A Department That Incurs Costs Without Generating Revenues Is A

Holbox

Mar 29, 2025 · 6 min read

Table of Contents

- A Department That Incurs Costs Without Generating Revenues Is A

- Table of Contents

- A Department That Incurs Costs Without Generating Revenue Is a: Cost Center Explained

- Understanding Cost Centers: The Basics

- The Difference Between Cost Centers and Profit Centers

- Types of Cost Centers

- 1. Based on the Nature of Control:

- 2. Based on the Nature of the Costs:

- Managing Cost Centers Effectively

- The Importance of Cost Center Analysis

- Cost Center Challenges and Mitigation Strategies

- The Future of Cost Center Management

- Conclusion: The Essential Role of Cost Centers

- Latest Posts

- Latest Posts

- Related Post

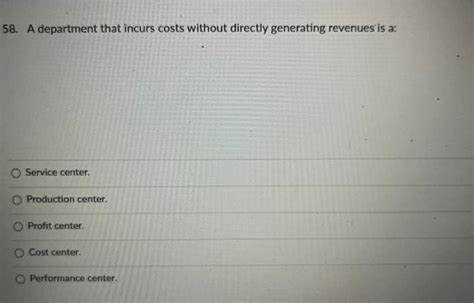

A Department That Incurs Costs Without Generating Revenue Is a: Cost Center Explained

A department that incurs costs without directly generating revenue is known as a cost center. Unlike profit centers, which aim to generate profit, cost centers focus on efficiency and effectiveness in managing expenses. Understanding cost centers is crucial for effective resource allocation, budgetary control, and overall organizational profitability. This in-depth guide delves into the intricacies of cost centers, exploring their characteristics, types, management strategies, and their crucial role within a larger organizational structure.

Understanding Cost Centers: The Basics

A cost center is a department, section, or unit within an organization that does not generate revenue directly. Its primary function is to support the organization's revenue-generating activities. These supporting functions are essential for the smooth operation of the business, but their contribution to the bottom line is indirect. Think of them as the backbone, providing the necessary infrastructure and support for the profit-making elements. Examples include:

- Human Resources (HR): Responsible for recruitment, training, compensation, and employee relations.

- Information Technology (IT): Manages the company's computer systems, networks, and data security.

- Accounting and Finance: Handles financial record-keeping, budgeting, and reporting.

- Marketing (Sometimes): While marketing can contribute indirectly to revenue generation through brand building, specific marketing departments focused solely on brand awareness or internal communications might be considered cost centers.

- Research and Development (R&D): Incurring costs for innovation and new product development; revenue generation comes later through the successful commercialization of these innovations.

- Legal Department: Handles legal matters and compliance.

- Administrative Departments: Handling general office operations, supplies, and facilities.

The Difference Between Cost Centers and Profit Centers

The key distinction lies in their primary objective:

-

Profit Centers: Aim to generate revenue and profit directly. Examples include sales departments, production units creating and selling products, and individual retail stores. They are responsible for their own revenue generation and profitability.

-

Cost Centers: Focus on efficiency and effectiveness in managing expenses. Their performance is measured by how well they control costs, not by how much revenue they generate. They are judged on their efficiency in supporting the profit centers.

Types of Cost Centers

Cost centers can be categorized in various ways, depending on the specific organizational structure and the nature of the costs incurred:

1. Based on the Nature of Control:

-

Standard Cost Centers: These centers have pre-determined budgets and standards against which actual costs are measured. Any deviations require explanations and corrective actions. This approach fosters accountability and allows for better cost control.

-

Flexible Cost Centers: These centers have budgets that adjust based on factors like production volume or activity level. This approach is more adaptable to fluctuations in business conditions but requires more sophisticated budgeting and forecasting techniques.

2. Based on the Nature of the Costs:

-

Fixed Cost Centers: These centers incur costs that remain relatively constant regardless of the level of activity. Examples include rent, salaries, and depreciation of fixed assets.

-

Variable Cost Centers: These centers incur costs that fluctuate directly with the level of activity. Examples include direct materials, direct labor, and utilities.

-

Semi-Variable Cost Centers: These centers incur costs that have both fixed and variable components. For example, a call center may have a fixed cost for rent and salaries, but variable costs based on the number of calls handled.

Managing Cost Centers Effectively

Effective management of cost centers is vital to overall organizational profitability. Here are some key strategies:

-

Establishing Clear Objectives and Performance Metrics: Defining specific, measurable, achievable, relevant, and time-bound (SMART) goals ensures everyone is aligned with the cost center's purpose. Metrics like cost per unit, cost reduction percentages, and efficiency ratios should be established and regularly monitored.

-

Budgeting and Forecasting: Developing accurate budgets and forecasts is crucial for anticipating expenses and controlling spending. Regular variance analysis helps identify areas where costs are exceeding expectations.

-

Process Optimization: Streamlining workflows and processes can significantly reduce costs. Identifying and eliminating redundancies, automating tasks, and improving efficiency are essential aspects of cost center management.

-

Technology Adoption: Investing in appropriate technology can automate processes, reduce manual labor, and improve overall efficiency. This can range from simple software solutions to sophisticated enterprise resource planning (ERP) systems.

-

Performance Evaluation and Reporting: Regularly evaluating the performance of cost centers using established metrics and reporting mechanisms allows for timely identification of issues and implementation of corrective actions.

-

Regular Communication and Collaboration: Open communication between the cost center managers and other departments is crucial for ensuring alignment with organizational goals and preventing conflicts.

-

Continuous Improvement: Embracing a culture of continuous improvement involves regularly assessing processes, identifying areas for improvement, and implementing changes to enhance efficiency and reduce costs. This may involve techniques like Lean management, Six Sigma, or Kaizen.

The Importance of Cost Center Analysis

Analyzing cost centers provides valuable insights into an organization's cost structure and operational efficiency. This analysis allows for:

-

Identifying Cost Drivers: Understanding the factors that influence costs helps in developing more accurate budgets and improving cost control.

-

Improving Efficiency: Identifying inefficiencies and bottlenecks enables the implementation of improvements that lead to reduced costs and enhanced productivity.

-

Optimizing Resource Allocation: Cost center analysis provides data-driven insights for efficient resource allocation, ensuring that resources are used effectively where they are most needed.

-

Supporting Strategic Decision-Making: The insights gleaned from cost center analysis inform strategic decisions related to resource allocation, investment, and overall organizational strategy.

Cost Center Challenges and Mitigation Strategies

While cost centers are essential, they also present challenges:

-

Difficulty in Measuring Performance: Since cost centers don't generate direct revenue, measuring their performance can be challenging. Clearly defined metrics are essential.

-

Potential for Cost Overruns: Without proper control mechanisms, costs can easily spiral out of control. Regular monitoring and variance analysis are critical.

-

Lack of Accountability: If responsibilities and accountabilities aren't clearly defined, it can be difficult to pinpoint the source of cost overruns or inefficiencies. Clear roles and responsibilities are essential.

-

Resistance to Change: Implementing changes to improve efficiency can face resistance from staff. Effective communication and change management strategies are crucial.

Mitigation strategies include:

-

Implementing a robust cost accounting system: This ensures accurate tracking and reporting of costs.

-

Establishing clear lines of responsibility: This makes it easier to hold individuals accountable for cost performance.

-

Using performance management systems: These systems can help to identify and address inefficiencies.

-

Investing in training and development: This can help staff to improve their skills and knowledge.

-

Fostering a culture of continuous improvement: This ensures that cost reduction is an ongoing process.

The Future of Cost Center Management

In today's dynamic business environment, effective cost center management is more critical than ever. The increasing use of technology, data analytics, and automation presents both opportunities and challenges. Advanced analytics can provide deep insights into cost drivers, enabling more precise optimization and informed decision-making. Automation can streamline processes and reduce costs, but requires careful planning and implementation to avoid unintended consequences. The ability to adapt to technological advancements and integrate new tools effectively will be crucial for successful cost center management in the future.

Conclusion: The Essential Role of Cost Centers

In conclusion, while cost centers don't directly generate revenue, they are the unsung heroes of any successful organization. Their efficient operation is crucial for supporting the revenue-generating functions and ensuring the overall profitability of the business. Effective management of cost centers, through careful planning, process optimization, and continuous improvement, is essential for long-term success. By understanding the intricacies of cost centers, organizations can optimize their resource allocation, enhance efficiency, and ultimately improve their bottom line. Investing in understanding and optimizing cost centers isn't just about saving money; it's about building a more robust, resilient, and ultimately, more profitable organization.

Latest Posts

Latest Posts

-

Descent With Modification Describes The Process Of Multiple Choice Question

Mar 31, 2025

-

Being Surprised At Paying 20 A Plate

Mar 31, 2025

-

Standard Costs Are Used In The Calculation Of

Mar 31, 2025

-

When Trading With More Developed Countries

Mar 31, 2025

-

Special Education In Contemporary Society An Introduction To Exceptionality

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about A Department That Incurs Costs Without Generating Revenues Is A . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.