Bing Inc Has Current Assets Of 5400

Holbox

Mar 28, 2025 · 5 min read

Table of Contents

- Bing Inc Has Current Assets Of 5400

- Table of Contents

- Bing Inc.'s Current Assets of $5400: A Deep Dive into Financial Health and Implications

- Understanding Current Assets: A Breakdown

- 1. Cash and Cash Equivalents: The Immediate Liquidity

- 2. Accounts Receivable: Money Owed to Bing Inc.

- 3. Inventories: Goods Available for Sale

- 4. Prepaid Expenses: Future Costs Paid in Advance

- Analyzing Current Assets in Relation to Other Financial Metrics

- 1. Current Ratio: Assessing Liquidity

- 2. Quick Ratio (Acid-Test Ratio): A More Stringent Liquidity Measure

- 3. Working Capital: A Measure of Operational Efficiency

- 4. Turnover Ratios: Measuring Efficiency

- Potential Implications of $5400 Million Current Assets

- Conclusion: The Need for Holistic Analysis

- Latest Posts

- Latest Posts

- Related Post

Bing Inc.'s Current Assets of $5400: A Deep Dive into Financial Health and Implications

Bing Inc. reporting current assets of $5400 (presumably in thousands or millions, depending on the context; we'll assume millions for illustrative purposes) presents a significant starting point for analysis. This figure, while a single data point, offers crucial insights into the company's short-term financial health, liquidity, and operational efficiency. However, to understand its true significance, we must delve deeper into the composition of these assets and their relationship to other financial metrics.

Understanding Current Assets: A Breakdown

Current assets represent a company's assets that can be readily converted into cash within one year or a single operating cycle. For Bing Inc., a $5400 million (assumed) figure encompasses several key components:

1. Cash and Cash Equivalents: The Immediate Liquidity

This is the most liquid form of current assets, representing readily available funds in bank accounts, short-term investments, and money market funds. The amount held significantly impacts a company's ability to meet its immediate obligations. A healthy cash balance provides a cushion against unexpected expenses and operational challenges. A low cash balance, however, can signal potential liquidity problems. For Bing Inc., the exact portion of the $5400 million allocated to cash and cash equivalents is crucial. A higher proportion suggests a more robust short-term financial position.

2. Accounts Receivable: Money Owed to Bing Inc.

This represents the money owed to Bing Inc. by customers for goods sold or services rendered on credit. The size of accounts receivable reflects sales volume and the company's credit policies. However, it also carries a credit risk. A significant portion of accounts receivable might be uncollectible, impacting the company's profitability and liquidity. Analyzing the days sales outstanding (DSO) – the average number of days it takes to collect payment – is critical in assessing the quality of accounts receivable. A high DSO suggests potential issues with collections and a higher risk of bad debts. Bing Inc. needs to balance aggressive sales with effective credit management to maintain a healthy accounts receivable balance without unduly increasing risk.

3. Inventories: Goods Available for Sale

If Bing Inc. is involved in manufacturing or retailing, inventories represent the raw materials, work-in-progress, and finished goods held for sale. Managing inventory effectively is crucial to profitability. Excess inventory ties up capital and incurs storage costs, potentially leading to obsolescence and write-downs. Insufficient inventory, on the other hand, can lead to lost sales opportunities. The inventory turnover ratio – which measures how efficiently Bing Inc. manages its inventory – is a critical indicator. A higher turnover ratio generally indicates efficient inventory management. Understanding the inventory composition and its turnover rate is essential in evaluating the $5400 million figure.

4. Prepaid Expenses: Future Costs Paid in Advance

These are costs paid in advance for goods or services that will be consumed in future periods. Examples include prepaid rent, insurance, and advertising. While technically assets, they represent future expenses and do not contribute directly to immediate liquidity. Their inclusion in the $5400 million total should be considered when assessing Bing Inc.'s readily available cash.

Analyzing Current Assets in Relation to Other Financial Metrics

The $5400 million current assets figure alone doesn’t tell the whole story. We need to compare it to other key financial metrics to gain a comprehensive understanding of Bing Inc.’s financial health.

1. Current Ratio: Assessing Liquidity

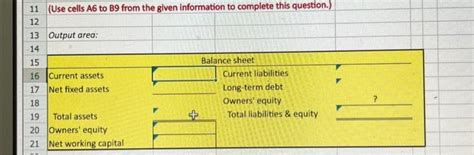

The current ratio (Current Assets / Current Liabilities) measures a company's ability to pay its short-term obligations with its short-term assets. A current ratio of 1 or greater is generally considered healthy. A significantly higher ratio might suggest excessive investment in current assets. A ratio below 1 signals potential liquidity concerns. To analyze Bing Inc.’s liquidity effectively, we need its current liabilities figure to calculate the current ratio.

2. Quick Ratio (Acid-Test Ratio): A More Stringent Liquidity Measure

The quick ratio ( (Current Assets – Inventories) / Current Liabilities) is a more stringent measure of liquidity, excluding inventories which might not be easily converted to cash. This provides a more conservative assessment of Bing Inc.'s immediate ability to meet its short-term debts. Again, we need the current liabilities figure for accurate calculation.

3. Working Capital: A Measure of Operational Efficiency

Working capital (Current Assets – Current Liabilities) represents the difference between current assets and current liabilities. Positive working capital indicates the company has sufficient resources to cover its short-term obligations. A large working capital balance can suggest efficient operations and financial strength. However, excessive working capital might indicate inefficient use of resources. Knowing Bing Inc.'s current liabilities is essential to determine its working capital.

4. Turnover Ratios: Measuring Efficiency

Various turnover ratios help assess how efficiently Bing Inc. utilizes its current assets. For example, the accounts receivable turnover ratio (Net Credit Sales / Average Accounts Receivable) indicates how effectively the company collects payments from customers. The inventory turnover ratio (Cost of Goods Sold / Average Inventory) reveals how efficiently inventory is managed. A high turnover ratio generally indicates efficient operations. Analyzing these ratios requires further financial information beyond the current assets figure.

Potential Implications of $5400 Million Current Assets

The $5400 million current assets (assumed) for Bing Inc. could have several implications, depending on the context:

-

Positive Implications: A large current asset figure could suggest strong sales, efficient inventory management, effective credit policies, and a robust cash position, leading to a strong short-term financial position and potentially greater investment opportunities.

-

Negative Implications: It's crucial to consider the composition of these assets. A high proportion of slow-moving inventory or difficult-to-collect accounts receivable could indicate operational inefficiencies or potential losses. This could also suggest a company is not investing its assets effectively and could be a sign of missed growth opportunities.

Conclusion: The Need for Holistic Analysis

The $5400 million (assumed) current assets for Bing Inc. provides a starting point for financial analysis, but its significance can only be fully understood by considering its composition and relating it to other key financial metrics. A comprehensive analysis encompassing the current ratio, quick ratio, working capital, and various turnover ratios is crucial for evaluating Bing Inc.’s short-term financial health, liquidity, and operational efficiency. Without access to the complete financial statement, a definitive assessment of the implications remains impossible. Analyzing Bing Inc.'s financial statements in their entirety is essential for a complete and accurate interpretation of the company’s financial performance. Remember to always consult official financial reports and professional advice for accurate and up-to-date information.

Latest Posts

Latest Posts

-

Nurse Toni Is Reviewing The Handout About Iv Pain

Mar 31, 2025

-

Getting A Bonus For Every Five Customer Referrals

Mar 31, 2025

-

All Of The Following Statements Are True Except

Mar 31, 2025

-

Label The Features Of A Neuromuscular Junction

Mar 31, 2025

-

Which Plane Is Represented By The Following Image

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Bing Inc Has Current Assets Of 5400 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.