A Statement Of Comprehensive Income Does Not Include

Holbox

Mar 28, 2025 · 6 min read

Table of Contents

- A Statement Of Comprehensive Income Does Not Include

- Table of Contents

- A Statement of Comprehensive Income Does Not Include: A Deep Dive into Exclusions

- Understanding the Statement of Comprehensive Income

- Key Exclusions from the Statement of Comprehensive Income

- 1. Transactions with Owners

- 2. Prior Period Adjustments

- 3. Changes in Accounting Policies

- 4. Effects of Changes in Foreign Currency Exchange Rates (Certain Items)

- 5. Certain Revaluation Gains or Losses

- 6. Accounting for Certain Employee Stock Options

- 7. Specific Items Related to Investments

- Where Excluded Items Are Reported

- The Importance of Understanding Exclusions

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

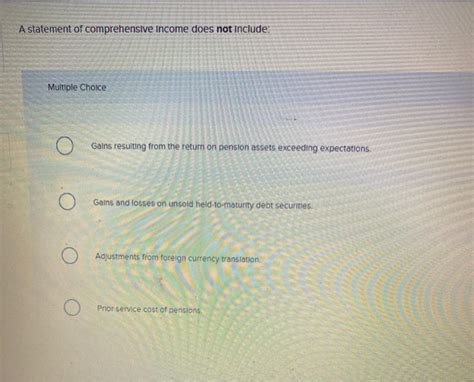

A Statement of Comprehensive Income Does Not Include: A Deep Dive into Exclusions

The Statement of Comprehensive Income (SCI) presents a complete picture of a company's financial performance over a specific period. However, despite its comprehensiveness, certain items are explicitly excluded. Understanding these exclusions is crucial for accurate financial analysis and interpretation. This article delves into the key elements that are not included in a statement of comprehensive income, explaining the reasons behind their exclusion and highlighting their reporting elsewhere in the financial statements.

Understanding the Statement of Comprehensive Income

Before exploring the exclusions, let's briefly review the core components of the SCI. The SCI aims to present a complete view of changes in equity during a reporting period, resulting from transactions and other events, other than those arising from transactions with owners. It generally comprises two sections:

-

Net Income (Profit or Loss): This is the traditional income statement's bottom line, representing revenues less expenses. It includes items directly related to the company's primary operations.

-

Other Comprehensive Income (OCI): This section captures gains and losses that are not recognized in net income but still impact equity. These items are usually unrealized gains or losses, meaning they haven't yet been realized through a transaction.

The sum of net income and OCI constitutes comprehensive income. This is a crucial figure reflecting the total change in equity during the period.

Key Exclusions from the Statement of Comprehensive Income

Several significant items are deliberately omitted from the SCI. These exclusions are essential to maintain the integrity and clarity of the statement, preventing misinterpretations and promoting consistent financial reporting. Here are the key exclusions:

1. Transactions with Owners

Any transactions directly involving the owners of the company are excluded from the SCI. These include:

-

Capital contributions: Investments made by shareholders are not reflected in the SCI as they don't represent the company's operational performance. These are instead recorded directly in equity.

-

Dividends paid: Distributions of profits to shareholders are also excluded. Dividends are a result of profits already recognized in the SCI, but they are not part of the calculation of comprehensive income itself. They represent a reduction in equity, reflected in the statement of changes in equity.

-

Share repurchases: Buying back the company's own shares is a transaction with owners and does not affect the performance of the business itself. This affects equity directly and isn't part of the SCI's core calculation.

These transactions, while essential for understanding the company's ownership structure and capital flow, are separate from the measurement of its operating performance and are reported accordingly in other financial statements.

2. Prior Period Adjustments

Corrections of errors from previous accounting periods are not included in the current SCI. These adjustments are treated retrospectively, meaning they're applied to the prior period's financial statements, rather than impacting the current year's comprehensive income. This approach maintains the consistency and accuracy of the financial statements across different periods.

3. Changes in Accounting Policies

While the effects of changes in accounting policies are reflected in the SCI, the adjustments themselves (i.e., the mathematical changes applied to restate prior period financial statements to the new policy) are not directly shown within the SCI. The cumulative effect of changes in accounting policies is included in retained earnings (a part of equity), but the individual adjustments are disclosed in the notes to the financial statements.

4. Effects of Changes in Foreign Currency Exchange Rates (Certain Items)

While some foreign currency translation effects are included in OCI, certain others are excluded. The precise treatment depends on the classification of the foreign operation – whether a subsidiary, joint venture, or associate. This often involves nuanced accounting rules (like using the current rate method or the temporal method) and will determine which portion of the effects of changes in foreign currency exchange rates is included or excluded. The accounting standards provide specific guidance for these complex scenarios.

5. Certain Revaluation Gains or Losses

While some revaluation gains and losses (e.g., on available-for-sale securities) are included in OCI, others are not. The inclusion depends on the nature of the asset and the specific accounting standard being followed. For example, certain revaluations of property, plant, and equipment might be permitted under specific circumstances but might still be excluded from the SCI if their inclusion would not accurately depict the company's core operational performance.

6. Accounting for Certain Employee Stock Options

The accounting treatment of employee stock options can be intricate. While the expense recognized for employee stock options is included in net income, some aspects of their accounting might lead to certain adjustments to equity that are not directly part of the SCI calculation. Again, the detailed treatment depends on the specific accounting standards and the option's characteristics.

7. Specific Items Related to Investments

Some complex investment accounting situations lead to the exclusion of certain items from the SCI. The specific details depend heavily on the nature of the investment and the accounting standards applied (e.g., IFRS 9, ASC 321).

Where Excluded Items Are Reported

While excluded from the SCI, these items are not simply ignored. They are typically reported elsewhere in the company's financial statements to provide a holistic view of its financial position and performance. Key locations include:

-

Statement of Changes in Equity: This statement details the changes in all equity accounts, including those affected by transactions with owners, prior period adjustments, and the effects of certain accounting policy changes.

-

Notes to the Financial Statements: Detailed explanations of accounting policies, significant judgments, and other relevant information concerning exclusions are found in the notes. This section serves to clarify aspects not directly depicted in the main financial statements.

-

Supplemental Schedules: Depending on the complexity of the business and specific reporting requirements, the company may provide supplementary schedules and disclosures to enhance transparency and understanding.

The Importance of Understanding Exclusions

Understanding what is not included in the SCI is as critical as understanding what is included. Ignoring these exclusions can lead to:

-

Misinterpretations of Financial Performance: An inaccurate picture of the company's actual profitability and overall financial health can be painted if excluded items are not properly considered.

-

Inaccurate Financial Analysis: Comparisons between companies or assessments of a company's financial health over time could be severely flawed if the impact of excluded items isn't factored in.

-

Poor Investment Decisions: Investors who fail to fully comprehend the implications of these exclusions could make misguided investment decisions based on incomplete or misleading financial information.

Conclusion

The Statement of Comprehensive Income offers a comprehensive view of a company's financial performance, but its comprehensiveness is defined by specific boundaries. Understanding the exclusions—transactions with owners, prior period adjustments, effects of certain accounting policy changes, specific aspects of foreign currency translation, certain revaluation gains and losses, and complexities related to employee stock options and investments—is crucial for interpreting the SCI accurately and for a robust financial analysis. By appreciating where these excluded items are reported elsewhere—in the statement of changes in equity, the notes to the financial statements, or supplemental schedules—investors and analysts can gain a more complete and nuanced understanding of the company's financial position and performance, making informed decisions. A thorough understanding of both inclusions and exclusions within the context of the complete set of financial statements is paramount for any credible financial assessment.

Latest Posts

Latest Posts

-

Special Channels That Enable Water To Cross The Plasma Membrane

Mar 31, 2025

-

Which Item Best Completes The List

Mar 31, 2025

-

Tina Taxpayer Makes 75000 A Year

Mar 31, 2025

-

The Graph Shows A Business Cycle For A Hypothetical Economy

Mar 31, 2025

-

Moles And Chemical Formulas Lab Report Answers

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about A Statement Of Comprehensive Income Does Not Include . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.