Allocative Efficiency Occurs Only At That Output Where

Holbox

Mar 15, 2025 · 6 min read

Table of Contents

Allocative Efficiency: Where Output Meets Optimal Resource Allocation

Allocative efficiency, a cornerstone of economic theory, signifies a state where resources are distributed optimally, maximizing societal welfare. It's not simply about producing goods and services efficiently; it's about producing the right mix of goods and services that society desires most. This article delves deep into the concept of allocative efficiency, exploring its definition, the conditions under which it occurs, its relationship to other economic efficiencies, common market failures that disrupt it, and finally, how governments and market mechanisms attempt to restore allocative efficiency.

Defining Allocative Efficiency: Beyond Productive Efficiency

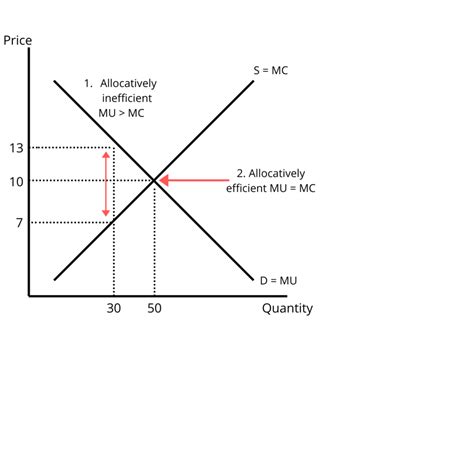

Unlike productive efficiency, which focuses on producing goods and services at the lowest possible cost, allocative efficiency centers on producing the correct combination of goods and services. Allocative efficiency occurs only at that output where the price of a good or service exactly equals its marginal cost (P = MC). This means that society values the last unit produced as much as it cost to produce it. Any deviation from this point suggests a misallocation of resources.

Understanding Marginal Cost (MC)

Marginal cost represents the additional cost incurred from producing one more unit of a good or service. It's a crucial element in determining allocative efficiency because it reflects the opportunity cost of producing that extra unit – what else could have been produced with those resources.

The Significance of Price (P)

The price of a good or service, in a perfectly competitive market, reflects the marginal benefit society derives from consuming that unit. Consumers will only purchase a good if its price is less than or equal to the value they place on it.

The P = MC Condition: The Sweet Spot of Allocative Efficiency

When the price (marginal benefit) equals the marginal cost, society is getting the maximum possible benefit from its resources. Producing more would cost more than it's worth to consumers, while producing less would mean foregoing potential benefits. This equilibrium point represents the Pareto efficient allocation – a situation where no one can be made better off without making someone else worse off.

Conditions for Achieving Allocative Efficiency

Several conditions must be met for a market to achieve allocative efficiency. These are often idealized conditions, rarely fully realized in the real world, but they serve as a benchmark against which to evaluate market performance.

1. Perfect Competition

A perfectly competitive market is characterized by:

- Many buyers and sellers: No single participant has market power to influence prices.

- Homogenous products: Goods and services offered are identical.

- Free entry and exit: Firms can easily enter or leave the market.

- Perfect information: All buyers and sellers have complete knowledge of prices and product characteristics.

- No externalities: The production or consumption of a good doesn't affect third parties.

Under perfect competition, the pursuit of profit maximization by individual firms naturally leads to P = MC, thus achieving allocative efficiency.

2. Absence of Market Failures

Market failures are situations where the free market fails to allocate resources efficiently. These include:

- Externalities: These are costs or benefits that affect parties not directly involved in a transaction (e.g., pollution from a factory).

- Public goods: Goods that are non-excludable (difficult to prevent people from consuming them) and non-rivalrous (one person's consumption doesn't diminish another's) (e.g., national defense).

- Information asymmetry: One party in a transaction has more information than the other (e.g., a used car salesman).

- Market power: A single firm or a small group of firms controls a significant portion of the market, allowing them to influence prices (e.g., monopolies).

Allocative Efficiency vs. Other Efficiencies

It's crucial to distinguish allocative efficiency from other forms of efficiency:

1. Productive Efficiency

Productive efficiency occurs when goods and services are produced at the lowest possible cost. While productive efficiency is necessary for allocative efficiency, it's not sufficient. A firm could be productively efficient but still produce the wrong mix of goods and services, leading to allocative inefficiency.

2. Pareto Efficiency

Pareto efficiency, as mentioned earlier, represents a state where it's impossible to make one person better off without making someone else worse off. Allocative efficiency is a specific type of Pareto efficiency that focuses on resource allocation.

3. X-efficiency

X-efficiency refers to a firm's ability to minimize costs for a given output level. It focuses on internal organizational efficiency and minimizing waste within the firm. Achieving x-efficiency contributes to productive efficiency which, in turn, helps to achieve allocative efficiency.

Market Failures and Their Impact on Allocative Efficiency

Market failures significantly disrupt allocative efficiency, leading to suboptimal resource allocation and a loss of societal welfare.

1. Externalities: The Hidden Costs and Benefits

Externalities, as discussed earlier, represent costs or benefits that spill over to third parties not involved in a transaction. Negative externalities (like pollution) lead to overproduction, as firms don't factor in the full social cost of production. Positive externalities (like education) lead to underproduction, as the private benefits don't capture the full social benefits.

2. Public Goods: The Free-Rider Problem

Public goods, because they are non-excludable, suffer from the free-rider problem. Individuals can benefit from public goods without paying for them, leading to under-provision by the market. Governments often intervene to provide public goods, financed through taxation.

3. Information Asymmetry: The Lemon Problem

Information asymmetry, where one party has more information than the other, can lead to inefficient market outcomes. The classic example is the "lemon problem" in the used car market, where sellers have more information about the car's condition than buyers, leading to lower prices and potentially fewer cars being traded.

4. Monopoly Power: Restricting Output and Raising Prices

Monopolies, by controlling supply, restrict output below the allocatively efficient level (where P = MC) to maximize profits. They charge higher prices than would prevail in a competitive market, reducing consumer surplus and creating deadweight loss.

Restoring Allocative Efficiency: Government Intervention and Market Mechanisms

Governments and market mechanisms can attempt to restore allocative efficiency in the face of market failures.

1. Government Intervention: Taxes, Subsidies, and Regulations

- Taxes: Taxes on goods with negative externalities (like pollution taxes) can internalize the external costs, leading to reduced production and a closer approximation to the socially optimal level.

- Subsidies: Subsidies for goods with positive externalities (like education subsidies) can increase production and bring it closer to the socially optimal level.

- Regulations: Regulations can set standards for pollution, product safety, and other areas, helping to correct market failures.

2. Market Mechanisms: Property Rights and Coase Theorem

The Coase Theorem suggests that if property rights are well-defined and transaction costs are low, private bargaining can lead to an efficient outcome even in the presence of externalities. For instance, a factory polluting a river might negotiate with downstream residents to compensate them for the damage, leading to a mutually agreeable level of pollution.

Conclusion: Striving for the Optimal Allocation

Allocative efficiency, while an ideal, serves as a crucial benchmark for evaluating market performance. Understanding the conditions necessary for its achievement and the various market failures that disrupt it is vital for designing effective policies to improve resource allocation and enhance societal welfare. While achieving perfect allocative efficiency is rarely feasible in the complex real world, striving towards it through a combination of government intervention and market-based mechanisms remains a key objective for economists and policymakers alike. The ongoing quest for optimal resource allocation continues to shape economic theory and policy debates, highlighting the enduring relevance of allocative efficiency in understanding and improving economic outcomes.

Latest Posts

Latest Posts

-

In Which Situations Can Simplifying Jobs Be Most Beneficial

Mar 17, 2025

-

For The Hr Planning Process How Should Goals Be Determined

Mar 17, 2025

-

How Does A Shortcut Link To Another File

Mar 17, 2025

-

Cash Flows From Financing Activities Do Not Include

Mar 17, 2025

-

A Positive Return On Investment For Education Happens When

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Allocative Efficiency Occurs Only At That Output Where . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.