Tina Taxpayer Makes 75000 A Year

Holbox

Mar 31, 2025 · 6 min read

Table of Contents

- Tina Taxpayer Makes 75000 A Year

- Table of Contents

- Tina Taxpayer Makes $75,000 a Year: A Deep Dive into Her Financial Landscape

- Understanding Tina's Income Bracket and its Implications

- Geographic Variations in Cost of Living

- Deconstructing Tina's Expenses: A Realistic Breakdown

- Housing: The Largest Expense

- Transportation: Getting Around

- Food: Sustenance and Choices

- Healthcare: A Growing Concern

- Debt Repayment: Managing Existing Obligations

- Other Expenses: The Hidden Costs

- Tina's Tax Obligations: Understanding the Deductions and Credits

- Federal Income Tax: A Progressive System

- State Income Tax: Varying by Location

- Tax Deductions and Credits: Minimizing Tax Burden

- Saving and Investing for Tina's Future: Strategies for Success

- Emergency Fund: A Financial Safety Net

- Retirement Savings: Planning for the Future

- Investing: Growing Wealth

- Navigating Potential Financial Challenges: Preparing for the Unexpected

- Job Loss: Protecting Against Unemployment

- Medical Emergencies: The High Cost of Healthcare

- Unexpected Expenses: Preparing for the Unexpected

- Conclusion: Tina's Journey to Financial Security

- Latest Posts

- Latest Posts

- Related Post

Tina Taxpayer Makes $75,000 a Year: A Deep Dive into Her Financial Landscape

Tina Taxpayer, a fictional yet relatable character, earns $75,000 annually. This seemingly comfortable income level, however, presents a complex financial picture influenced by numerous factors. This article explores the various aspects of Tina's financial life, examining her potential expenses, savings strategies, tax obligations, and long-term financial planning. We'll delve into how her income impacts her lifestyle, her ability to achieve financial goals, and the choices she needs to make to secure her future.

Understanding Tina's Income Bracket and its Implications

A $75,000 annual salary places Tina firmly within the middle class in many parts of the developed world. This income level provides a degree of financial security, allowing for a comfortable lifestyle and potential savings. However, it's crucial to understand that the "comfort" level is highly subjective and varies significantly based on geographical location, lifestyle choices, and personal financial priorities. Living in a high-cost-of-living area like San Francisco will present vastly different challenges compared to a lower-cost area like Des Moines.

Geographic Variations in Cost of Living

High Cost of Living Areas: In cities with high costs of living, $75,000 may feel tighter than in other areas. Rent, groceries, transportation, and healthcare can all significantly impact Tina's budget. She may find it challenging to save significantly or pursue substantial investments.

Lower Cost of Living Areas: In areas with lower costs of living, $75,000 can provide a more comfortable lifestyle. Tina could potentially save a higher percentage of her income, invest more aggressively, and enjoy a higher quality of life overall.

Deconstructing Tina's Expenses: A Realistic Breakdown

To truly understand Tina's financial situation, we need to analyze her potential expenses. This will vary based on her lifestyle, family status, and location. Let's explore a potential breakdown:

Housing: The Largest Expense

- Rent/Mortgage: This is often the biggest expense. In high-cost areas, a significant portion of Tina's income could go towards rent or mortgage payments. In lower-cost areas, this expense would be proportionally lower.

- Utilities: Electricity, water, gas, internet, and other utilities will add to her monthly housing costs.

Transportation: Getting Around

- Car Payment/Public Transportation: Owning a car comes with payments, insurance, gas, maintenance, and repairs. Public transportation costs can also be substantial, especially in densely populated areas.

Food: Sustenance and Choices

- Groceries: The cost of groceries varies widely based on dietary choices and lifestyle. Eating out frequently will significantly increase food expenses.

- Dining Out: Regular restaurant meals can add up quickly, significantly impacting her budget.

Healthcare: A Growing Concern

- Health Insurance Premiums: Health insurance costs can be substantial, even with employer-sponsored plans. Deductibles and co-pays also contribute to healthcare expenses.

- Medical Bills: Unexpected medical bills can severely strain Tina's finances, emphasizing the importance of adequate health insurance.

Debt Repayment: Managing Existing Obligations

- Student Loans: If Tina has student loan debt, repayments will significantly impact her disposable income.

- Credit Card Debt: High-interest credit card debt can be detrimental to her financial health.

Other Expenses: The Hidden Costs

- Clothing: This can range from modest to extravagant, depending on Tina's preferences.

- Entertainment: Movies, concerts, travel, and other leisure activities will also influence her spending.

- Personal Care: This includes toiletries, haircuts, and other personal grooming expenses.

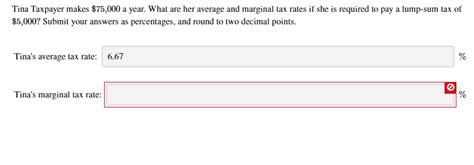

Tina's Tax Obligations: Understanding the Deductions and Credits

Tina's $75,000 income will subject her to federal and state income taxes. The exact amount will depend on several factors, including her filing status (single, married filing jointly, etc.), deductions, and credits. Understanding these aspects is crucial for effective tax planning.

Federal Income Tax: A Progressive System

The US federal income tax system is progressive, meaning higher earners pay a higher percentage of their income in taxes. Tina will fall into a specific tax bracket, and her tax liability will be calculated accordingly.

State Income Tax: Varying by Location

State income taxes vary significantly across the US. Some states have no income tax, while others have relatively high rates. Tina's state of residence will determine her state income tax liability.

Tax Deductions and Credits: Minimizing Tax Burden

Tina can potentially reduce her tax liability by taking advantage of available deductions and credits. These include deductions for mortgage interest, charitable contributions, and itemized deductions. Credits, such as the earned income tax credit (EITC) or child tax credit, can directly reduce the amount of tax owed.

Saving and Investing for Tina's Future: Strategies for Success

Saving and investing are crucial for Tina's long-term financial well-being. She needs to develop a strategy that aligns with her financial goals and risk tolerance.

Emergency Fund: A Financial Safety Net

Building an emergency fund is paramount. This fund should cover 3-6 months of living expenses, providing a safety net in case of job loss or unexpected expenses.

Retirement Savings: Planning for the Future

Tina should contribute to a retirement account, such as a 401(k) or IRA. Employer matching contributions in a 401(k) should be maximized to take full advantage of this benefit. Regular contributions, even small ones, can compound over time, significantly increasing her retirement savings.

Investing: Growing Wealth

Investing can help Tina's savings grow faster than inflation. Her investment strategy should align with her risk tolerance and time horizon. Diversification across different asset classes is crucial to mitigate risk.

Navigating Potential Financial Challenges: Preparing for the Unexpected

Life throws curveballs. Tina needs to be prepared to handle potential financial challenges:

Job Loss: Protecting Against Unemployment

Job loss can be financially devastating. Tina should have an emergency fund and explore unemployment benefits if she loses her job.

Medical Emergencies: The High Cost of Healthcare

Unexpected medical bills can be financially crippling. Having comprehensive health insurance is essential.

Unexpected Expenses: Preparing for the Unexpected

Car repairs, home repairs, or other unexpected expenses can strain Tina's budget. An emergency fund helps alleviate this stress.

Conclusion: Tina's Journey to Financial Security

Tina Taxpayer's $75,000 income presents a complex financial picture. While it provides a degree of financial security, careful budgeting, strategic saving, and effective tax planning are crucial for achieving her financial goals. Understanding her expenses, leveraging available tax benefits, and developing a robust savings and investment strategy are key to securing her financial future. By proactively managing her finances, Tina can build a comfortable life and achieve long-term financial security. This requires consistent effort, financial literacy, and a willingness to adapt her strategies as her circumstances evolve. The information provided here serves as a starting point, and seeking professional financial advice is always recommended for personalized guidance.

Latest Posts

Latest Posts

-

This Type Of Chemical Initiates Irreversible Alterations

Apr 02, 2025

-

Circuit Diagram Full Wave Center Tap Rectifier Unregulated

Apr 02, 2025

-

A Food Worker Has Nausea And Diarrhea The Night Before

Apr 02, 2025

-

Which Sentence Contains A Comma Splice

Apr 02, 2025

-

Which Of The Following Factors Contribute To Economic Growth

Apr 02, 2025

Related Post

Thank you for visiting our website which covers about Tina Taxpayer Makes 75000 A Year . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.