A Business Disability Buyout Plan Policy Is Designed

Holbox

Mar 27, 2025 · 7 min read

Table of Contents

- A Business Disability Buyout Plan Policy Is Designed

- Table of Contents

- A Business Disability Buyout Plan Policy: Designed for Security and Peace of Mind

- Understanding the Core Purpose of a Disability Buyout Plan

- 1. Protecting the Business:

- 2. Protecting the Disabled Owner:

- Key Components of a Disability Buyout Plan Policy

- 1. Definition of Disability:

- 2. Disability Insurance Policy:

- 3. Buy-Sell Agreement:

- 4. Valuation of the Business:

- 5. Funding Mechanisms:

- 6. Tax Implications:

- 7. Contingency Planning:

- Designing a Disability Buyout Plan: A Step-by-Step Guide

- Frequently Asked Questions (FAQs)

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

A Business Disability Buyout Plan Policy: Designed for Security and Peace of Mind

A business disability buyout plan is a crucial component of any robust succession plan, offering crucial protection for both the business and its owners in the event of a disabling illness or injury. This policy ensures the continuation of the business and provides financial security for the disabled owner, preventing potential financial ruin and mitigating the disruption a disability can cause. Understanding the intricacies of this plan is vital for business owners aiming to safeguard their futures. This comprehensive guide explores the design and implementation of a business disability buyout plan, addressing key considerations and frequently asked questions.

Understanding the Core Purpose of a Disability Buyout Plan

The primary goal of a business disability buyout plan is to provide a financially sound mechanism for buying out the ownership interest of a disabled business owner. This prevents a potentially crippling situation where the business struggles to function due to the owner's inability to work, and the disabled owner faces financial hardship. The plan serves two primary functions:

1. Protecting the Business:

- Maintaining Operational Continuity: A disability buyout plan ensures a smooth transition of ownership, preventing disruption to operations and preserving the business's value. It avoids the uncertainties and potential conflicts associated with a sudden and unplanned change in ownership.

- Preserving Business Value: The plan prevents a forced liquidation or sale at a discounted price, preserving the business's equity and maximizing its future potential.

- Minimizing Legal and Financial Complications: By outlining a clear process for buyout, the plan prevents potential disputes among owners or legal battles over the ownership stake.

2. Protecting the Disabled Owner:

- Financial Security: The buyout provides a much-needed financial safety net, covering lost income and medical expenses. This prevents financial hardship and allows the disabled owner to focus on their recovery.

- Peace of Mind: Knowing they are financially protected in case of disability gives business owners a sense of security, enabling them to concentrate on managing their business without excessive worry.

- Fair and Equitable Treatment: The plan ensures the disabled owner receives a fair value for their business interest, preventing exploitation or undervaluation.

Key Components of a Disability Buyout Plan Policy

A well-structured disability buyout plan encompasses several key components:

1. Definition of Disability:

The plan must clearly define what constitutes a "disability" to avoid ambiguity and disputes. This definition should align with the policy of the chosen disability insurance provider. Common definitions include the inability to perform the essential functions of one's job for a specified period. This requires careful consideration of the owner's role and responsibilities within the business.

2. Disability Insurance Policy:

The core of the plan involves securing a disability insurance policy that provides the funds necessary for the buyout. This policy should cover the value of the disabled owner's equity in the business. The amount of coverage is determined by a professional valuation of the business. The policy should also address the payment schedule, duration of payments, and any potential tax implications. Different types of disability insurance exist, including individual and group plans. Carefully evaluating the needs of the business and the owners is critical in selecting the right policy.

3. Buy-Sell Agreement:

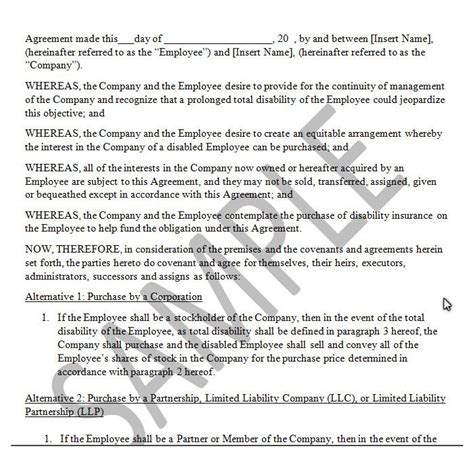

This legally binding agreement outlines the terms and conditions of the buyout process. It specifies who will purchase the disabled owner's shares (other owners, the business itself, or a third party), the purchase price, the payment method, and the timeline for the transaction. This agreement should be reviewed and updated regularly to reflect changes in business value and the owners' circumstances. Legal counsel is crucial in ensuring the agreement is legally sound and protects the interests of all parties involved.

4. Valuation of the Business:

Regular and accurate valuation of the business is critical to determining the buyout price. This valuation should be performed by a qualified professional and reflect the current market value of the business. The valuation method used, such as discounted cash flow analysis or asset-based valuation, should be explicitly stated in the plan. Periodic reviews ensure the valuation remains current and accurate.

5. Funding Mechanisms:

The plan should outline how the buyout will be funded. This could involve using the proceeds from the disability insurance policy, loans from financial institutions, or a combination of both. A detailed funding plan ensures a smooth and efficient buyout process.

6. Tax Implications:

The tax implications of the buyout should be carefully considered. Professional tax advice is essential to ensure compliance with all relevant tax laws and minimize tax liabilities for both the business and the disabled owner. Understanding tax consequences associated with the transfer of ownership is vital for planning and budgeting.

7. Contingency Planning:

The plan should include contingency measures to address unforeseen circumstances, such as the failure of the disability insurance policy to pay out or disputes among owners. Contingency planning ensures the plan remains robust and addresses potential challenges.

Designing a Disability Buyout Plan: A Step-by-Step Guide

Developing a comprehensive disability buyout plan involves a systematic approach:

- Assess the Business's Needs: Carefully evaluate the business’s structure, size, profitability, and the owners' roles to determine the need for a disability buyout plan.

- Determine the Buyout Price: Engage a qualified business appraiser to determine the fair market value of the business and each owner's share.

- Select a Disability Insurance Provider: Research and compare different insurers to find a policy that aligns with the business’s needs and budget, paying close attention to policy coverage, terms, and conditions.

- Draft a Buy-Sell Agreement: Consult with legal counsel to draft a legally sound buy-sell agreement that outlines the terms of the buyout. This agreement is legally binding and clarifies each party’s responsibilities.

- Establish a Funding Mechanism: Determine how the buyout will be funded, considering factors such as the insurance policy's payout, available loans, and the business's financial resources.

- Implement Tax Planning: Consult with a tax professional to understand the tax implications of the plan and develop a strategy to minimize tax liabilities.

- Regular Review and Update: The plan should be reviewed and updated periodically to account for changes in the business's value, the owners' circumstances, and relevant regulations.

Frequently Asked Questions (FAQs)

Q: Who should have a disability buyout plan?

A: Any business with multiple owners, especially those where the owners are actively involved in the daily operations, should consider a disability buyout plan. This is particularly important for businesses where the loss of an owner due to disability could significantly impact the business's viability.

Q: How much does a disability buyout plan cost?

A: The cost depends on various factors, including the value of the business, the amount of coverage needed, the type of disability insurance policy, and the health and age of the owners. Obtaining quotes from multiple insurers is recommended to compare costs and coverage.

Q: What happens if the disability insurance policy is denied?

A: A well-designed plan should include contingency measures for such scenarios. This might involve alternative funding sources, negotiations between owners, or even the sale of the business.

Q: How often should the plan be reviewed and updated?

A: The plan should be reviewed at least annually, or more frequently if significant changes occur in the business or the owners' circumstances. This ensures the plan remains relevant and effective.

Q: What is the role of legal counsel in creating a disability buyout plan?

A: Legal counsel is crucial in drafting the buy-sell agreement, ensuring it complies with all relevant laws, and protecting the interests of all parties involved. They will guide you through the legal ramifications of the plan.

Q: Can a disability buyout plan be combined with other succession planning tools?

A: Yes, a disability buyout plan can be integrated with other succession planning tools, such as a buy-sell agreement for death or retirement, creating a comprehensive strategy for business continuity.

Conclusion

A business disability buyout plan is an essential element of a comprehensive business succession strategy, offering critical protection for both the business and its owners. By providing a structured and financially sound mechanism for the buyout of a disabled owner's interest, the plan ensures business continuity, protects the financial stability of the disabled owner, and prevents potential legal and financial complications. The careful planning and implementation of a well-designed disability buyout plan provide peace of mind and safeguard the future of the business and its owners. Remember, seeking professional advice from legal, financial, and insurance experts is crucial for creating a plan that meets your specific needs and circumstances. Proactive planning is key to navigating the complexities of business ownership and ensuring a secure future for all involved.

Latest Posts

Latest Posts

-

Special Channels That Enable Water To Cross The Plasma Membrane

Mar 31, 2025

-

Which Item Best Completes The List

Mar 31, 2025

-

Tina Taxpayer Makes 75000 A Year

Mar 31, 2025

-

The Graph Shows A Business Cycle For A Hypothetical Economy

Mar 31, 2025

-

Moles And Chemical Formulas Lab Report Answers

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about A Business Disability Buyout Plan Policy Is Designed . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.