detailed guide will walk you through the process of computing the gross profit on the sale of Job 201, illustrating the concepts with examples and exploring potential complexities. We'll cover everything from understanding the basic formula to tackling scenarios involving indirect costs and variations in sales pricing.

Understanding Job-Order Costing and Gross Profit

Before diving into the specifics of Job 201, let's establish a solid foundation. Job-order costing is an accounting system used to track the costs associated with individual projects or jobs. It's particularly useful for businesses that produce unique or customized products or services, where each job requires a distinct set of resources and efforts.

Gross profit, on the other hand, represents the difference between the revenue generated from a job and the direct costs incurred in completing it. It's a key indicator of a company's profitability and efficiency. The formula is simple:

Gross Profit = Sales Revenue - Cost of Goods Sold (COGS)

Identifying Relevant Costs for Job 201

To accurately compute the gross profit for Job 201, we need to meticulously identify and categorize all relevant costs. These costs typically fall into two main categories:

1. Direct Costs:

Direct costs are those that can be directly traced to a specific job. These include:

-

Direct Materials: The raw materials directly used in producing Job 201. This includes the cost of purchasing these materials, and any associated freight and handling charges directly attributable to Job 201. Examples could include lumber, concrete, specific components, etc., depending on the nature of Job 201.

-

Direct Labor: The wages and salaries paid to employees who worked directly on Job 201. This excludes supervisory or administrative salaries, which are considered indirect costs. Detailed time sheets are crucial for accurately tracking direct labor hours for Job 201. Remember to include any associated payroll taxes directly related to these employees' time on the job.

2. Indirect Costs (Overhead):

Indirect costs are those that cannot be directly traced to a specific job but are still necessary for the overall production process. These are allocated to jobs using a predetermined overhead rate. Examples of indirect costs include:

- Factory Rent: The cost of renting the factory space where Job 201 was produced.

- Factory Utilities: Electricity, water, and heating costs related to the factory.

- Factory Supervision: Salaries of supervisors overseeing production, including their benefits.

- Depreciation on Factory Equipment: The depreciation expense related to the machinery used in producing Job 201.

- Factory Insurance: Insurance premiums covering the factory and its contents.

- Maintenance and Repairs: Costs of maintaining and repairing factory equipment.

Calculating the Predetermined Overhead Rate

Before we can allocate indirect costs to Job 201, we need to calculate a predetermined overhead rate. This is typically done at the beginning of the accounting period (e.g., annually) and is based on estimated overhead costs and a chosen allocation base (e.g., direct labor hours, machine hours, or direct materials cost).

Predetermined Overhead Rate = Estimated Total Manufacturing Overhead Costs / Estimated Total Allocation Base

Example: Let's assume the estimated total manufacturing overhead costs for the year are $100,000, and the estimated total direct labor hours are 10,000. The predetermined overhead rate would be:

$100,000 / 10,000 hours = $10 per direct labor hour

This means that for every direct labor hour spent on Job 201, $10 of overhead costs will be allocated.

Allocating Overhead Costs to Job 201

Once the predetermined overhead rate is calculated, we can allocate indirect costs to Job 201 based on its actual direct labor hours or other chosen allocation base.

Example: If Job 201 required 500 direct labor hours, the allocated overhead would be:

500 hours * $10/hour = $5,000

Calculating the Cost of Goods Sold (COGS) for Job 201

The cost of goods sold (COGS) for Job 201 is the sum of its direct materials, direct labor, and allocated overhead costs.

COGS = Direct Materials + Direct Labor + Allocated Overhead

Example: Let's assume the following costs for Job 201:

- Direct Materials: $10,000

- Direct Labor: $5,000 (500 hours * $10/hour)

- Allocated Overhead: $5,000

COGS = $10,000 + $5,000 + $5,000 = $20,000

Determining Sales Revenue for Job 201

The sales revenue for Job 201 is the amount the company received from selling the completed job. This is determined by the agreed-upon price with the client and documented in the sales contract or invoice.

Example: Let's assume the sales revenue for Job 201 is $25,000.

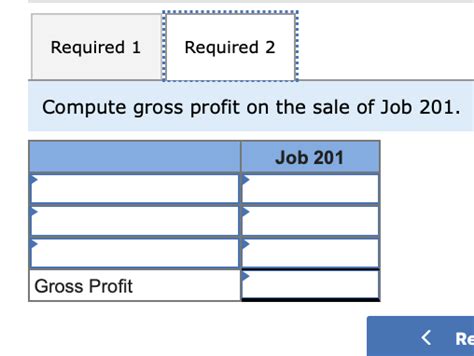

Computing the Gross Profit for Job 201

Finally, we can compute the gross profit for Job 201 using the formula:

Gross Profit = Sales Revenue - Cost of Goods Sold (COGS)

Example: Using the figures from our examples:

Gross Profit = $25,000 - $20,000 = $5,000

Therefore, the gross profit on the sale of Job 201 is $5,000.

Analyzing Gross Profit and Identifying Potential Issues

The $5,000 gross profit indicates that Job 201 was profitable. However, a deeper analysis is necessary to ensure efficient cost management and future profitability.

-

Comparison to Target Profit Margin: Compare the achieved gross profit to the company's target profit margin. If it falls short, investigate potential areas for cost reduction or price adjustments.

-

Variance Analysis: Analyze variances between actual and budgeted costs for direct materials, direct labor, and overhead. Significant variances might indicate inefficiencies or unexpected issues that need attention.

-

Pricing Strategy: Evaluate the pricing strategy used for Job 201. Was the pricing competitive yet profitable? Analyze the profitability of similar jobs to refine the pricing model.

-

Cost Control Measures: Identify potential areas for cost savings without compromising quality. This might involve negotiating better deals with suppliers, optimizing production processes, or improving labor efficiency.

Handling Complex Scenarios

Real-world job costing often involves more complex scenarios:

-

Multiple Jobs: If the same resources are used for multiple jobs, accurate allocation of direct and indirect costs is crucial. Using activity-based costing (ABC) may provide more accurate allocations.

-

Variations in Sales Prices: Negotiated pricing can affect gross profit calculations. Carefully track sales agreements and variations from standard pricing models.

-

Scrap and Spoilage: Costs associated with scrap and spoilage need to be included in the COGS. These can be included as part of direct materials cost if directly attributable to the Job.

-

Changes in Overhead Rates: Significant changes in overhead rates during the year require adjustments to the allocated overhead cost.

-

Long-term Projects: For long-term projects, the timing of revenue recognition and cost allocation is critical and involves more complex accounting considerations.

Understanding these complexities and applying appropriate accounting methods is crucial for accurate gross profit calculation and informed decision-making.

Conclusion

Calculating the gross profit on the sale of Job 201 requires a systematic approach to cost accounting. By meticulously tracking direct and indirect costs, accurately allocating overhead, and carefully considering potential complexities, businesses can gain valuable insights into their profitability and make informed decisions to enhance their financial performance. Remember to regularly review and analyze your costing procedures to maintain accuracy and efficiency in tracking job profitability. This process, while detailed, is essential for sound financial management and sustainable business growth.

Latest Posts

Latest Posts

-

Correctly Label The Posterior Muscles Of The Thigh

Apr 01, 2025

-

A Processing Department Is An Organization Unit

Apr 01, 2025

-

Which Phenomenon Is Reduced By Oil Immersion Microscopy

Apr 01, 2025

-

A Liability For Cash Dividends Is Recorded

Apr 01, 2025

-

You Can Recognize The Process Of Pinocytosis When

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Compute Gross Profit On The Sale Of Job 201. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.