Cash Flow From Assets Is Defined As

Holbox

Mar 24, 2025 · 6 min read

Table of Contents

- Cash Flow From Assets Is Defined As

- Table of Contents

- Cash Flow From Assets: A Comprehensive Guide

- Defining Cash Flow From Assets (CFFA)

- Calculating Cash Flow From Assets (CFFA)

- Method 1: The Direct Method

- Method 2: The Indirect Method

- Choosing a Method

- Interpreting Cash Flow From Assets (CFFA)

- The Significance of Cash Flow From Assets (CFFA)

- Limitations of CFFA

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

Cash Flow From Assets: A Comprehensive Guide

Cash flow from assets (CFFA), also known as free cash flow (FCF), represents the cash flow available to a company's investors (both debt and equity holders) after all operating expenses, interest, and principal repayments have been met. Understanding CFFA is crucial for evaluating a company's financial health, profitability, and investment potential. This comprehensive guide will delve deep into the definition, calculation, interpretation, and significance of cash flow from assets.

Defining Cash Flow From Assets (CFFA)

CFFA essentially measures the cash generated by a company's operations and investments that is available for distribution to its investors. It's a key metric that bridges the gap between a company's accounting profits and its actual cash generation capabilities. Unlike net income, which is an accounting measure that can be manipulated by accounting policies, CFFA provides a more direct and realistic picture of a company's ability to generate cash.

In simpler terms, CFFA answers the fundamental question: How much cash did the company generate from its assets after covering all expenses and reinvestments? This figure is crucial for assessing a company's ability to:

- Pay dividends to shareholders: A positive CFFA suggests the company has ample cash to distribute to its shareholders.

- Repay debt: A strong CFFA indicates the company's capacity to meet its debt obligations comfortably.

- Invest in growth opportunities: A healthy CFFA allows the company to fund future expansion and innovation.

- Acquire other businesses: CFFA provides the financial muscle for strategic acquisitions.

- Repurchase its own stock: Companies with substantial CFFA can buy back their own shares to increase shareholder value.

Calculating Cash Flow From Assets (CFFA)

There are several methods to calculate CFFA. The most common approaches are:

Method 1: The Direct Method

This method directly calculates CFFA by starting with cash flow from operating activities and adjusting for capital expenditures and changes in working capital. The formula is:

CFFA = Cash Flow from Operations – Capital Expenditures – Increases in Net Working Capital + Decreases in Net Working Capital

Let's break down each component:

- Cash Flow from Operations: This is found on the statement of cash flows and represents the cash generated from the company's core business activities. It includes cash received from sales, payments to suppliers, salaries, taxes, etc.

- Capital Expenditures (CAPEX): These are investments in long-term assets like property, plant, and equipment (PP&E). They are crucial for maintaining and expanding the company's operations. CAPEX is usually found on the statement of cash flows or can be calculated by looking at the change in PP&E on the balance sheet. Remember to adjust for any asset sales.

- Changes in Net Working Capital (NWC): NWC is the difference between current assets (like cash, accounts receivable, and inventory) and current liabilities (like accounts payable and short-term debt). An increase in NWC means the company is using more cash to fund its operations (e.g., building up inventory), while a decrease means it's freeing up cash.

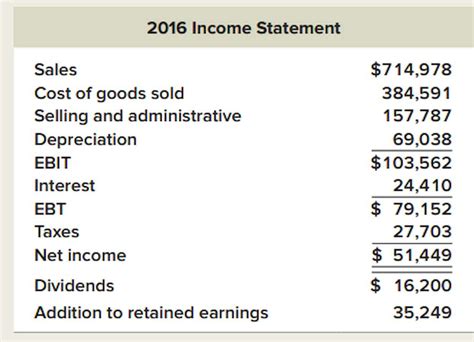

Method 2: The Indirect Method

This method uses net income as a starting point and makes several adjustments to arrive at CFFA. The formula is:

CFFA = Net Income + Non-Cash Charges – Increases in Working Capital + Decreases in Working Capital + Capital Expenditures

The key adjustments are:

- Non-Cash Charges: These are expenses that don't involve an actual cash outflow, such as depreciation and amortization. These need to be added back to net income because they reduce net income but don't affect cash flow.

- Interest Expense: While included in net income calculation, it should be added back because it represents a payment to debt holders, not a reduction in cash available to all investors.

Choosing a Method

Both methods yield the same CFFA result, provided the underlying data is consistent. The choice often depends on the information readily available. The direct method is generally preferred as it's more transparent and less prone to manipulation, directly showing the cash flow generated from operations.

Interpreting Cash Flow From Assets (CFFA)

A positive CFFA generally indicates that the company is generating more cash than it's spending, suggesting strong financial health and growth potential. A negative CFFA, on the other hand, means the company is consuming cash, potentially signaling financial distress. However, a negative CFFA isn't always a red flag. It could be a temporary situation due to significant investments in growth opportunities, such as large capital expenditures for expansion.

Analyzing the trend of CFFA over time is equally crucial. A consistently increasing CFFA indicates a healthy and growing business, while a declining CFFA could indicate underlying problems. Comparing CFFA to other financial metrics like net income, revenue, and return on assets provides a more comprehensive picture of a company's financial performance.

The Significance of Cash Flow From Assets (CFFA)

CFFA holds immense significance for various stakeholders:

For Investors:

- Valuation: CFFA is a key input in discounted cash flow (DCF) valuation models, which are used to estimate the intrinsic value of a company.

- Investment Decisions: Investors use CFFA to assess a company's ability to generate returns and make informed investment decisions.

- Risk Assessment: Consistent positive CFFA suggests lower financial risk compared to a company with fluctuating or negative CFFA.

For Creditors:

- Creditworthiness: CFFA provides insights into a company's ability to repay its debt obligations, influencing credit rating agencies' assessments.

- Lending Decisions: Creditors use CFFA to evaluate the creditworthiness of borrowers and make informed lending decisions.

For Management:

- Performance Measurement: CFFA is a crucial metric for evaluating the effectiveness of management's strategies and operational efficiency.

- Strategic Planning: Management uses CFFA to plan for future investments, expansions, and capital allocations.

- Resource Allocation: CFFA helps management prioritize investments and allocate resources effectively to maximize shareholder value.

Limitations of CFFA

While CFFA is a powerful metric, it's essential to acknowledge its limitations:

- Dependence on Accounting Practices: CFFA can be influenced by accounting policies and estimations, especially concerning depreciation and working capital management.

- Short-Term Fluctuations: CFFA can fluctuate significantly in the short term due to various factors like seasonal changes in sales or temporary working capital needs.

- Ignoring Qualitative Factors: CFFA doesn't capture qualitative factors that can affect a company's long-term success, such as management quality, competitive landscape, and technological disruptions.

Conclusion

Cash flow from assets (CFFA) is a crucial metric for assessing a company's financial health and investment potential. By understanding its definition, calculation, interpretation, and significance, investors, creditors, and management can make more informed decisions. While CFFA provides valuable insights, it shouldn't be considered in isolation. A holistic assessment that considers other financial metrics and qualitative factors is crucial for a comprehensive evaluation of a company's performance and prospects. Remember to analyze CFFA trends over time and compare it with other relevant financial indicators for a more accurate and meaningful assessment. By carefully analyzing CFFA and understanding its context, you can gain a deeper understanding of a company's true cash-generating ability and its capacity for future growth.

Latest Posts

Latest Posts

-

Personnel Services Contracts Are Authorized By The Government When

Mar 29, 2025

-

How Can Browser Profiles Help With Online Shopping

Mar 29, 2025

-

Calling Someone Darling To Indicate Intimacy Is An Example Of

Mar 29, 2025

-

Monopolies Exist Because Of Barriers To Entry

Mar 29, 2025

-

Consider The Reaction Of 4 Methyl 3 Penten 2 One With Ethylmagnesium Bromide

Mar 29, 2025

Related Post

Thank you for visiting our website which covers about Cash Flow From Assets Is Defined As . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.