An Understatement Of Ending Inventory Will Cause

Holbox

Mar 16, 2025 · 5 min read

Table of Contents

An Understatement of Ending Inventory Will Cause… Chaos! (And Lower Profits)

Understating ending inventory – that is, reporting less inventory than actually exists – might seem like a simple accounting error. However, the ripple effects of this seemingly small mistake can be devastating, impacting financial statements, tax liabilities, and even future business decisions. This article delves deep into the consequences of inventory understatement, providing a comprehensive understanding of its implications for businesses of all sizes.

The Domino Effect: How Inventory Understatement Impacts Financial Statements

The most immediate consequence of understating ending inventory is the distortion of financial statements. This error affects several key areas:

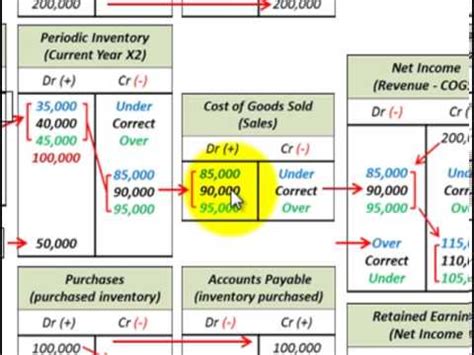

1. Cost of Goods Sold (COGS): Artificially Inflated

The fundamental equation affecting COGS is: Beginning Inventory + Purchases - Ending Inventory = Cost of Goods Sold. If ending inventory is understated, the calculation will yield a higher cost of goods sold. This is because a smaller number is being subtracted from the sum of beginning inventory and purchases.

This artificially inflated COGS directly impacts the following:

-

Gross Profit: With a higher COGS, gross profit (Revenue - COGS) will be artificially lowered. This paints an inaccurate picture of the company's profitability. Investors and stakeholders rely on these figures to assess the health and potential of the business. An understated inventory leads to an understatement of gross profit, potentially leading to missed investment opportunities.

-

Net Income: The reduced gross profit then flows down to net income, further diminishing the company's apparent profitability. This can affect credit ratings, investor confidence, and even executive compensation tied to performance metrics.

-

Earnings Per Share (EPS): A lower net income directly impacts earnings per share, a crucial metric for publicly traded companies. An understated EPS can negatively impact the stock price, potentially costing shareholders significant value.

2. Current Assets: Understated

Ending inventory is a current asset. Understating it directly reduces the total value of current assets reported on the balance sheet. This can misrepresent the company's liquidity – its ability to meet short-term obligations. Creditors may be misled about the company's financial health, potentially impacting their willingness to extend credit or renegotiate existing terms.

3. Current Ratio: Misleading Indication of Liquidity

The current ratio (Current Assets / Current Liabilities) is a key indicator of a company's short-term liquidity. Understating current assets, specifically inventory, will artificially lower this ratio. This gives a misleading picture of the company's ability to pay its short-term debts, which can negatively affect its creditworthiness.

4. Working Capital: Reduced Value

Working capital (Current Assets - Current Liabilities) is a measure of a company's operational efficiency and its ability to fund operations. Since understating inventory reduces current assets, the working capital figure will also be artificially lower. This again misrepresents the company's operational health and ability to manage its finances effectively.

Beyond Financial Statements: The Broader Ramifications

The problems caused by inventory understatement extend beyond the confines of the financial statements. Here are some other significant consequences:

1. Tax Implications: Higher Tax Liability

An understated ending inventory leads to a higher cost of goods sold, and consequently, a lower taxable income. This sounds beneficial at first glance. However, this is only a temporary advantage. When the inventory is eventually sold, the cost of goods sold will be adjusted, resulting in a higher tax liability in the future. This can lead to penalties and interest charges if not managed correctly. Furthermore, consistent understatement of inventory can raise red flags with tax authorities, leading to audits and investigations.

2. Inventory Management: Impaired Decision-Making

Understating ending inventory masks the true level of inventory on hand. This distorted information can lead to poor inventory management decisions. The company might:

-

Overorder: Believing they have less stock than they actually do, they might place larger orders than necessary, leading to increased storage costs, obsolescence, and potential write-downs.

-

Underorder: Conversely, they might underestimate demand due to the inaccurate inventory count, leading to stockouts and lost sales opportunities.

-

Poor Production Planning: For manufacturing companies, inaccurate inventory data will hinder production planning, leading to inefficient production runs and potential delays.

3. Operational Inefficiencies: Wasted Resources

The cascading effects of inaccurate inventory data lead to operational inefficiencies. These inefficiencies include increased storage costs, potential spoilage or obsolescence of goods, and missed sales opportunities due to stockouts. All of these contribute to a reduction in overall profitability and a compromised competitive advantage.

4. Reputational Damage: Loss of Trust

If the inventory understatement is discovered by customers or stakeholders, it can severely damage the company's reputation. A lack of transparency and accuracy in financial reporting can erode trust, leading to a loss of customers, investors, and employees. This reputational damage can be difficult and costly to repair.

Detecting and Preventing Inventory Understatement

Preventing inventory understatement requires a robust system of internal controls. Some key strategies include:

-

Regular Physical Inventory Counts: Conducting frequent and accurate physical inventory counts is crucial. This involves physically counting all inventory items to verify their existence and quantity. Cycle counting, which involves counting a smaller portion of inventory regularly, is an effective way to reduce the burden of a full inventory count.

-

Strong Internal Controls: Implementing strong internal controls, such as segregation of duties (different individuals responsible for inventory purchasing, receiving, and counting), can help prevent intentional or accidental understatement of inventory.

-

Technology Adoption: Utilizing inventory management software can significantly improve accuracy. These systems provide real-time tracking of inventory levels, automate inventory counts, and generate accurate reports.

-

Proper Training: Ensuring that all personnel involved in inventory management are properly trained in inventory procedures and the importance of accuracy is essential.

-

Independent Audits: Regular independent audits can help identify discrepancies and ensure the accuracy of inventory records.

Conclusion: The High Cost of Inaccuracy

Understating ending inventory is not a trivial error; it’s a serious accounting issue with far-reaching consequences. It distorts financial statements, impacts tax liabilities, hinders effective inventory management, and can ultimately damage a company's reputation and financial health. By implementing strong internal controls, leveraging technology, and prioritizing accurate inventory management practices, businesses can avoid the costly and potentially devastating effects of inventory understatement. The key is proactive measures to ensure accuracy and transparency in all aspects of inventory management. The cost of correcting an understatement far outweighs the effort of preventing it in the first place.

Latest Posts

Latest Posts

-

If Manufacturing Overhead Is Underapplied Then

Mar 17, 2025

-

Draw The Missing Organic Structures Do Not Draw Inorganic By Products

Mar 17, 2025

-

National Party Organizations Can Dictate The Day To Day Decisions Of

Mar 17, 2025

-

Dealing With Difficult Clients Negatively Impacts My Disposition

Mar 17, 2025

-

Your Company Offers A Single Premium Mobile Phone Handset

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about An Understatement Of Ending Inventory Will Cause . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.