Which Statement Below Best Describes The Accounting Equation

Holbox

Mar 29, 2025 · 6 min read

Table of Contents

- Which Statement Below Best Describes The Accounting Equation

- Table of Contents

- Which Statement Below Best Describes the Accounting Equation? A Deep Dive into Fundamental Accounting Principles

- Understanding the Accounting Equation: Assets, Liabilities, and Equity

- The Core Equation: A Simple Truth

- Variations and Interpretations: Unpacking the Equation

- Analyzing the Best Description: A Comparative Approach

- Beyond the Equation: Practical Implications

- The Accounting Equation: A Foundation for Success

- Latest Posts

- Latest Posts

- Related Post

Which Statement Below Best Describes the Accounting Equation? A Deep Dive into Fundamental Accounting Principles

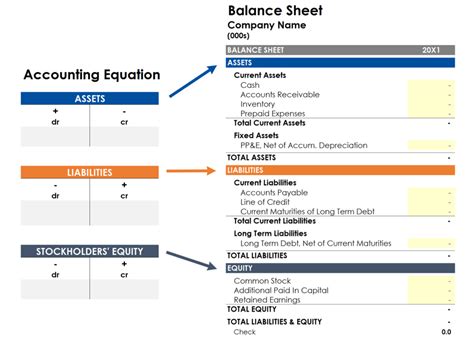

The accounting equation is the bedrock of double-entry bookkeeping, a fundamental concept in accounting. Understanding it is crucial for anyone involved in finance, from aspiring accountants to seasoned business owners. But what exactly does it describe? Let's explore the different ways this core principle can be stated and determine which best captures its essence.

Understanding the Accounting Equation: Assets, Liabilities, and Equity

Before we delve into the various statements, let's establish a firm grasp of the components:

-

Assets: These are resources controlled by a business as a result of past events and from which future economic benefits are expected to flow to the entity. Examples include cash, accounts receivable (money owed to the business), inventory, equipment, and buildings.

-

Liabilities: These are present obligations of an entity arising from past events, the settlement of which is expected to result in an outflow of resources embodying economic benefits. Examples include accounts payable (money owed by the business), loans payable, salaries payable, and deferred revenue.

-

Equity (or Owner's Equity): This represents the residual interest in the assets of an entity after deducting all its liabilities. In simpler terms, it's what's left over for the owners after all debts are paid. For a sole proprietorship or partnership, this is often referred to as owner's equity. For corporations, it's typically called shareholder's equity.

The Core Equation: A Simple Truth

The accounting equation itself is remarkably straightforward:

Assets = Liabilities + Equity

This equation demonstrates the fundamental principle that everything a business owns (its assets) is either financed by borrowing (liabilities) or by the owners' investment (equity). This balance must always hold true; it's the cornerstone of financial record-keeping.

Variations and Interpretations: Unpacking the Equation

While the basic equation is clear, various statements might attempt to describe it. Let's examine some potential options and analyze their accuracy:

Option 1: "A company's assets are always equal to the sum of its liabilities and equity."

This statement is accurate and represents a direct, concise interpretation of the accounting equation. It clearly states the fundamental relationship between assets, liabilities, and equity. The word "always" emphasizes the perpetual balance that must be maintained.

Option 2: "The total value of a company's resources is equivalent to the combined value of its obligations and the owners' investment."

This statement is also accurate. It utilizes more descriptive language, replacing "assets" with "total value of a company's resources," "liabilities" with "combined value of its obligations," and "equity" with "owners' investment." This phrasing might be easier for non-accountants to understand.

Option 3: "The accounting equation demonstrates that a company's assets are funded either through debt or equity."

This statement is accurate but focuses more on the source of funding for assets rather than the direct equality. It highlights the fundamental duality of financing—either through borrowing (debt/liabilities) or through owners' contributions (equity). This perspective is valuable for understanding the financial structure of a business.

Option 4: "A company's liabilities always exceed its assets unless the company has positive equity."

This statement is incorrect. It implies a condition where liabilities can surpass assets. While a company might temporarily have negative equity (e.g., during periods of significant losses), the accounting equation always necessitates a balance. Liabilities can never inherently exceed assets; the difference is reflected in the equity component.

Option 5: "The accounting equation is a dynamic relationship that adjusts with every transaction."

This statement is accurate and highlights an important aspect often overlooked. The accounting equation isn't static; it constantly adapts to reflect the impact of each financial transaction. Every transaction affects at least two accounts, ensuring the equation remains balanced. This is the essence of double-entry bookkeeping.

Option 6: "The accounting equation proves that business profits always increase assets."

This statement is partially accurate but oversimplified. While profits do generally increase assets (e.g., through retained earnings), the equation doesn't exclusively prove this. Profits increase equity, which in turn impacts the overall equation and can lead to an increase in assets. However, profits could also be used to pay down liabilities, which would decrease liabilities without necessarily increasing assets directly.

Analyzing the Best Description: A Comparative Approach

Given the options, Option 1 ("A company's assets are always equal to the sum of its liabilities and equity") and Option 2 ("The total value of a company's resources is equivalent to the combined value of its obligations and the owners' investment") are the most accurate and concise. They directly and unequivocally represent the core principle of the accounting equation.

Option 3 is also very good, offering a slightly different perspective that highlights the source of asset financing, which is a valuable insight. However, options 1 and 2 provide a more direct representation of the fundamental equation itself.

Beyond the Equation: Practical Implications

Understanding the accounting equation is more than just theoretical knowledge. It has significant practical implications:

-

Financial Statement Analysis: The equation serves as a basis for analyzing a company's financial health. Analyzing the relationship between assets, liabilities, and equity provides insights into solvency, liquidity, and profitability.

-

Creditworthiness Assessment: Lenders and investors use the equation (and the financial statements derived from it) to assess a company's creditworthiness and risk profile. A strong equity position relative to liabilities suggests better financial stability.

-

Internal Control Systems: Maintaining the balance of the accounting equation is crucial for establishing effective internal control systems. Any discrepancies require investigation and correction, helping prevent fraud and errors.

-

Decision-Making: Business decisions, such as investing in new equipment or taking on debt, are often evaluated based on their impact on the accounting equation and overall financial position.

-

Auditing: Auditors use the accounting equation as a fundamental check during the audit process, ensuring the accuracy and reliability of financial records.

The Accounting Equation: A Foundation for Success

The accounting equation, while seemingly simple, is the cornerstone of financial accounting. A deep understanding of its components and implications is essential for anyone working with financial data. Choosing the best statement to describe it depends on the context and audience, but options emphasizing the direct equality between assets and the sum of liabilities and equity offer the most accurate and concise representation. The constant balancing act represented by the equation underscores the dynamic nature of financial transactions and provides a vital framework for understanding a business's financial health. Mastering this concept is a crucial step towards financial literacy and business success.

Latest Posts

Latest Posts

-

Personal Eyeglasses Provide As Much Protection As

Apr 01, 2025

-

Microbiology With Diseases By Body System

Apr 01, 2025

-

Match Each Term With Its Correct Definition

Apr 01, 2025

-

Health Economics And Policy 8th Edition Cite

Apr 01, 2025

-

Human Behavior In The Social Environment 6th Edition Pdf Free

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Which Statement Below Best Describes The Accounting Equation . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.