A Lender Need Not Be Penalized By Inflation If The

Holbox

Mar 21, 2025 · 6 min read

Table of Contents

A Lender Need Not Be Penalized by Inflation If the Loan is Properly Structured

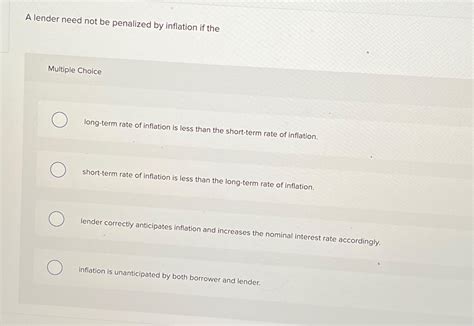

Inflation, the persistent increase in the general price level of goods and services in an economy, presents a significant challenge for lenders. If not carefully managed, inflation can erode the real value of loan repayments, leaving lenders with less purchasing power than initially anticipated. However, a lender need not be penalized by inflation if the loan is properly structured. This article will explore several strategies that lenders can employ to protect themselves from the detrimental effects of inflation.

Understanding the Inflationary Risk for Lenders

The core problem inflation presents to lenders is the time value of money. A loan disbursed today will be repaid in the future, and if inflation is high, the purchasing power of those future repayments will be lower. This means the lender receives less in real terms than the initial loan value. For example, a loan of $100,000 repaid in five years may be worth significantly less than $100,000 in today's money if inflation averages 5% annually during that period. This loss of purchasing power constitutes the inflationary risk for lenders.

The Impact of Unexpected Inflation

The risk is amplified when inflation is unexpected. If inflation is consistently higher than anticipated, the erosion of the loan's real value will be greater than projected, leading to substantial financial losses for the lender. Conversely, if inflation is lower than predicted, the lender benefits, earning a higher real return than planned. Predicting inflation accurately is notoriously difficult, adding to the complexity of managing this risk.

Types of Inflation and Their Effects

Different types of inflation impact lenders differently. Demand-pull inflation, driven by excessive consumer demand, tends to increase prices across the board, affecting all loan repayments. Cost-push inflation, stemming from rising production costs (e.g., wages, raw materials), similarly reduces the real value of repayments, though it might be more sector-specific. Built-in inflation – a self-perpetuating cycle where rising prices lead to higher wages, which in turn fuel further price increases – poses a particularly persistent and challenging threat to lenders.

Strategies for Mitigating Inflationary Risk

Several strategies can help lenders mitigate the risk of inflation:

1. Adjustable-Rate Loans (ARLs)

ARLs are structured to adjust the interest rate periodically based on a benchmark rate, often tied to an inflation index like the Consumer Price Index (CPI). This mechanism allows the lender to maintain a relatively consistent real return regardless of inflationary pressures. If inflation rises, the interest rate on the loan also increases, preserving the lender's purchasing power. However, ARLs also expose borrowers to interest rate risk, making them potentially less attractive for borrowers and potentially increasing default risk for the lender.

2. Indexed Loans

Similar to ARLs, indexed loans directly link repayments to an inflation index. The principal or interest, or both, is adjusted periodically to reflect changes in the price level. This ensures the lender receives repayments with a consistent real value. This approach offers a clearer and more predictable approach to inflation hedging compared to ARLs, where interest rate fluctuations can be influenced by multiple market factors beyond inflation.

3. Inflation-Linked Securities (ILS)

ILS are debt instruments whose principal and/or interest payments are adjusted based on an inflation index. These are suitable for lenders who wish to invest a portion of their funds in inflation-protected assets to offset the inflationary risk inherent in their loan portfolio. ILS offer a form of diversification, hedging against inflation while possibly earning a higher real yield than traditional fixed-income securities in inflationary environments.

4. Short-Term Loans

Shortening the loan term reduces the duration of exposure to inflation. The shorter the repayment period, the less opportunity inflation has to erode the real value of repayments. While this strategy limits inflationary risk, it may also reduce potential profits for the lender, as longer-term loans often command higher interest rates to compensate for the increased risk over a longer time horizon.

5. Higher Interest Rates

Charging higher nominal interest rates than would be otherwise necessary can compensate for anticipated inflation. This approach, however, must be carefully calibrated to remain competitive and avoid deterring borrowers. Overestimating inflation can lead to excessively high interest rates which can reduce demand for loans and hurt the lender in the long term. Underestimating inflation, however, exposes the lender to significant losses.

6. Diversification of Loan Portfolio

Diversifying the loan portfolio across different sectors, borrowers, and loan types can help mitigate the impact of inflation. While inflation might affect certain sectors more severely, the overall impact on a diversified portfolio could be lessened. Diversification reduces the impact of a single bad loan or a sector-specific inflationary shock.

7. Careful Credit Risk Assessment

Thorough due diligence and careful borrower assessment is crucial. Lending to borrowers with a higher credit risk increases the likelihood of defaults, exacerbating the effects of inflation. A higher default rate means that the lender loses principal and interest, compounding the losses from inflation. Strong credit scoring, thorough income verification, and collateral evaluation are vital steps to minimize this risk.

8. Hedging with Derivatives

Financial derivatives, such as inflation swaps or options, can be used to hedge against inflationary risk. These instruments allow lenders to transfer or reduce their exposure to inflation, providing a level of protection against unexpected price increases. However, these instruments come with their own complexities and risks, requiring specialized knowledge and expertise. Misusing derivatives can significantly increase risk rather than mitigate it.

Building Robust Loan Agreements

Beyond strategic choices, the loan agreement itself plays a crucial role in protecting the lender from inflation. Key clauses to consider include:

-

Interest Rate Adjustment Clauses: These clauses specify the mechanism for adjusting interest rates in response to inflation, ensuring the lender's real return is maintained.

-

Inflation Index Definition: The specific inflation index used to adjust interest rates or payments should be clearly defined to avoid ambiguity and disputes.

-

Payment Schedules: Clearly outline payment frequency and any penalty clauses for late payments, protecting the lender from further losses due to delayed repayments in an inflationary environment.

-

Prepayment Penalties: These penalties discourage borrowers from paying off the loan early, ensuring the lender receives the anticipated interest income over the entire loan term, even if inflation unexpectedly falls.

Conclusion: Proactive Management is Key

Inflation poses a significant threat to lenders, but it's not an insurmountable challenge. By employing a combination of strategic loan structuring, careful risk assessment, and the utilization of appropriate financial instruments, lenders can significantly mitigate the inflationary risk and protect their real returns. Proactive management of inflationary risk is not merely a matter of financial prudence but essential for the long-term sustainability and profitability of lending institutions. Understanding the nuances of different types of inflation, their impact on various loan types, and the options available for mitigating these risks is crucial for any lender aiming to operate successfully in an inflationary environment. Finally, seeking professional financial advice tailored to the specific circumstances and risk tolerance of the lender is strongly recommended to navigate the complexities of inflation management effectively.

Latest Posts

Latest Posts

-

Which Of The Following Are Not Secreted By Platelets

Mar 21, 2025

-

Name The Vertebral Projection Oriented In A Sagittal Plane

Mar 21, 2025

-

All Of The Following Are Representations Of 2 Methylpentane Except

Mar 21, 2025

-

Regulation Of Mobile Health Technology Varies By

Mar 21, 2025

-

How Is Asymmetrical Balance Achieved In The Painting Below

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about A Lender Need Not Be Penalized By Inflation If The . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.