Active Policymaking Would Include All Of The Following Except

Holbox

Mar 24, 2025 · 6 min read

Table of Contents

- Active Policymaking Would Include All Of The Following Except

- Table of Contents

- Active Policymaking: Understanding What It Excludes

- Defining Active Policymaking

- The Exception: A Passive Approach to Economic Fluctuations

- Understanding the Laissez-Faire Perspective

- Contrasting Active and Passive Approaches

- Analyzing the Elements of Active Policymaking

- 1. Fiscal Policy Intervention: A Key Tool

- 2. The Central Bank's Role in Monetary Policy

- 3. Regulatory Policies and Market Influence

- 4. Supply-Side Policies: Long-Term Growth Focus

- Limitations and Challenges of Active Policymaking

- Conclusion: Understanding the Boundaries of Intervention

- Latest Posts

- Latest Posts

- Related Post

Active Policymaking: Understanding What It Excludes

Active policymaking, a cornerstone of macroeconomic management, involves the deliberate intervention of government authorities to influence the economy's performance. This contrasts sharply with passive or laissez-faire approaches, where the government largely refrains from intervention. Understanding what constitutes active policymaking is crucial, but equally important is recognizing what it doesn't include. This article will delve into the core tenets of active policymaking and specifically identify the exception among several commonly cited actions. We'll explore the nuances of fiscal and monetary policies, examining their roles in stabilizing the economy and addressing economic fluctuations. Finally, we'll discuss the limitations and potential drawbacks of active policymaking.

Defining Active Policymaking

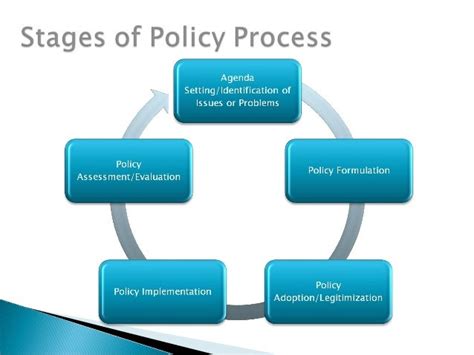

Active policymaking encompasses a range of deliberate actions taken by governments to influence economic outcomes. This typically involves the strategic use of:

-

Fiscal Policy: This involves manipulating government spending and taxation levels to stimulate or cool down economic activity. Expansionary fiscal policy, for instance, might involve increased government spending on infrastructure projects or tax cuts to boost aggregate demand. Conversely, contractionary fiscal policy might involve reduced government spending or tax increases to curb inflation.

-

Monetary Policy: This involves the central bank's control over the money supply and interest rates to influence inflation, employment, and economic growth. For example, lowering interest rates can stimulate borrowing and investment, while raising interest rates can curb inflation.

-

Regulatory Policies: These encompass a vast array of government regulations impacting various sectors of the economy, affecting everything from environmental protection to financial markets. Active policymaking here could involve tightening regulations to address market failures or loosening them to promote innovation and competition.

-

Supply-Side Policies: These focus on improving the productive capacity of the economy by influencing factors like labor market flexibility, education, and technological advancements. Examples include tax incentives for businesses to invest in research and development or reforms to improve labor market efficiency.

The Exception: A Passive Approach to Economic Fluctuations

While active policymaking embraces intervention to shape economic outcomes, there's one key element that explicitly falls outside its purview: a passive, hands-off approach to economic fluctuations.

This doesn't imply complete governmental inaction. Essential functions like maintaining the rule of law and providing basic public services continue. However, a passive approach fundamentally avoids deliberate intervention to counteract economic downturns or inflationary pressures. It relies on the self-correcting mechanisms of the free market to restore equilibrium.

Understanding the Laissez-Faire Perspective

The laissez-faire philosophy, often associated with a passive approach, suggests that government intervention can often be more harmful than helpful. Proponents argue that markets are inherently efficient and will naturally adjust to shocks and imbalances. Government intervention, they claim, can distort market signals, leading to unintended consequences and potentially exacerbating economic problems. They believe that the economy’s natural fluctuations are a necessary part of its long-term growth and stability.

Contrasting Active and Passive Approaches

The core difference lies in the intent and timing of action. Active policymaking anticipates and responds to economic shifts proactively. It aims to moderate the severity of economic cycles through timely interventions. A passive approach, in contrast, views economic fluctuations as unavoidable and prefers to allow the economy to adjust naturally over time.

Analyzing the Elements of Active Policymaking

Let's examine each of the core elements mentioned earlier and understand why they are integral to active policymaking:

1. Fiscal Policy Intervention: A Key Tool

Fiscal policy is a powerful tool for influencing aggregate demand. During a recession, expansionary fiscal policy, such as increased government spending or tax cuts, can boost demand, stimulating economic activity and creating jobs. Conversely, during periods of high inflation, contractionary fiscal policy can help cool down the economy by reducing government spending or increasing taxes. The timing and magnitude of these interventions are crucial for their effectiveness.

2. The Central Bank's Role in Monetary Policy

The central bank plays a vital role in managing the economy through monetary policy. By adjusting interest rates, the central bank can influence borrowing costs and investment levels. Lowering interest rates can encourage borrowing and investment, stimulating economic growth, while raising interest rates can help curb inflation by reducing demand. The central bank also uses tools like reserve requirements and open market operations to control the money supply. These are all active interventions aimed at achieving specific economic goals.

3. Regulatory Policies and Market Influence

Regulatory policies are another crucial aspect of active policymaking. These regulations can be used to address market failures, correct externalities, or promote competition. Examples include environmental regulations to protect the environment, financial regulations to prevent market crashes, or antitrust laws to prevent monopolies. These regulatory interventions are deliberately designed to influence market outcomes, ensuring fairer and more sustainable growth.

4. Supply-Side Policies: Long-Term Growth Focus

Supply-side policies focus on improving the long-term productive capacity of the economy. This often involves investments in education, infrastructure, and technology, aiming to enhance labor productivity and efficiency. Tax incentives for research and development or reforms to streamline regulations are examples of supply-side measures that actively shape the economy's potential for future growth.

Limitations and Challenges of Active Policymaking

While active policymaking offers considerable benefits, it also faces several challenges:

-

Time Lags: There's often a significant time lag between the implementation of a policy and its impact on the economy. This makes it difficult to predict the precise effect of a policy and can lead to unintended consequences.

-

Information Asymmetry: Policymakers may not always have access to complete and accurate information about the economy. This can lead to poor policy decisions and potentially exacerbate economic instability.

-

Political Considerations: Political pressures and partisan interests can influence policy decisions, leading to policies that are not necessarily economically optimal.

-

Unintended Consequences: Active policy interventions can have unintended consequences that are difficult to anticipate. For example, lowering interest rates too aggressively might lead to excessive inflation, while raising taxes too steeply could stifle economic growth.

-

Complexity and Uncertainty: The complexities of modern economies make it extremely difficult to model and predict the effects of policy interventions with precision. Economic forecasting is inherently uncertain, meaning policy decisions often involve significant uncertainty.

Conclusion: Understanding the Boundaries of Intervention

Active policymaking is a critical tool for managing macroeconomic fluctuations and promoting sustainable economic growth. However, it's important to understand its boundaries. A passive, hands-off approach to economic fluctuations, relying solely on the self-correcting mechanisms of the free market, stands in stark contrast to active interventions. While a degree of government regulation and provision of public goods are essential even in a largely laissez-faire system, the deliberate manipulation of fiscal, monetary, or regulatory levers to counter specific economic trends distinguishes active policymaking from a more passive approach. Understanding these distinctions, along with the challenges and limitations of active policymaking, is crucial for crafting effective economic strategies. The most successful economic management often involves a carefully balanced approach, leveraging the benefits of active interventions while also recognizing the potential risks and limitations involved.

Latest Posts

Latest Posts

-

A Company Bought A New Machine

Mar 26, 2025

-

Which Of The Following Compounds Is Most Basic

Mar 26, 2025

-

Ethical Behavior At Work Is Learned By

Mar 26, 2025

-

The Us Government Has Subsidized Ethanol Production Since 1978

Mar 26, 2025

-

If You Suspect Information Has Been Improperly Or Unnecessarily Classified

Mar 26, 2025

Related Post

Thank you for visiting our website which covers about Active Policymaking Would Include All Of The Following Except . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.