Which Of The Following Best Describes A Fiscal Policy Tool

Holbox

Apr 01, 2025 · 7 min read

Table of Contents

- Which Of The Following Best Describes A Fiscal Policy Tool

- Table of Contents

- Which of the Following Best Describes a Fiscal Policy Tool?

- Defining Fiscal Policy Tools

- Key Objectives of Fiscal Policy

- Examining the Fiscal Policy Toolkit

- 1. Government Spending: A Powerful Lever

- 2. Taxation: Influencing Disposable Income and Investment

- Which Tool Best Describes Fiscal Policy?

- Beyond the Basics: Other Considerations

- Conclusion: A Holistic Approach to Fiscal Policy

- Latest Posts

- Latest Posts

- Related Post

Which of the Following Best Describes a Fiscal Policy Tool?

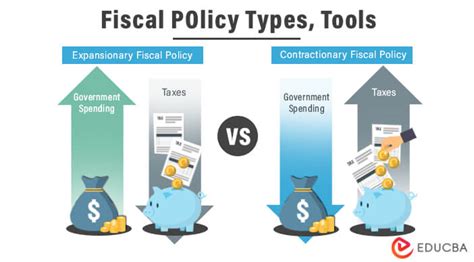

Fiscal policy, a cornerstone of macroeconomic management, involves the government's use of spending and taxation to influence the economy. Understanding the tools employed in fiscal policy is crucial for comprehending its impact on economic growth, inflation, and unemployment. This comprehensive guide will delve into the various instruments used in fiscal policy, examining their effectiveness and potential drawbacks. We'll explore the nuances of each tool and determine which best describes the core function of fiscal policy.

Defining Fiscal Policy Tools

Before we delve into specific tools, let's establish a clear definition. Fiscal policy tools are the mechanisms governments utilize to adjust government spending and taxation to achieve desired economic outcomes. These tools aren't independent; they often work in concert to achieve specific policy goals. The effectiveness of these tools can vary based on several factors, including the state of the economy, the responsiveness of consumers and businesses, and the overall political climate.

Key Objectives of Fiscal Policy

The primary objectives guiding the application of fiscal policy tools include:

- Stabilizing the economy: Mitigating the severity of economic fluctuations (boom and bust cycles) through counter-cyclical measures.

- Promoting economic growth: Stimulating aggregate demand and investment to encourage economic expansion.

- Managing inflation: Curbing inflationary pressures through contractionary policies.

- Reducing unemployment: Stimulating demand and job creation through expansionary policies.

- Addressing income inequality: Utilizing progressive taxation and targeted social programs to redistribute wealth and reduce income disparities.

- Managing government debt: Maintaining a sustainable level of government debt through prudent fiscal management.

Examining the Fiscal Policy Toolkit

Several tools are available to governments for implementing fiscal policy. These tools can be broadly categorized as:

1. Government Spending: This refers to the amount of money the government spends on various goods and services. Changes in government spending directly impact aggregate demand.

2. Taxation: This involves the levying of taxes on individuals and corporations. Changes in tax rates and policies affect disposable income and investment.

Let's examine these two core tools in more detail:

1. Government Spending: A Powerful Lever

Government spending encompasses a wide range of expenditures, including:

-

Infrastructure spending: Investments in roads, bridges, public transportation, and other infrastructure projects. These investments create jobs, improve productivity, and stimulate economic activity. The multiplier effect is significant, as the initial investment generates further economic activity through subsequent spending rounds. Keywords: infrastructure investment, multiplier effect, job creation.

-

Defense spending: Funding for national defense, including military personnel, equipment, and operations. This type of spending has both direct and indirect economic effects, impacting employment in the defense industry and related sectors. However, its economic benefits are often debated, and it can divert resources from other potentially more productive areas. Keywords: military spending, defense budget, national security.

-

Social welfare programs: Government programs aimed at providing social safety nets and support, such as unemployment benefits, social security, and Medicaid. These programs provide crucial support to vulnerable populations and act as automatic stabilizers during economic downturns. However, they can also increase government debt if not carefully managed. Keywords: social safety net, unemployment benefits, welfare programs.

-

Education spending: Investments in education at all levels, from primary school to higher education. This is considered a long-term investment that enhances human capital, improving productivity and economic growth. Keywords: education investment, human capital, skill development.

-

Research and development spending: Funding for scientific research and technological innovation. These investments drive technological progress and contribute to long-term economic growth. Keywords: R&D spending, innovation, technological advancement.

Impact of Changes in Government Spending:

-

Increased spending (Expansionary fiscal policy): This boosts aggregate demand, leading to increased economic activity, job creation, and potentially higher inflation. It's often employed during recessions to stimulate the economy.

-

Decreased spending (Contractionary fiscal policy): This reduces aggregate demand, potentially curbing inflation but also risking a slowdown in economic growth and increased unemployment. It might be used during periods of high inflation.

2. Taxation: Influencing Disposable Income and Investment

Taxation is another crucial tool in fiscal policy. Taxes directly impact disposable income (the amount of income available to consumers after taxes) and corporate profits (affecting investment decisions).

Types of Taxes:

-

Progressive taxes: Tax rates increase as income increases. Examples include income tax systems where higher earners pay a larger percentage of their income in taxes. These are often used to redistribute wealth and reduce income inequality. Keywords: progressive taxation, income inequality, wealth redistribution.

-

Regressive taxes: Tax rates decrease as income increases. Sales taxes are often cited as an example because low-income earners tend to spend a larger proportion of their income, thus paying a larger percentage in sales tax relative to their income compared to high-income earners. Keywords: regressive taxation, sales tax, consumption tax.

-

Proportional taxes: Tax rates remain constant regardless of income level. A flat tax is an example. Keywords: proportional taxation, flat tax.

Impact of Changes in Taxation:

-

Tax cuts (Expansionary fiscal policy): Increase disposable income, leading to higher consumer spending and potentially stimulating economic growth. However, they can also increase the budget deficit.

-

Tax increases (Contractionary fiscal policy): Reduce disposable income, potentially curbing inflation but also slowing economic growth and potentially increasing unemployment.

Which Tool Best Describes Fiscal Policy?

The question of which tool best describes fiscal policy is not easily answered with a single definitive response. Both government spending and taxation are integral and interdependent parts of the fiscal policy mechanism. Neither can fully represent the complete picture. They function in tandem to influence the economy. While both tools impact aggregate demand, they achieve this through different channels: spending directly, and taxation indirectly by influencing disposable income and investment.

Arguably, government spending is often seen as the more direct and immediately impactful tool, particularly in times of crisis. The government can quickly allocate funds to stimulate specific sectors or provide direct relief. Taxation, while equally crucial, often operates with a time lag, as it takes time for changes in tax rates to influence consumer and business behavior.

However, the most effective fiscal policy utilizes a combination of both spending and taxation adjustments tailored to the specific economic situation and policy objectives. For example, during a recession, an expansionary fiscal policy might involve increased government spending and tax cuts to stimulate aggregate demand. Conversely, during inflationary periods, a contractionary policy could entail reduced government spending and tax increases to curb economic overheating.

Beyond the Basics: Other Considerations

The effectiveness of fiscal policy tools depends on numerous factors, including:

-

The size of the economy: The impact of a fiscal stimulus is likely to be greater in a smaller economy compared to a larger one.

-

The state of the economy: Expansionary policies are more effective during recessions, while contractionary policies are more suitable during inflationary periods.

-

The responsiveness of consumers and businesses: The effectiveness of fiscal policies depends on how consumers and businesses react to changes in government spending and taxation.

-

The level of government debt: High levels of government debt can limit the government's ability to use fiscal policy tools effectively.

-

Political considerations: The implementation of fiscal policy is often influenced by political factors, which can affect its timing and effectiveness.

Conclusion: A Holistic Approach to Fiscal Policy

In conclusion, the question of which tool – government spending or taxation – best describes fiscal policy is misleading. The most effective approach involves a holistic strategy that skillfully employs both government spending and taxation adjustments to achieve macroeconomic objectives. Understanding the intricate interplay between these two core tools is vital for policymakers to effectively manage the economy and promote sustainable growth. The choice of tools and their implementation depend critically on the specific economic circumstances, desired outcomes, and the overall political and economic context. Effective fiscal policy is not about choosing one tool over the other, but rather about skillfully orchestrating their combined impact to achieve stability, growth, and prosperity.

Latest Posts

Latest Posts

-

Accountants Not Only Provide Financial Information To The Firm They

Apr 05, 2025

-

Consuming Too Much Protein May Stress An Infants Immature

Apr 05, 2025

-

A Pharmaceutical Company Claims That Side Effects

Apr 05, 2025

-

Which Empty Cleaned And Sanitized Container

Apr 05, 2025

-

Decision Making Management Information Systems Are Necessary Because

Apr 05, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Best Describes A Fiscal Policy Tool . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.