A Company Can Repay Outstanding Principal And Interest When

Holbox

Mar 13, 2025 · 6 min read

Table of Contents

When Can a Company Repay Outstanding Principal and Interest? A Comprehensive Guide

Repaying outstanding principal and interest is a crucial aspect of financial management for any company. Understanding the circumstances under which a company can repay these obligations is essential for both creditors and the company itself. This article delves into the various scenarios and factors that influence a company's ability to repay its debt, providing a comprehensive overview of the subject.

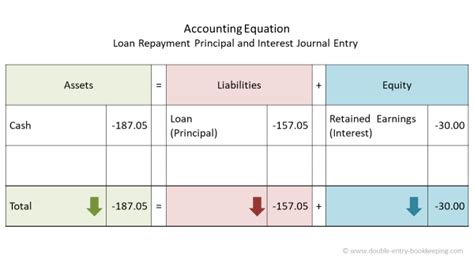

Understanding Principal and Interest

Before diving into the specifics of repayment, let's clarify the terms:

-

Principal: This is the original amount of money borrowed by the company. It's the core debt that needs to be repaid.

-

Interest: This is the cost of borrowing money. It's a percentage of the principal that the company pays to the lender as compensation for the use of their funds. Interest payments can be calculated in various ways, such as simple interest or compound interest, depending on the loan agreement.

Factors Influencing a Company's Ability to Repay Debt

Several internal and external factors dictate when a company can comfortably repay its outstanding principal and interest. These factors are interconnected and need to be assessed holistically:

1. Financial Performance and Liquidity

-

Profitability: A consistently profitable company generates cash flow, which is crucial for debt repayment. Strong profits indicate a higher ability to meet financial obligations. Analyzing key financial ratios like the profit margin and return on assets (ROA) provides insights into profitability.

-

Cash Flow: Positive cash flow is paramount. Even highly profitable companies might struggle if they have poor cash management. Analyzing the statement of cash flows is vital. Specifically, focusing on operating cash flow shows the cash generated from core business activities – a key indicator of debt repayment capacity.

-

Liquidity Ratios: These ratios assess a company's ability to meet its short-term obligations. Key ratios include the current ratio and the quick ratio. A healthy liquidity position suggests the company has sufficient liquid assets to cover immediate debt repayments.

-

Working Capital: This represents the difference between current assets and current liabilities. Adequate working capital is essential to ensure the smooth functioning of operations and the ability to meet debt obligations.

2. Debt Structure and Covenants

-

Loan Terms: The repayment schedule, including the frequency of payments (monthly, quarterly, annually) and the maturity date (the final repayment date), are crucial.

-

Interest Rates: Higher interest rates increase the cost of borrowing and can strain a company's ability to repay.

-

Loan Covenants: These are clauses in the loan agreement that impose restrictions on the borrower's activities. Violating these covenants can trigger default, even if the company is financially sound. Common covenants include limitations on debt levels, dividend payments, and capital expenditures.

3. Market Conditions and Economic Factors

-

Interest Rate Environment: Rising interest rates increase borrowing costs and can make debt repayment more challenging. Conversely, falling rates can make it easier.

-

Economic Growth: A strong economy generally benefits companies, leading to increased revenue and improved ability to repay debt. Recessions, however, can severely impact a company's financial performance.

-

Industry Trends: Industry-specific factors, such as technological disruptions or changes in consumer demand, can significantly impact a company's financial health and debt repayment ability.

-

Access to Capital Markets: The ability to access further funding (through loans, equity financing, or debt refinancing) can provide a buffer against financial difficulties and enhance repayment capabilities.

4. Management's Financial Strategy

-

Debt Management Policies: A well-defined debt management policy helps companies effectively manage their debt levels and prioritize repayment.

-

Financial Planning and Forecasting: Accurate financial planning and forecasting are crucial for anticipating potential financial challenges and proactively managing debt repayment.

-

Risk Management: Effective risk management strategies help mitigate potential financial risks and enhance the stability of the company's financial position.

-

Strategic Investments: Strategic investments in projects with high returns on investment can boost profitability and enhance the company's capacity for debt repayment.

Scenarios When a Company Can Repay Outstanding Principal and Interest

Based on the factors discussed above, here are scenarios where a company is likely to be able to repay its debt:

-

Consistent profitability and positive cash flow: This is the most straightforward scenario. The company earns sufficient profits and manages its cash effectively, enabling it to make timely principal and interest payments.

-

Successful refinancing: The company might refinance its existing debt with a new loan at more favorable terms, extending the repayment period or lowering the interest rate. This provides flexibility and eases the burden of repayment.

-

Asset sales: Selling non-core assets can generate cash that can be used to repay debt. This is a common strategy when a company needs to quickly improve its liquidity position.

-

Equity financing: Issuing new shares to raise capital can provide funds for debt repayment, but this dilutes the ownership stake of existing shareholders.

-

Improved operational efficiency: Implementing cost-cutting measures and improving operational efficiency can increase profitability and cash flow, making debt repayment easier.

-

Favorable economic conditions: A booming economy generally boosts company performance, making debt repayment more manageable.

Scenarios When a Company Might Struggle to Repay

Conversely, several scenarios increase the risk of a company struggling with debt repayment:

-

Persistent losses and negative cash flow: Consistent losses and insufficient cash flow severely hinder a company's ability to meet its debt obligations.

-

High debt levels: An excessively high debt burden can put immense pressure on the company's finances, even if it’s profitable.

-

Violation of loan covenants: Failure to comply with the terms of the loan agreement can trigger default, regardless of the company's financial performance.

-

Economic downturn: A recession can drastically reduce demand for a company's products or services, leading to financial distress and inability to repay debt.

-

Unforeseen events: Unexpected events, such as natural disasters or significant legal challenges, can severely impact a company's financial stability and its ability to repay debt.

Conclusion: A Proactive Approach to Debt Management

The ability of a company to repay outstanding principal and interest hinges on a complex interplay of internal and external factors. A proactive approach to debt management is crucial. This involves:

- Careful financial planning and forecasting: Anticipate future financial needs and potential challenges.

- Effective cash management: Optimize cash flow to ensure sufficient liquidity.

- Maintaining strong relationships with lenders: Open communication fosters understanding and can help navigate challenging periods.

- Regular monitoring of financial ratios: Track key financial indicators to assess the company's financial health.

- Adaptability and responsiveness to changing market conditions: Be prepared to adjust strategies in response to economic shifts.

By understanding these factors and proactively managing its finances, a company can significantly increase its chances of successfully repaying its outstanding principal and interest, maintaining its financial stability, and achieving long-term success. Remember that consistent monitoring, strategic planning, and a clear understanding of the financial landscape are essential components for any company aiming for robust financial health.

Latest Posts

Latest Posts

-

A Company Pledges Its Receivables So It Can

Mar 17, 2025

-

Striated Multinucleate Cells Are Commonly Found In

Mar 17, 2025

-

According To The School Of Ethical Relativism

Mar 17, 2025

-

Overapplied Manufacturing Overhead Would Result If

Mar 17, 2025

-

All Of The Following Accurately Describe Lockout Tags Except

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about A Company Can Repay Outstanding Principal And Interest When . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.