A Credit To A Liability Account

Holbox

Mar 21, 2025 · 6 min read

Table of Contents

- A Credit To A Liability Account

- Table of Contents

- A Credit to a Liability Account: Understanding the Double-Entry System

- What is a Liability Account?

- The Double-Entry Bookkeeping System

- Crediting a Liability Account: The Mechanics

- Example 1: Accounts Payable

- Example 2: Loans Payable

- Example 3: Unearned Revenue

- Debiting a Liability Account: Reducing Obligations

- Example 4: Paying Accounts Payable

- Example 5: Paying off a Loan

- Common Mistakes and Misunderstandings

- Importance of Accurate Liability Accounting

- Advanced Concepts: Liability Accruals and Deferrals

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

A Credit to a Liability Account: Understanding the Double-Entry System

Understanding how to properly account for credits and debits is fundamental to mastering bookkeeping and accounting. This comprehensive guide delves into the intricacies of crediting a liability account, explaining its implications within the double-entry bookkeeping system. We'll explore various scenarios, providing clear examples and addressing common misconceptions. By the end, you'll have a strong grasp of this essential accounting concept.

What is a Liability Account?

Before diving into credits, let's define a liability account. In simple terms, a liability account represents a company's financial obligations to external parties. These obligations are debts that the company must repay in the future. Common examples include:

- Accounts Payable (A/P): Money owed to suppliers for goods or services purchased on credit.

- Loans Payable: Money borrowed from banks or other lending institutions.

- Notes Payable: Formal written promises to repay a debt, often with interest.

- Salaries Payable: Wages owed to employees at the end of a pay period.

- Taxes Payable: Taxes owed to governmental agencies.

- Unearned Revenue: Money received from customers for goods or services yet to be delivered.

The Double-Entry Bookkeeping System

The double-entry system is the cornerstone of modern accounting. Every financial transaction affects at least two accounts, maintaining the accounting equation: Assets = Liabilities + Equity. This ensures that the accounting equation always remains balanced.

Debits and Credits:

- Debit: A debit increases the balance of asset, expense, and dividend accounts, while it decreases the balance of liability, equity, and revenue accounts. Think of a debit as adding to something you own or owe to expenses.

- Credit: A credit increases the balance of liability, equity, and revenue accounts, while it decreases the balance of asset, expense, and dividend accounts. Think of a credit as adding to something you owe or adding to the company's earnings.

Crediting a Liability Account: The Mechanics

A credit to a liability account increases its balance. This signifies an increase in the company's financial obligations. Let's illustrate this with examples:

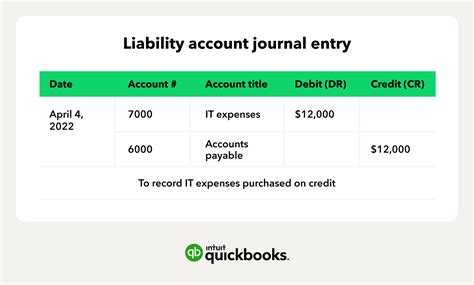

Example 1: Accounts Payable

Imagine your company purchased $1,000 worth of inventory on credit from a supplier. This transaction increases your Accounts Payable (a liability) and increases your Inventory (an asset). The journal entry would be:

| Account Name | Debit | Credit |

|---|---|---|

| Inventory | $1,000 | |

| Accounts Payable | $1,000 | |

| To record purchase of inventory on credit |

Notice how the debit to Inventory increases the asset account, and the credit to Accounts Payable increases the liability account. The equation remains balanced ($1,000 = $1,000).

Example 2: Loans Payable

Suppose your company takes out a $50,000 loan from a bank. This transaction increases your Loans Payable (a liability) and increases your Cash (an asset). The journal entry would be:

| Account Name | Debit | Credit |

|---|---|---|

| Cash | $50,000 | |

| Loans Payable | $50,000 | |

| To record loan proceeds |

Here, the debit to Cash increases the asset, and the credit to Loans Payable increases the liability. Again, the accounting equation remains balanced.

Example 3: Unearned Revenue

Your company receives $2,000 in advance payment for services that will be provided in the future. This increases your Unearned Revenue (a liability) because you owe the customer the service. It also increases your Cash (an asset). The journal entry is:

| Account Name | Debit | Credit |

|---|---|---|

| Cash | $2,000 | |

| Unearned Revenue | $2,000 | |

| To record advance payment received |

The debit increases the asset (cash), and the credit increases the liability (unearned revenue), reflecting the obligation to perform the service.

Debiting a Liability Account: Reducing Obligations

Conversely, debiting a liability account decreases its balance. This means the company is reducing its financial obligations. This typically occurs when a liability is paid off.

Example 4: Paying Accounts Payable

When your company pays off the $1,000 owed to the supplier from Example 1, the journal entry would be:

| Account Name | Debit | Credit |

|---|---|---|

| Accounts Payable | $1,000 | |

| Cash | $1,000 | |

| To record payment of accounts payable |

The debit reduces the Accounts Payable liability, and the credit reduces the Cash asset. The equation remains balanced.

Example 5: Paying off a Loan

Similarly, when making payments towards your loan from Example 2, the journal entry would involve debiting Loans Payable and crediting Cash.

Common Mistakes and Misunderstandings

- Confusing Debits and Credits: A common mistake is misinterpreting the impact of debits and credits on different account types. Remember the mnemonic: DEAD CLIC (Debits increase Expenses, Assets, and Dividends; Credits increase Liabilities, Income, and Capital).

- Ignoring the Accounting Equation: Always ensure that your journal entries maintain the balance of the accounting equation. If the equation is not balanced, there's an error in the entry.

- Incorrect Account Classification: Misclassifying accounts as assets, liabilities, or equity can lead to inaccurate financial statements. Ensure you correctly categorize each account.

Importance of Accurate Liability Accounting

Accurate liability accounting is crucial for several reasons:

- Financial Statement Accuracy: Accurate liability reporting is vital for producing reliable balance sheets, income statements, and cash flow statements. This ensures that stakeholders have a clear understanding of the company's financial health.

- Creditworthiness: Lenders use liability information to assess a company's creditworthiness. Accurate liability accounting can improve a company's chances of securing loans at favorable terms.

- Tax Compliance: Accurate liability recording is essential for complying with tax regulations. Incorrect liability reporting can lead to penalties and legal issues.

- Internal Control: Proper accounting for liabilities is an integral part of a strong internal control system, minimizing the risk of fraud and errors.

Advanced Concepts: Liability Accruals and Deferrals

Liability accounting also involves accruals and deferrals:

- Accrued Liabilities: Liabilities that have been incurred but not yet paid. For example, accrued salaries are wages earned by employees but not yet paid at the end of a pay period.

- Deferred Liabilities (Unearned Revenue): Liabilities representing goods or services yet to be provided to customers. As the services are provided, the liability is reduced, and revenue is recognized.

Understanding the nuances of accruals and deferrals is essential for accurate financial reporting.

Conclusion

Mastering the art of crediting liability accounts is a fundamental skill in accounting. By understanding the double-entry system and the impact of debits and credits on liability accounts, businesses can ensure the accuracy of their financial statements, improve their creditworthiness, and maintain compliance with regulations. Remember to always double-check your work and consult with a qualified accountant if you have any doubts or encounter complex situations. The principles outlined in this guide provide a strong foundation for managing your company's financial obligations effectively. Accurate and timely liability accounting is not just a bookkeeping task; it's a crucial aspect of maintaining the overall financial health and stability of any organization.

Latest Posts

Latest Posts

-

An Inverted U Tube Manometer Containing Oil

Mar 28, 2025

-

The Four Major Types Of Enterprise Applications Are

Mar 28, 2025

-

The Following Costs Were Incurred In May

Mar 28, 2025

-

Devoted Health Value Proposition Is To

Mar 28, 2025

-

Which Of The Following Is A Feature Of Job Posting

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about A Credit To A Liability Account . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.