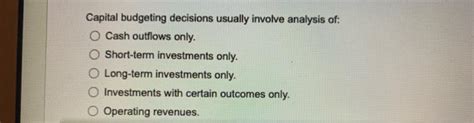

Capital Budgeting Decisions Usually Involve Analysis Of

Holbox

Mar 15, 2025 · 6 min read

Table of Contents

Capital Budgeting Decisions: A Deep Dive into the Analytical Process

Capital budgeting, the process of evaluating and selecting long-term investments, is a cornerstone of financial management. These decisions, often involving significant sums of money and long-term implications, require a rigorous and multifaceted analytical approach. The success of a business is heavily reliant on making sound capital budgeting choices, ensuring that investments align with strategic goals and generate positive returns. This article delves into the core analytical methods employed in capital budgeting decisions, exploring their strengths, weaknesses, and practical applications.

The Importance of Capital Budgeting Analysis

Before diving into the analytical methods, it's crucial to understand why a thorough analysis is indispensable. Capital budgeting decisions are characterized by:

-

Irreversibility: Many capital investments are difficult or impossible to reverse, making the initial decision critically important. A poorly chosen investment can tie up resources for years, hindering future opportunities.

-

Large Outlays: The sums of money involved are substantial, often representing a significant portion of the firm's resources. A wrong decision can severely impact profitability and even threaten the firm's financial health.

-

Long-Term Implications: The effects of capital budgeting decisions unfold over extended periods, making accurate forecasting and risk assessment crucial. Future economic conditions, technological advancements, and competitive pressures can significantly influence the outcome of an investment.

-

Strategic Alignment: Capital budgeting decisions should align with the firm's overall strategic goals and objectives. Investments must contribute to the firm's long-term growth and sustainability.

Key Analytical Methods in Capital Budgeting

Several analytical methods are used to evaluate capital budgeting proposals. The choice of method often depends on the nature of the project, the availability of data, and the firm's risk tolerance. The most common methods include:

1. Net Present Value (NPV)

The Net Present Value (NPV) method is widely considered the most robust technique for evaluating capital investments. It calculates the difference between the present value of future cash inflows and the present value of cash outflows. A positive NPV indicates that the investment is expected to generate more value than its cost, while a negative NPV suggests that the investment is not worthwhile.

Formula:

NPV = Σ (Ct / (1 + r)^t) - C0

Where:

- Ct = Net cash inflow during period t

- r = Discount rate (reflecting the cost of capital)

- t = Number of periods

- C0 = Initial investment

Strengths:

- Considers the time value of money.

- Provides a direct measure of the investment's profitability in present value terms.

- Incorporates the firm's cost of capital, reflecting the opportunity cost of investing.

Weaknesses:

- Requires accurate forecasting of future cash flows, which can be challenging.

- The choice of discount rate can significantly influence the NPV result.

- May not be suitable for mutually exclusive projects with significantly different lifespans.

2. Internal Rate of Return (IRR)

The Internal Rate of Return (IRR) is the discount rate that makes the NPV of an investment equal to zero. It represents the investment's expected rate of return. Projects with an IRR higher than the firm's cost of capital are generally considered acceptable.

Strengths:

- Easy to understand and interpret.

- Provides a clear measure of the investment's profitability in percentage terms.

- Useful for comparing projects with different scales and lifespans.

Weaknesses:

- Can lead to multiple IRRs for projects with unconventional cash flows.

- May not be appropriate for mutually exclusive projects with different scales or lifespans.

- Doesn't directly consider the size of the investment.

3. Payback Period

The Payback Period is the length of time it takes for an investment's cumulative cash inflows to equal its initial cost. It's a simple method that emphasizes the speed of recouping the investment.

Strengths:

- Easy to calculate and understand.

- Provides a quick measure of an investment's liquidity.

- Particularly useful for projects with high uncertainty or short time horizons.

Weaknesses:

- Ignores the time value of money.

- Ignores cash flows beyond the payback period.

- May not be suitable for projects with long lifespans or uneven cash flows.

4. Discounted Payback Period

The Discounted Payback Period addresses the limitation of the traditional payback period by incorporating the time value of money. It calculates the time it takes for the discounted cash inflows to equal the initial investment.

Strengths:

- Considers the time value of money, providing a more accurate assessment than the traditional payback period.

- Provides a measure of liquidity while acknowledging the time value of money.

Weaknesses:

- Still ignores cash flows beyond the payback period.

- Can be more complex to calculate than the traditional payback period.

5. Profitability Index (PI)

The Profitability Index (PI), also known as the benefit-cost ratio, is the ratio of the present value of future cash inflows to the present value of cash outflows. A PI greater than 1 indicates that the investment is expected to generate more value than its cost.

Formula:

PI = Σ (Ct / (1 + r)^t) / C0

Strengths:

- Considers the time value of money.

- Useful for ranking projects with different investment requirements.

- Provides a relative measure of profitability.

Weaknesses:

- Can be less intuitive than NPV or IRR.

- Requires accurate forecasting of future cash flows.

Advanced Considerations in Capital Budgeting Analysis

Beyond the core analytical methods, several advanced considerations enhance the rigor and accuracy of capital budgeting decisions:

1. Sensitivity Analysis

Sensitivity analysis examines how changes in key assumptions (e.g., sales volume, cost of capital, operating expenses) affect the project's NPV or IRR. This helps managers understand the project's vulnerability to uncertainty and make informed decisions.

2. Scenario Analysis

Scenario analysis considers different possible outcomes (e.g., best-case, worst-case, most-likely case) to assess the project's overall risk profile. This provides a broader perspective on the potential range of outcomes.

3. Simulation Analysis

Simulation analysis uses statistical techniques to model the probability distribution of project outcomes, providing a more comprehensive understanding of the risk involved. This method is particularly useful for complex projects with numerous uncertain variables.

4. Real Options

Real options analysis recognizes that managers often have the flexibility to adjust their investment decisions over time based on new information. This approach incorporates managerial flexibility into the valuation process, often leading to higher valuations for projects with significant flexibility.

5. Risk-Adjusted Discount Rates

Risk-adjusted discount rates reflect the project's specific risk profile. Higher-risk projects require higher discount rates, which appropriately adjusts the NPV and other metrics to account for the increased uncertainty.

Conclusion

Effective capital budgeting decisions are critical for long-term business success. A thorough analysis using appropriate techniques, along with a consideration of advanced concepts like sensitivity and scenario analysis, is vital for making informed investment choices. While the NPV method is often considered the most comprehensive, selecting the right tool depends on the specific characteristics of the project and the firm's circumstances. By applying these analytical tools effectively, businesses can increase the probability of selecting projects that align with their strategic goals and create long-term value. Remember, a robust capital budgeting process is not just about numbers; it’s about making strategic decisions that drive sustainable growth and profitability. The analysis should be complemented by qualitative factors, considering market trends, competitive landscape, and alignment with the overall business strategy to ensure a holistic approach to capital allocation.

Latest Posts

Latest Posts

-

A Flexible Budget Performance Report Compares

Mar 15, 2025

-

During The Breakfast Rush An Angry Customer

Mar 15, 2025

-

Is The Characteristic Of The Individuals Within The Population

Mar 15, 2025

-

Converting Nfa To Dfa Theorem 1 39

Mar 15, 2025

-

The Waiting Times Between A Subway Departure

Mar 15, 2025

Related Post

Thank you for visiting our website which covers about Capital Budgeting Decisions Usually Involve Analysis Of . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.