A Government's Policy Of Redistributing Income Makes The Income Distribution:

Holbox

Mar 27, 2025 · 6 min read

Table of Contents

- A Government's Policy Of Redistributing Income Makes The Income Distribution:

- Table of Contents

- A Government's Policy of Redistributing Income: Impacts on Income Distribution

- Understanding Income Redistribution

- Common Income Redistribution Policies:

- Measuring the Impact of Redistribution Policies

- The Complexities and Challenges

- Unintended Consequences:

- Finding the Optimal Balance:

- Conclusion:

- Latest Posts

- Latest Posts

- Related Post

A Government's Policy of Redistributing Income: Impacts on Income Distribution

The question of income inequality is a persistent theme in political and economic discourse. Many governments actively pursue policies aimed at redistributing income, seeking to create a more equitable society. However, the impact of these policies on income distribution is complex and multifaceted, with both intended and unintended consequences. This article delves into the intricate relationship between government income redistribution policies and their effects on the overall income distribution within a nation.

Understanding Income Redistribution

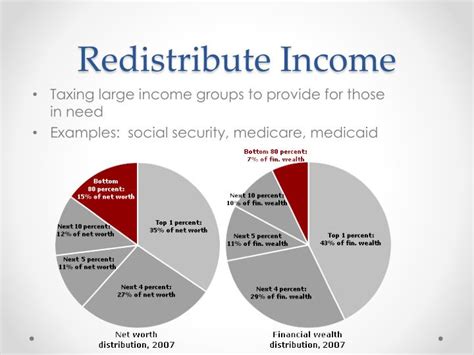

Income redistribution refers to government policies designed to transfer income from higher-income earners to lower-income earners. These policies aim to reduce income inequality and improve the living standards of the less fortunate. The methods employed vary widely across nations, encompassing a range of tools and approaches.

Common Income Redistribution Policies:

-

Progressive Taxation: This involves imposing higher tax rates on higher earners and lower rates on lower earners. This system ensures that wealthier individuals contribute a larger proportion of their income to government revenue. Examples include income tax brackets, estate taxes, and wealth taxes. The effectiveness of progressive taxation hinges on factors such as the tax system's design, enforcement, and the overall economic climate. Loopholes and avoidance strategies can significantly diminish its impact.

-

Transfer Payments: These are direct cash or in-kind payments made by the government to individuals or households with low incomes. Social Security benefits, unemployment insurance, welfare programs (like Temporary Assistance for Needy Families - TANF in the US), and housing subsidies are prime examples. These payments provide a crucial safety net, mitigating poverty and improving living standards. The impact is dependent on the generosity and accessibility of the programs, as well as the overall economic environment.

-

Subsidies and Public Services: Governments often provide subsidies for essential goods and services, like food, housing, and healthcare, making them more affordable for lower-income households. Public education, healthcare programs (like Medicare and Medicaid in the US), and public transportation are vital examples of such policies. These programs can significantly improve access to essential resources, but their effectiveness depends on the quality and accessibility of these services.

-

Minimum Wage Laws: Setting a minimum wage floor aims to ensure a baseline income for workers, preventing exploitation and contributing to income equality. The impact of minimum wage laws is a subject of ongoing debate, with arguments focusing on potential job losses versus improved living standards for low-wage earners. The effectiveness is highly sensitive to the prevailing economic conditions and the level at which the minimum wage is set.

-

Regulation of Markets: Certain government regulations, such as price controls on essential goods or limitations on monopolies, aim to curb excessive profits and ensure fair competition, indirectly affecting income distribution. The effects of market regulation can be complex, with potential trade-offs between efficiency and equity. The success of such measures hinges on the specific regulations implemented and their enforcement.

Measuring the Impact of Redistribution Policies

Evaluating the effectiveness of income redistribution policies requires careful consideration of various metrics and methodologies. Several key indicators are frequently used:

-

Gini Coefficient: This widely used metric measures income inequality on a scale of 0 to 1, with 0 representing perfect equality and 1 representing perfect inequality. A lower Gini coefficient suggests a more equitable income distribution. Changes in the Gini coefficient over time can offer insights into the impact of redistribution policies.

-

Poverty Rate: This measures the percentage of the population living below the poverty line. Reductions in the poverty rate signify improved living standards for the poorest segments of the population, often a primary objective of income redistribution policies. However, the definition of the poverty line can significantly affect this measure.

-

Income Shares: Analyzing the share of national income held by different income quintiles (20% segments of the population) provides a more granular picture of income distribution. This allows for the identification of trends within specific income groups and how redistribution policies affect them.

-

Social Mobility: This refers to the ability of individuals to move between different income levels over time. Policies that promote social mobility, such as improved access to education and job training, contribute to a more dynamic and equitable income distribution. This indicator offers a longer-term perspective than snapshot measures of income distribution.

The Complexities and Challenges

While the goal of income redistribution policies is often laudable, their implementation and impact are complex. Several factors influence their effectiveness:

-

Economic Growth: A robust economy can generate more wealth, allowing for more effective redistribution without significant reductions in overall prosperity. In periods of economic stagnation or recession, the same level of redistribution might have a more negative effect on overall economic activity.

-

Tax Avoidance and Evasion: Sophisticated tax avoidance strategies employed by high-income earners can undermine the effectiveness of progressive taxation, diminishing the revenue available for redistribution. Robust tax enforcement mechanisms are crucial.

-

Program Design and Administration: The effectiveness of transfer payments and public services hinges on efficient program design and administration. Bureaucracy, inefficiencies, and corruption can hinder the delivery of benefits to those who need them most.

-

Behavioral Responses: Income redistribution policies can trigger behavioral changes that affect their ultimate impact. For example, higher taxes might incentivize individuals to work less, invest less, or engage in tax avoidance strategies.

-

Political Considerations: Income redistribution policies are often subject to intense political debate, with conflicting interests and priorities shaping their design and implementation. Political gridlock and partisan divisions can prevent the enactment or effective implementation of such policies.

Unintended Consequences:

Redistribution policies, while aiming to reduce inequality, can also have unintended consequences:

-

Disincentives to Work: High marginal tax rates can discourage work effort among high-income earners, potentially reducing the overall tax base and economic activity.

-

Reduced Investment: High taxes on capital gains and inheritance can diminish investment, hindering economic growth and long-term prosperity.

-

Government Dependency: Generous welfare programs could potentially foster dependency on government assistance, disincentivizing self-reliance and work.

-

Inefficient Resource Allocation: Government intervention in markets through subsidies or price controls can lead to inefficiencies and distort resource allocation.

-

Brain Drain: High taxes on high-income earners can potentially lead to a "brain drain," where highly skilled individuals relocate to countries with more favorable tax policies.

Finding the Optimal Balance:

The optimal level of income redistribution remains a subject of ongoing debate. Different economic schools of thought offer contrasting perspectives on the ideal balance between equity and efficiency. Some argue for significant redistribution to address societal inequality and foster social cohesion, emphasizing the social benefits of a more equitable society. Others prioritize economic efficiency, arguing that excessive redistribution can stifle economic growth and create unintended negative consequences.

The key lies in designing and implementing policies that effectively address income inequality without significantly hindering economic growth. This requires careful consideration of the various factors discussed above, including economic growth, tax design, program administration, and behavioral responses. A nuanced approach is necessary, taking into account the specific circumstances of each nation and its unique social and economic context.

Conclusion:

Government policies aimed at redistributing income play a crucial role in shaping income distribution. While these policies can effectively reduce inequality and improve the living standards of the less fortunate, their implementation involves complexities and potential unintended consequences. The optimal level of redistribution is a matter of ongoing debate, requiring careful consideration of the trade-offs between equity and efficiency. Effective policies require careful design, robust administration, and an understanding of the various factors influencing their impact. The continuing evolution of economic thought and empirical research will continue to inform the development of more effective and equitable income redistribution strategies in the future. The challenge remains to find a balance that fosters both economic prosperity and social justice, ensuring a more inclusive and equitable society for all.

Latest Posts

Latest Posts

-

The Day Manager Noticed That The Prep Cook

Mar 31, 2025

-

How To Cite A Letter Apa Style

Mar 31, 2025

-

Non Occupational Disability Coverage Is Designed For

Mar 31, 2025

-

Enterprise Information Systems Are Also Known As Collaborative Systems

Mar 31, 2025

-

A Companys Ledger Or General Ledger Is

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about A Government's Policy Of Redistributing Income Makes The Income Distribution: . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.