A Cost Accounting System Check All That Apply

Holbox

Mar 24, 2025 · 6 min read

Table of Contents

- A Cost Accounting System Check All That Apply

- Table of Contents

- A Cost Accounting System Check: All That Apply

- Key Components of a Robust Cost Accounting System

- 1. Cost Identification and Classification:

- 2. Cost Accumulation and Allocation:

- 3. Cost Control and Analysis:

- 4. Reporting and Decision-Making:

- Cost Accounting System Checklist: A Comprehensive Review

- Addressing Weaknesses in Your Cost Accounting System

- Choosing the Right Cost Accounting Software

- Latest Posts

- Latest Posts

- Related Post

A Cost Accounting System Check: All That Apply

Cost accounting is the bedrock of any successful business, regardless of size or industry. A robust cost accounting system provides crucial insights into the cost of production, helping businesses make informed decisions regarding pricing, resource allocation, and overall profitability. However, a poorly designed or implemented system can lead to inaccurate data, flawed strategies, and ultimately, financial losses. This comprehensive guide explores the essential elements of a cost accounting system, providing a checklist to ensure yours is operating efficiently and effectively.

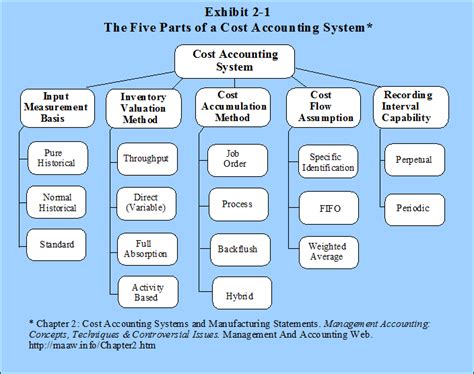

Key Components of a Robust Cost Accounting System

Before diving into the checklist, let's establish the fundamental components of a strong cost accounting system. These elements work together to provide a holistic view of your company's costs.

1. Cost Identification and Classification:

This is the foundational step. It involves accurately identifying and classifying all costs incurred in the production process. This includes:

- Direct Materials: Raw materials directly used in producing the finished goods (e.g., wood for furniture, fabric for clothing). The system should track the quantity and cost of these materials efficiently.

- Direct Labor: Wages paid to employees directly involved in production (e.g., assembly line workers, machine operators). Accurate time tracking and labor costing are crucial.

- Manufacturing Overhead: All indirect costs associated with production, including factory rent, utilities, depreciation of equipment, and indirect labor (e.g., factory supervisors). Proper allocation of overhead costs is vital for accurate product costing.

- Selling and Administrative Expenses: Costs incurred outside of the manufacturing process, such as marketing, sales commissions, and administrative salaries. These expenses are typically treated separately but still need careful tracking.

2. Cost Accumulation and Allocation:

Once costs are identified, they must be systematically accumulated and allocated to specific products or services. This requires:

- Cost Centers: Establishing cost centers (departments or units) responsible for specific costs. This enables better cost control and analysis.

- Cost Allocation Methods: Selecting appropriate methods to allocate indirect costs (like overhead) to products or services. Common methods include direct labor hours, machine hours, and activity-based costing (ABC). The chosen method should align with the company's operations and industry best practices.

- Job Order Costing: Tracking costs for individual projects or jobs (e.g., construction projects, custom-made furniture). This offers detailed cost information for each specific order.

- Process Costing: Tracking costs for mass-produced, identical products (e.g., canned goods, textiles). This averages costs over a large production volume.

3. Cost Control and Analysis:

A robust system goes beyond simple tracking; it facilitates effective cost control and analysis:

- Budgeting and Variance Analysis: Comparing actual costs against budgeted costs to identify variances and investigate their causes. This is crucial for proactive cost management.

- Performance Measurement: Using key performance indicators (KPIs) to track cost efficiency and identify areas for improvement. Examples include cost per unit, labor productivity, and overhead ratios.

- Cost Reduction Strategies: Implementing strategies to reduce costs without compromising quality or efficiency. This could involve process optimization, material sourcing, or technology upgrades.

4. Reporting and Decision-Making:

The final, critical stage involves generating comprehensive reports and using cost data for informed decision-making:

- Cost Reports: Regular reports summarizing costs by product, department, or time period. These reports should be easily understandable and actionable.

- Management Accounting: Using cost information for planning, control, and decision-making related to pricing, product mix, and investment decisions.

- Financial Reporting: Integrating cost data into financial statements for external reporting purposes, ensuring compliance with accounting standards.

Cost Accounting System Checklist: A Comprehensive Review

Now, let's delve into a detailed checklist to assess your current cost accounting system. Answering "Yes" or "No" to each question will highlight areas of strength and areas needing improvement.

I. Cost Identification and Classification:

- [ ] Do you have a clear and consistent method for identifying and classifying all direct and indirect costs?

- [ ] Is your system capable of tracking the cost of direct materials used in production, including waste and spoilage?

- [ ] Do you accurately track direct labor costs, including overtime and benefits?

- [ ] Have you identified and categorized all manufacturing overhead costs?

- [ ] Do you have a well-defined method for allocating overhead costs to products or services?

- [ ] Are selling and administrative expenses clearly separated from manufacturing costs?

- [ ] Do you regularly review and update your cost classification system to reflect changes in operations?

II. Cost Accumulation and Allocation:

- [ ] Are cost centers clearly defined and monitored?

- [ ] Do you utilize a suitable cost allocation method (e.g., direct labor hours, machine hours, ABC) that accurately reflects your operations?

- [ ] If applicable, is your job order costing system comprehensive and reliable?

- [ ] If applicable, is your process costing system accurate and efficient for high-volume production?

- [ ] Do you maintain detailed records of all cost transactions?

- [ ] Is your system integrated with other business systems (e.g., ERP, inventory management) to ensure data accuracy and consistency?

III. Cost Control and Analysis:

- [ ] Do you develop and use a budget to track and control costs?

- [ ] Do you regularly conduct variance analysis to identify and investigate cost deviations?

- [ ] Do you track key performance indicators (KPIs) related to cost efficiency?

- [ ] Do you have processes in place to identify and implement cost reduction strategies?

- [ ] Are cost control measures regularly reviewed and updated?

- [ ] Is there a system for monitoring and evaluating the effectiveness of cost control initiatives?

IV. Reporting and Decision-Making:

- [ ] Do you generate regular cost reports that are accurate, timely, and easy to understand?

- [ ] Are your cost reports used for effective management accounting and decision-making?

- [ ] Is cost information integrated into financial reporting processes?

- [ ] Do managers use cost data to inform decisions about pricing, product mix, and resource allocation?

- [ ] Is your system capable of generating customized reports to meet specific management needs?

- [ ] Do you regularly review the usefulness and effectiveness of your cost reporting system?

Addressing Weaknesses in Your Cost Accounting System

After completing the checklist, you'll likely identify areas for improvement. Here's a breakdown of common issues and solutions:

-

Inaccurate Data: This stems from poor data collection methods, lack of training, or outdated systems. Implement stricter data entry protocols, invest in updated technology, and provide comprehensive training to your staff.

-

Inefficient Processes: Manual processes can be slow and error-prone. Automate tasks where possible using software solutions designed for cost accounting.

-

Lack of Integration: Data silos create inefficiencies and inconsistencies. Integrate your cost accounting system with other business systems for a unified view of your operations.

-

Poor Reporting: Unclear or untimely reports hinder effective decision-making. Invest in reporting tools that provide clear, concise, and actionable insights.

-

Lack of Cost Control Measures: Without clear cost control measures, costs can spiral out of control. Implement regular cost reviews, budgets, and variance analyses.

-

Inadequate Training: Staff need proper training on the cost accounting system and its use. Provide comprehensive training programs to ensure competence.

Choosing the Right Cost Accounting Software

The right software can significantly enhance the efficiency and accuracy of your cost accounting system. Consider the following factors when choosing a software solution:

- Scalability: Choose software that can grow with your business.

- Integration capabilities: Ensure it integrates with your existing systems.

- User-friendliness: Opt for intuitive software that is easy for your staff to use.

- Reporting features: Ensure it provides comprehensive and customizable reporting options.

- Cost: Balance functionality with affordability.

By thoroughly reviewing your cost accounting system using this checklist and addressing any weaknesses, you can build a robust system that provides valuable insights, facilitates informed decision-making, and ultimately contributes to the long-term success of your business. Remember, a well-functioning cost accounting system is not a one-time project; it requires ongoing maintenance, updates, and adaptation to meet evolving business needs.

Latest Posts

Latest Posts

-

For The Circuit Shown In The Figure

Mar 27, 2025

-

Acceleration Due To Gravity Of Jupiter

Mar 27, 2025

-

When Making Decisions Managers Should Consider

Mar 27, 2025

-

Consider The Following T Account For Cash

Mar 27, 2025

-

Trends In The External Labor Force Affect A Companys

Mar 27, 2025

Related Post

Thank you for visiting our website which covers about A Cost Accounting System Check All That Apply . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.