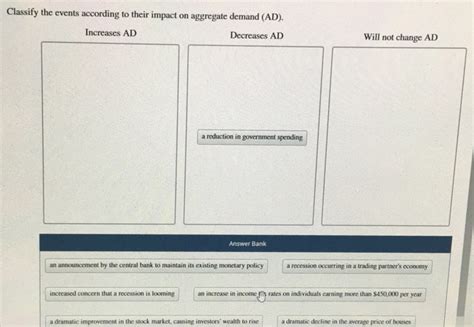

Classify The Events According To Their Impact On Aggregate Demand

Holbox

Mar 28, 2025 · 6 min read

Table of Contents

- Classify The Events According To Their Impact On Aggregate Demand

- Table of Contents

- Classifying Events According to Their Impact on Aggregate Demand

- Factors Affecting Aggregate Demand

- Events Increasing Aggregate Demand (Positive Shifts)

- 1. Increased Consumer Confidence and Spending

- 2. Expansionary Monetary Policy

- 3. Increased Government Spending

- 4. Increased Exports

- 5. Increased Business Confidence and Investment

- Events Decreasing Aggregate Demand (Negative Shifts)

- 1. Decreased Consumer Confidence and Spending

- 2. Contractionary Monetary Policy

- 3. Decreased Government Spending

- 4. Decreased Exports

- 5. Decreased Business Confidence and Investment

- Analyzing the Interplay of Factors

- The Role of Expectations

- Long-Term vs. Short-Term Impacts

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

Classifying Events According to Their Impact on Aggregate Demand

Aggregate demand (AD) represents the total demand for final goods and services in an economy at a given price level. Understanding the factors that shift AD is crucial for policymakers and businesses alike. This article comprehensively classifies various events based on their impact on aggregate demand, exploring both positive and negative shifts, and analyzing the underlying mechanisms.

Factors Affecting Aggregate Demand

Before delving into specific events, let's review the key components of aggregate demand:

- Consumption (C): Household spending on goods and services. This is influenced by disposable income, consumer confidence, interest rates, and wealth.

- Investment (I): Spending by businesses on capital goods (machinery, equipment, buildings), inventories, and residential construction. Influenced by interest rates, business confidence, technological advancements, and government policies.

- Government Spending (G): Spending by all levels of government on goods and services. This includes infrastructure projects, defense spending, and social welfare programs.

- Net Exports (NX): The difference between exports (goods and services sold to other countries) and imports (goods and services bought from other countries). Affected by exchange rates, global economic conditions, and trade policies.

Any event that significantly impacts one or more of these components will shift the aggregate demand curve.

Events Increasing Aggregate Demand (Positive Shifts)

These events lead to an increase in the overall demand for goods and services at any given price level, shifting the AD curve to the right.

1. Increased Consumer Confidence and Spending

Mechanism: When consumers feel optimistic about the future economy, their confidence rises, leading to increased spending. This boosts consumption (C), a major component of AD.

Examples: Positive news about job growth, rising wages, reduced inflation, government tax cuts focused on boosting disposable income, successful marketing campaigns promoting consumer goods.

Impact: A rightward shift of the AD curve, leading to higher output and potentially higher price levels.

2. Expansionary Monetary Policy

Mechanism: Central banks can stimulate the economy by lowering interest rates. Lower interest rates reduce borrowing costs for businesses and consumers, encouraging investment (I) and consumption (C).

Examples: Central bank rate cuts, quantitative easing (injecting money into the financial system), lowering reserve requirements for banks.

Impact: Increased investment and consumption lead to a rightward shift of the AD curve, potentially leading to higher inflation if the economy is near full employment.

3. Increased Government Spending

Mechanism: Government spending directly increases the (G) component of AD. This can involve infrastructure projects, defense spending, or social programs.

Examples: A government stimulus package focused on infrastructure improvements, increased military spending, expansion of social safety nets.

Impact: A direct increase in AD, shifting the curve to the right, boosting economic growth but potentially increasing the national debt.

4. Increased Exports

Mechanism: An increase in exports (relative to imports) leads to a rise in net exports (NX), a component of AD.

Examples: A weaker domestic currency making exports more competitive internationally, strong global demand for domestic goods and services, successful trade agreements opening new export markets.

Impact: Increased demand for domestic goods leads to a rightward shift of the AD curve, boosting economic growth and employment.

5. Increased Business Confidence and Investment

Mechanism: When businesses feel optimistic about future profitability, they increase investment (I) in new capital goods and expansion.

Examples: Technological breakthroughs creating new investment opportunities, government policies encouraging business investment (tax breaks, subsidies), positive economic forecasts.

Impact: Increased investment directly boosts AD, leading to a rightward shift of the curve and stimulating economic growth.

Events Decreasing Aggregate Demand (Negative Shifts)

These events reduce the overall demand for goods and services, shifting the AD curve to the left.

1. Decreased Consumer Confidence and Spending

Mechanism: Negative economic news or uncertainty can lead to decreased consumer confidence and reduced spending. This directly lowers consumption (C).

Examples: Rising unemployment, high inflation eroding purchasing power, increased uncertainty about the future, a major stock market crash.

Impact: A leftward shift of the AD curve, leading to lower output and potentially deflationary pressures.

2. Contractionary Monetary Policy

Mechanism: Central banks can cool down an overheated economy by raising interest rates. Higher interest rates make borrowing more expensive, reducing investment (I) and consumption (C).

Examples: Central bank rate hikes, reducing the money supply, increasing reserve requirements for banks.

Impact: Reduced investment and consumption lead to a leftward shift of the AD curve, potentially curbing inflation but potentially leading to slower economic growth.

3. Decreased Government Spending

Mechanism: Reduced government spending directly lowers the (G) component of AD.

Examples: Government austerity measures aimed at reducing the budget deficit, cuts in defense spending, reductions in social programs.

Impact: A direct decrease in AD, shifting the curve to the left, slowing economic growth.

4. Decreased Exports

Mechanism: A decline in exports (relative to imports) leads to a decrease in net exports (NX).

Examples: A stronger domestic currency making exports less competitive internationally, weak global economic conditions reducing demand for domestic goods, trade wars and tariffs restricting exports.

Impact: Reduced demand for domestic goods leads to a leftward shift of the AD curve, slowing economic growth.

5. Decreased Business Confidence and Investment

Mechanism: Negative economic news or uncertainty can lead to decreased business confidence and reduced investment.

Examples: Recessionary fears, increased regulatory burdens, geopolitical instability, rising input costs.

Impact: Decreased investment directly lowers AD, shifting the curve to the left and potentially leading to a recession.

Analyzing the Interplay of Factors

It's crucial to understand that these events rarely occur in isolation. Often, several factors interact to influence aggregate demand. For instance, a global recession (decreasing exports) could coincide with a rise in interest rates (contractionary monetary policy), leading to a significant leftward shift of the AD curve. Similarly, a technological boom (increased investment) coupled with rising consumer confidence (increased consumption) might result in a substantial rightward shift.

The Role of Expectations

Expectations play a vital role in shaping aggregate demand. Consumer and business expectations about future economic conditions significantly influence their current spending and investment decisions. Positive expectations drive up AD, while negative expectations suppress it. This highlights the importance of communication from policymakers and the media in shaping economic sentiment.

Long-Term vs. Short-Term Impacts

The impact of events on aggregate demand can vary over time. Some events, like a temporary tax cut, might have a short-term stimulative effect, while others, like a major technological innovation, can have long-lasting effects on the productive capacity of the economy and thus sustained impacts on aggregate demand.

Conclusion

Classifying events according to their impact on aggregate demand requires careful consideration of their influence on consumption, investment, government spending, and net exports. Understanding these factors is critical for forecasting economic trends, implementing effective economic policies, and making informed business decisions. While the examples provided offer a solid framework, the real world is far more nuanced, and the interplay of numerous factors often dictates the ultimate effect on aggregate demand. The importance of analyzing the interconnectedness of these events and the role of expectations cannot be overstated. This comprehensive analysis provides a strong foundation for understanding the dynamics of aggregate demand and its implications for economic performance.

Latest Posts

Latest Posts

-

Which Countries Would Benefit Most From Fuel Made From Seawater

Apr 01, 2025

-

Label The Images To Review The Spectrum Of Cutaneous Mycoses

Apr 01, 2025

-

Martys Email To Their College Professor

Apr 01, 2025

-

The Cost Of Land Does Not Include

Apr 01, 2025

-

The Term Xenophobia Can Best Be Defined As

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Classify The Events According To Their Impact On Aggregate Demand . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.