A Company Sells 10000 Shares Of Previously

Holbox

Mar 28, 2025 · 6 min read

Table of Contents

- A Company Sells 10000 Shares Of Previously

- Table of Contents

- A Company Sells 10,000 Shares of Previously Authorized but Unissued Stock: Implications and Analysis

- Understanding the Context: Authorized, Issued, and Outstanding Shares

- Potential Motivations Behind the Sale

- Raising Capital:

- Strategic Acquisitions:

- Shareholder Dilution:

- Employee Stock Option Plans (ESOPs):

- Market Opportunities:

- Implications of the Sale

- Impact on Earnings Per Share (EPS):

- Share Price Volatility:

- Changes in Ownership Structure:

- Increased Liquidity:

- Signaling Effects:

- Analyzing the Financial Statements

- Due Diligence and Investor Considerations

- Conclusion: Navigating the Complexities

- Latest Posts

- Latest Posts

- Related Post

A Company Sells 10,000 Shares of Previously Authorized but Unissued Stock: Implications and Analysis

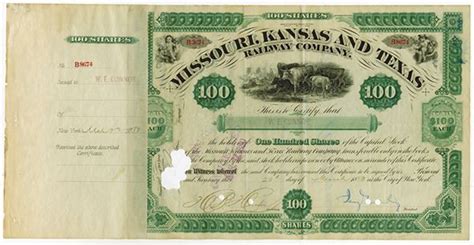

The sale of 10,000 shares of previously authorized but unissued stock represents a significant event for a company, impacting its capital structure, shareholder base, and overall financial health. This action, while seemingly straightforward, carries numerous implications that require careful consideration by investors, analysts, and the company itself. This comprehensive analysis delves into the various facets of such a transaction, exploring its potential motivations, effects, and the broader context within which it occurs.

Understanding the Context: Authorized, Issued, and Outstanding Shares

Before delving into the specifics of selling 10,000 previously authorized but unissued shares, it's crucial to understand the fundamental distinctions between authorized, issued, and outstanding shares.

-

Authorized Shares: This represents the maximum number of shares a company is legally permitted to issue, as outlined in its corporate charter. It's a ceiling on the company's potential share count.

-

Issued Shares: These are the shares that have been officially distributed by the company to investors. They represent the total number of shares that have been sold.

-

Outstanding Shares: This refers to the issued shares that are currently held by investors, excluding any shares repurchased by the company (treasury stock).

The sale of 10,000 previously authorized but unissued shares means the company had the legal capacity to issue these shares, but had not done so previously. Now, they're being offered to the market.

Potential Motivations Behind the Sale

Several factors can drive a company to sell previously authorized but unissued shares. Understanding these motivations offers valuable insight into the company's strategy and financial condition.

Raising Capital:

This is often the primary driver. The sale of shares injects fresh capital into the company's coffers. This capital can be used for various purposes:

- Funding Expansion: Investing in new projects, acquiring other businesses, or expanding existing operations.

- Debt Reduction: Reducing the company's debt burden, thereby lowering its financial risk.

- Research and Development: Funding crucial research and development initiatives to innovate and improve products or services.

- Working Capital Management: Improving the company's short-term liquidity position, enabling it to meet immediate operational needs.

Strategic Acquisitions:

Companies may sell shares to fund acquisitions that align with their strategic growth plans. Acquiring a competitor, securing key technology, or expanding into new markets are all potential reasons.

Shareholder Dilution:

While often seen as a negative, selling additional shares can be a deliberate strategy to dilute the ownership of existing shareholders. This might occur in situations where significant internal conflicts need resolution or to accommodate new investors, for example, in a private equity deal.

Employee Stock Option Plans (ESOPs):

Companies with ESOPs might sell shares to cover employee stock options exercised. This avoids direct issuance from the company's treasury, maintaining a cleaner balance sheet.

Market Opportunities:

A favorable market environment, with strong investor demand and high stock prices, can incentivize companies to issue additional shares to capitalize on the opportunity to raise capital at favorable terms.

Implications of the Sale

The sale of 10,000 shares, although a relatively small number for a large company, still has significant implications:

Impact on Earnings Per Share (EPS):

The increase in the number of outstanding shares will dilute earnings per share (EPS). This is because the same amount of net income is now distributed among a larger number of shares, leading to a lower EPS. Investors should carefully evaluate the impact of this dilution on their investment.

Share Price Volatility:

The offering of new shares could impact share price, depending on market conditions. If the market is positive and there is strong demand, the price might be relatively unaffected or even increase slightly. Conversely, a large issuance in a weak market could lead to a price decrease.

Changes in Ownership Structure:

The introduction of new shareholders alters the company's ownership structure. This could shift the balance of power within the company and influence decision-making processes.

Increased Liquidity:

The increased number of shares outstanding generally increases the liquidity of the stock, making it easier for investors to buy and sell shares. This can be beneficial for both existing and prospective shareholders.

Signaling Effects:

The sale of shares can signal different things to the market. A sale to fund expansion might be viewed positively, demonstrating growth ambitions. However, a sale to cover losses or repay debt could be interpreted negatively. The circumstances surrounding the sale are crucial for interpretation.

Analyzing the Financial Statements

Analyzing the company's financial statements – particularly the balance sheet and statement of cash flows – is crucial to understanding the impact of the share sale.

-

Balance Sheet: The balance sheet will show an increase in equity (contributed capital) reflecting the proceeds from the share sale, and an increase in the number of outstanding shares.

-

Statement of Cash Flows: The cash inflow from the share sale will be evident in the financing activities section of the statement of cash flows.

Due Diligence and Investor Considerations

Investors should conduct thorough due diligence before investing in a company that has recently sold shares. This includes:

-

Understanding the rationale: Why did the company sell the shares? Is the reason credible and aligned with the company's long-term strategy?

-

Assessing the use of proceeds: How will the company use the proceeds from the share sale? Is the allocation of funds sensible and aligned with shareholder value creation?

-

Evaluating the impact on EPS: What will be the impact on EPS? Is the dilution acceptable given the potential benefits from the capital raised?

-

Analyzing the market conditions: Was the share sale undertaken at a favorable time in the market?

Conclusion: Navigating the Complexities

The sale of 10,000 shares of previously authorized but unissued stock is a multifaceted event with far-reaching implications. Understanding the context, motivations, and implications is vital for both the company and its stakeholders. Investors need to analyze the details surrounding the share sale, assess the potential risks and rewards, and make informed investment decisions. A thorough understanding of the company's financial health, strategic goals, and the broader market environment is crucial for navigating the complexities involved in such transactions. The seemingly simple act of selling shares reveals a much deeper story about a company's financial strategy and its future prospects. Careful analysis is paramount for making informed judgments about the long-term health and potential of the company. By considering the factors outlined above, investors and analysts can form a more comprehensive and accurate assessment of the company's performance and potential. This detailed analysis should form a crucial part of any investment strategy. The information presented here is for informational purposes only and not financial advice. Always seek the advice of a qualified financial professional before making investment decisions.

Latest Posts

Latest Posts

-

The Theory We Have Constructed Originates With The Three Phases

Mar 31, 2025

-

Which Was Not True About Egyptian Views Of The Afterlife

Mar 31, 2025

-

Draw The Shear And Moment Diagrams For The Overhang Beam

Mar 31, 2025

-

A Professional Upholstering All The Trade Secrets

Mar 31, 2025

-

Select The Graph That Is Positively Skewed

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about A Company Sells 10000 Shares Of Previously . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.