A Company Bought A Computer For 1500

Holbox

Mar 12, 2025 · 5 min read

Table of Contents

A Company Bought a Computer for $1500: A Deep Dive into the Implications

The seemingly simple act of a company purchasing a computer for $1500 hides a multitude of implications, reaching far beyond the initial transaction. This seemingly small expense ripples through the business's finances, operations, and even its overall strategic direction. Let's dissect this event, examining its impact from various perspectives.

The Financial Implications: More Than Just $1500

The immediate impact, of course, is the $1500 expenditure. This will reduce the company's cash on hand and affect its balance sheet. However, the true financial implications are far more nuanced and depend heavily on factors like:

Depreciation and Amortization:

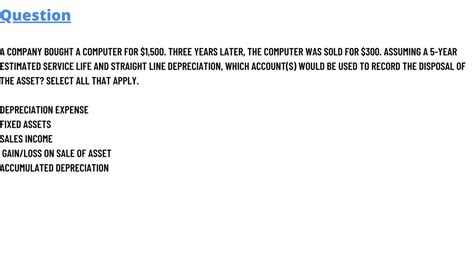

The $1500 isn't a one-time cost. According to generally accepted accounting principles (GAAP), the computer's value depreciates over its useful life. This depreciation expense is spread out over several years, impacting the company's income statement each year. The specific depreciation method (straight-line, double-declining balance, etc.) will influence the annual expense. Understanding the depreciation schedule is crucial for accurate financial forecasting and reporting.

Tax Implications:

Depreciation is tax-deductible, offering a financial benefit. The company can deduct a portion of the computer's cost each year, reducing its taxable income and ultimately its tax liability. This is a significant factor to consider, especially for companies operating in higher tax brackets. The specifics will depend on the applicable tax laws and regulations.

Return on Investment (ROI):

The $1500 investment should ideally generate a return. This isn't necessarily a direct monetary return, but rather an increase in productivity, efficiency, or revenue resulting from the computer's use. Calculating the ROI involves assessing the benefits (increased sales, reduced operational costs, improved employee efficiency) against the initial investment and ongoing expenses (maintenance, software updates, etc.).

Opportunity Cost:

The $1500 could have been invested elsewhere within the business. This represents an opportunity cost – the potential return that was forgone by choosing to invest in the computer instead. A thorough cost-benefit analysis should be undertaken to ensure the investment in the computer offers a higher return than alternative investment opportunities.

Operational Implications: Boosting Productivity and Efficiency

The acquisition of a new computer has a profound impact on the day-to-day operations of the company. The improvements can be both direct and indirect:

Increased Productivity:

A modern computer with sufficient processing power and memory can significantly enhance employee productivity. Faster processing speeds, improved software capabilities, and reliable hardware can streamline workflows and reduce the time spent on tasks. This can lead to increased output and a more efficient use of employee time.

Improved Efficiency:

Efficient software and streamlined workflows facilitated by the new computer can minimize errors, reduce bottlenecks, and optimize operational processes. For instance, automated tasks can free up employee time for more strategic work, leading to cost savings and increased profitability.

Enhanced Collaboration:

The new computer might facilitate better collaboration among employees. Features like cloud storage, shared document editing, and video conferencing can improve communication and teamwork, leading to better project outcomes.

Access to New Technologies:

A new computer may provide access to new software and technologies that were previously unavailable. This can lead to improvements in areas like data analysis, customer relationship management (CRM), and marketing automation.

Strategic Implications: Aligning with Business Goals

The purchase of a $1500 computer, seemingly insignificant in isolation, is part of a broader strategic plan. Its implications extend beyond immediate operational gains:

Aligning with Business Objectives:

The decision to purchase the computer should be linked to overarching business objectives. Is it intended to support growth initiatives? Improve customer service? Enhance data analysis capabilities? The computer’s role must be clearly defined and aligned with the company's strategic direction.

Technological Advancement:

The purchase of a new computer represents a commitment to technological advancement. It signals the company's intention to keep up with industry trends and leverage technology to maintain a competitive edge. This can attract talent, enhance the company's reputation, and open doors to new opportunities.

Scalability and Future Growth:

A robust computer system provides a foundation for future growth. As the company expands, its technological infrastructure should be able to scale to support increased demands. The initial investment in a capable computer lays the groundwork for future scalability and prevents potential bottlenecks.

Long-Term Considerations: Maintenance and Upgrading

The $1500 investment is only the beginning. The computer will require ongoing maintenance, software updates, and potential upgrades in the future:

Maintenance and Repairs:

Regular maintenance is crucial to prevent costly repairs and downtime. This includes software updates, virus protection, and regular hardware checks. The budget must incorporate these ongoing costs to ensure the computer’s continued performance.

Software Licenses and Subscriptions:

The cost of software licenses and subscription services should be factored into the overall investment. These recurring costs can significantly influence the overall financial impact of the computer acquisition.

Future Upgrades:

Technology advances rapidly. The $1500 computer may require upgrades or replacement in the future to maintain its efficiency and functionality. A long-term plan should be in place to address these potential expenses.

Conclusion: A Holistic Perspective

The purchase of a $1500 computer for a company is far more complex than a simple financial transaction. It has significant implications for the company's finances, operations, strategic direction, and long-term viability. Understanding the financial implications, operational improvements, strategic alignment, and long-term maintenance requirements is crucial for maximizing the return on investment and ensuring the computer serves its intended purpose effectively. A well-informed decision, considering all these aspects, is essential for maximizing the value of this seemingly small investment. By taking a holistic perspective, businesses can ensure their technology investments contribute significantly to their overall success and growth. Ignoring the broader context can lead to missed opportunities and ultimately hinder the company's progress. Therefore, a thorough analysis is crucial before committing to any technology purchase, no matter how seemingly insignificant the initial cost may appear.

Latest Posts

Latest Posts

-

The Loss Prevention Department At Dollar General

Mar 12, 2025

-

The Following Data Were Reported By A Corporation

Mar 12, 2025

-

The Overall Function Of The Calvin Cycle Is

Mar 12, 2025

-

Question Elvis Select The Correct Configuration

Mar 12, 2025

-

When Finn Applied For A Mortgage

Mar 12, 2025

Related Post

Thank you for visiting our website which covers about A Company Bought A Computer For 1500 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.