Alan Is Recording Payroll That Was Processed Outside Of Quickbooks

Holbox

Mar 29, 2025 · 6 min read

Table of Contents

- Alan Is Recording Payroll That Was Processed Outside Of Quickbooks

- Table of Contents

- Alan Is Recording Payroll That Was Processed Outside of QuickBooks: A Comprehensive Guide

- Understanding the Process: Why Record External Payroll in QuickBooks?

- Essential Steps for Recording External Payroll in QuickBooks

- Step 1: Verify the Payroll Data

- Step 2: Creating Journal Entries in QuickBooks

- Step 3: Reconciling Payroll Accounts

- Step 4: Paying Payroll Taxes

- Step 5: Regular Backup

- Advanced Considerations and Troubleshooting

- Best Practices for Recording External Payroll

- Conclusion: Accuracy and Compliance are Paramount

- Latest Posts

- Latest Posts

- Related Post

Alan Is Recording Payroll That Was Processed Outside of QuickBooks: A Comprehensive Guide

Processing payroll outside of QuickBooks and then recording it within the software is a common scenario for many businesses, particularly those using third-party payroll services. This process requires meticulous attention to detail to ensure accuracy and compliance. This comprehensive guide will walk you through the steps Alan needs to take to accurately record payroll processed externally in QuickBooks, covering best practices, potential pitfalls, and troubleshooting tips.

Understanding the Process: Why Record External Payroll in QuickBooks?

While many businesses handle payroll entirely within QuickBooks, outsourcing it to a dedicated payroll provider offers various benefits, including expertise in tax compliance, reduced administrative burden, and access to advanced features. However, simply processing payroll externally isn't sufficient for comprehensive financial record-keeping. Integrating this external payroll data into QuickBooks is crucial for:

- Complete Financial Picture: QuickBooks provides a consolidated view of your company's finances. Recording external payroll ensures this view remains accurate and comprehensive, reflecting all income and expense transactions.

- Accurate Reporting: Financial reports generated in QuickBooks, such as profit and loss statements, balance sheets, and tax forms, will be inaccurate without the inclusion of payroll data.

- Streamlined Accounting: Integrating external payroll data eliminates the need for manual data entry across multiple systems, reducing errors and saving valuable time.

- Improved Audit Trail: A complete record of all payroll transactions within QuickBooks improves accountability and facilitates audits.

Essential Steps for Recording External Payroll in QuickBooks

Before Alan begins, he needs to gather the necessary information from the external payroll provider. This typically includes:

- Payroll Register: This detailed report lists all employees, their hours worked, gross pay, deductions (taxes, benefits, etc.), and net pay.

- Payment Summaries: These reports detail the total amounts paid to employees, along with the associated tax liabilities.

- Tax Forms: The external payroll provider should provide the necessary tax forms, such as W-2s and 1099s.

Step 1: Verify the Payroll Data

Before entering any data, Alan must thoroughly review the payroll reports provided by the external payroll provider. This crucial step helps to identify and correct any discrepancies early on. He should verify:

- Employee Names and IDs: Ensure all employee details match QuickBooks' employee records.

- Hours Worked: Compare the hours recorded by the external payroll provider with the time tracking data, if applicable, within QuickBooks or other time management systems.

- Gross Pay, Deductions, and Net Pay: Carefully check that all calculations are accurate.

- Tax Withholdings: Verify that the tax withholdings comply with all applicable federal, state, and local regulations.

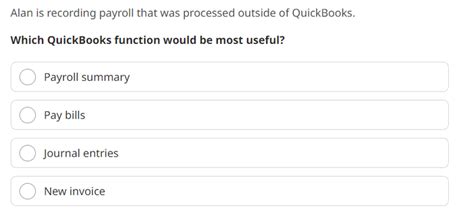

Step 2: Creating Journal Entries in QuickBooks

This is where Alan integrates the external payroll data into QuickBooks. The most common method is using journal entries. He needs to create separate journal entries for:

- Payroll Expense: This entry debits (increases) the appropriate payroll expense accounts (e.g., Wages Expense, Payroll Taxes Expense) and credits (decreases) the liability accounts representing the amounts owed to employees and the government.

- Payroll Liabilities: This entry details the specific payroll liabilities. This could include entries for:

- Federal Income Tax Payable: The amount withheld from employees' paychecks for federal income tax.

- State Income Tax Payable: The amount withheld for state income tax.

- Social Security Tax Payable: The employer's and employee's shares of Social Security tax.

- Medicare Tax Payable: The employer's and employee's shares of Medicare tax.

- Unemployment Tax Payable: State and federal unemployment taxes.

- Other Deductions Payable: Amounts withheld for health insurance, retirement contributions, etc.

Example Journal Entry:

Let's say the total gross payroll was $10,000, with $2,000 in federal income tax withheld, $500 in state income tax withheld, $1,200 in Social Security taxes (combined employee and employer share), and $300 in Medicare taxes (combined employee and employer share).

The journal entry would look something like this:

| Account Name | Debit | Credit |

|---|---|---|

| Wages Expense | $10,000 | |

| Payroll Taxes Expense | $1,500 | |

| Federal Income Tax Payable | $2,000 | |

| State Income Tax Payable | $500 | |

| Social Security Tax Payable | $1,200 | |

| Medicare Tax Payable | $300 | |

| Employee Net Pay | $5,000 |

Note: The "Employee Net Pay" liability account is used to track the payments made to the employees. This liability will be reduced when the actual payments are made.

Step 3: Reconciling Payroll Accounts

After posting the journal entries, Alan should reconcile the payroll expense and liability accounts to ensure that the information recorded in QuickBooks matches the payroll reports from the external provider. Any discrepancies need immediate investigation and correction.

Step 4: Paying Payroll Taxes

Alan should carefully follow the instructions from the external payroll provider to pay the payroll taxes. These are typically paid electronically or by check. Remember to update the liability accounts accordingly in QuickBooks.

Step 5: Regular Backup

Backing up QuickBooks data is crucial, especially when dealing with sensitive financial information like payroll. This protects against data loss and ensures business continuity. Alan should schedule regular backups, following the recommended guidelines provided by Intuit.

Advanced Considerations and Troubleshooting

Dealing with Payroll Errors: If discrepancies arise between the external payroll report and QuickBooks records, Alan must carefully analyze the data to identify the source of the error. This may involve reviewing employee time sheets, tax rates, and the accuracy of the external payroll processing.

Managing Multiple Payroll Providers: Some businesses use multiple payroll providers for different employee groups (e.g., salaried vs. hourly). Managing this requires careful organization of the payroll data, separate journal entries for each provider, and meticulous reconciliation.

Integrating with Other Software: Alan's business may use other software, such as HR management systems or time-tracking applications. Properly integrating these systems with QuickBooks streamlines data flow and reduces the risk of errors.

Year-End Reporting: At the end of the year, the external payroll provider will furnish the necessary tax forms, such as W-2s and 1099s. Alan must verify these forms against the payroll data recorded in QuickBooks to ensure accuracy. These forms are crucial for tax filing.

Understanding Payroll Tax Laws: Keeping abreast of changes in payroll tax laws and regulations is essential to maintain compliance. Regular review of tax updates and consultations with tax professionals are highly recommended.

Utilizing QuickBooks Online Payroll: If Alan consistently encounters challenges recording external payroll, switching to QuickBooks Online Payroll, or a similar integrated solution, might improve efficiency and accuracy, although it might increase expenses.

Best Practices for Recording External Payroll

- Regular Reconciliation: Regular reconciliation of payroll accounts minimizes the risk of accumulating errors.

- Detailed Documentation: Maintaining thorough documentation of all payroll transactions helps in troubleshooting and auditing.

- Employee Communication: Keep employees informed about payroll processing and any changes in the system.

- Professional Assistance: Consult with an accountant or payroll specialist if faced with complex payroll issues.

Conclusion: Accuracy and Compliance are Paramount

Recording external payroll in QuickBooks requires careful planning, execution, and attention to detail. By following the steps outlined in this guide, Alan can effectively integrate his external payroll data, maintain a complete and accurate financial record, and ensure full compliance with all relevant tax regulations. Remember that accuracy and compliance are paramount; seeking professional assistance when needed is a wise business practice. The investment in accuracy pays off in the long run through efficient financial management and minimized risks.

Latest Posts

Latest Posts

-

Mrs Pierce Would Like To Enroll

Apr 01, 2025

-

To The Economist Total Cost Includes

Apr 01, 2025

-

Athletes Who Consume Adequate Carbohydrates Experience

Apr 01, 2025

-

Todays Modern Managers Place More Emphasis On

Apr 01, 2025

-

Capital Budgeting Decisions Usually Involve Analysis Of

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Alan Is Recording Payroll That Was Processed Outside Of Quickbooks . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.