When Supplies Are Purchased On Credit It Means That

Holbox

Mar 26, 2025 · 6 min read

Table of Contents

- When Supplies Are Purchased On Credit It Means That

- Table of Contents

- When Supplies Are Purchased on Credit: A Comprehensive Guide for Businesses

- Understanding Credit Purchases

- Key Aspects of Credit Purchases:

- Advantages of Purchasing Supplies on Credit

- Disadvantages of Purchasing Supplies on Credit

- Accounting Implications of Credit Purchases

- Best Practices for Managing Credit Accounts

- Choosing Between Credit and Cash Purchases

- Latest Posts

- Latest Posts

- Related Post

When Supplies Are Purchased on Credit: A Comprehensive Guide for Businesses

Purchasing supplies on credit is a common practice for businesses of all sizes. It offers flexibility and can improve cash flow, but it's crucial to understand the implications. This in-depth guide will explore what it means to buy supplies on credit, the advantages and disadvantages, accounting implications, and best practices for managing credit accounts.

Understanding Credit Purchases

When supplies are purchased on credit, it signifies that a business is acquiring goods or services without immediate payment. Instead, the business agrees to pay the supplier at a later date, typically within a specified timeframe, as outlined in the credit terms. This arrangement essentially represents a short-term loan extended by the supplier to the business. The supplier trusts the business to fulfill its payment obligation, often based on established credit history and financial standing.

Key Aspects of Credit Purchases:

-

Credit Terms: These are the conditions under which the credit is granted. Common terms might include "Net 30," meaning payment is due in 30 days, or "2/10, Net 30," meaning a 2% discount is offered if payment is made within 10 days, otherwise, the full amount is due in 30 days. Understanding these terms is crucial for effective cash flow management.

-

Credit Limit: Suppliers often set a credit limit, representing the maximum amount a business can owe at any given time. Exceeding this limit could result in suspended credit privileges or late payment fees.

-

Credit Application: Before extending credit, suppliers typically require a credit application to assess the business's creditworthiness. This involves providing financial information, such as revenue, expenses, and credit history.

-

Invoices: After a credit purchase, the supplier issues an invoice detailing the goods or services provided, the amount due, and the payment terms. Careful tracking of invoices is essential to avoid late payments and maintain a positive credit standing.

Advantages of Purchasing Supplies on Credit

Purchasing supplies on credit offers several significant advantages for businesses:

-

Improved Cash Flow: The most significant advantage is the ability to maintain healthy cash flow. Businesses can acquire necessary supplies without depleting their immediate cash reserves, allowing them to prioritize other essential expenditures like payroll or marketing. This is particularly beneficial for startups or businesses experiencing temporary cash flow constraints.

-

Bulk Purchasing Discounts: Credit accounts often allow businesses to purchase supplies in larger quantities, leading to potential bulk discounts. This can significantly reduce the overall cost of supplies, improving profitability.

-

Established Supplier Relationships: Maintaining a good credit history with suppliers fosters strong business relationships. These relationships can lead to preferential treatment, such as extended credit terms or priority service during periods of high demand.

-

Access to Essential Supplies: Credit enables businesses to acquire necessary supplies even when facing short-term financial limitations. This ensures uninterrupted operations and prevents delays in production or service delivery.

Disadvantages of Purchasing Supplies on Credit

While credit offers numerous benefits, it's crucial to be aware of potential drawbacks:

-

Interest Charges: If payments are not made within the stipulated credit terms, late payment fees and interest charges can be applied, increasing the overall cost of supplies. This can significantly impact profitability, especially for businesses with tight margins.

-

Debt Accumulation: Overreliance on credit can lead to accumulating significant debt, potentially hindering the business's financial health and making it difficult to manage other financial obligations. Careful budgeting and credit management are essential to avoid this scenario.

-

Impact on Credit Score: Consistent late payments or defaults can negatively affect the business's credit score, making it harder to secure future loans or credit lines from banks or other financial institutions. This can limit growth opportunities and increase borrowing costs in the future.

-

Administrative Burden: Managing credit accounts requires careful tracking of invoices, payment due dates, and communication with suppliers. This can add to the administrative burden, especially for smaller businesses with limited staff.

Accounting Implications of Credit Purchases

Credit purchases have specific accounting implications that businesses must understand and accurately record:

-

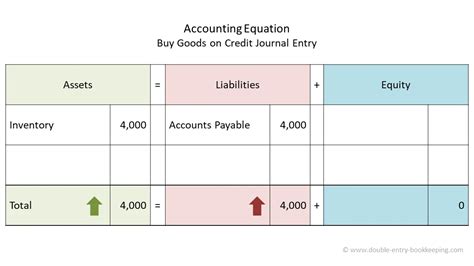

Accounts Payable: When supplies are purchased on credit, the transaction is recorded as an increase in accounts payable (a liability account) and an increase in supplies (an asset account). This reflects the obligation to pay the supplier in the future.

-

Journal Entries: The journal entry for a credit purchase typically involves debiting the supplies account and crediting the accounts payable account. This represents the increase in assets (supplies) and the increase in liabilities (accounts payable).

-

Invoice Processing: Accurate invoice processing is crucial for maintaining accurate accounts payable records. Invoices should be reviewed for accuracy, matched with purchase orders, and entered into the accounting system promptly.

-

Aging Reports: Regularly reviewing aging reports of accounts payable helps businesses track overdue invoices and manage their payment obligations effectively. This helps prevent late payment penalties and maintains a good credit standing with suppliers.

-

Financial Statements: Accounts payable are reported on the balance sheet as a current liability. The impact of credit purchases on the financial statements is significant, affecting both the balance sheet and the cash flow statement.

Best Practices for Managing Credit Accounts

Effective management of credit accounts is essential for maximizing the benefits of purchasing supplies on credit while minimizing the risks:

-

Negotiate Favorable Credit Terms: Before opening a credit account, negotiate favorable terms with suppliers, including payment deadlines and potential discounts for prompt payment.

-

Track Invoices and Due Dates: Implement a system for tracking invoices and payment due dates to ensure timely payments and avoid late payment fees. This could involve using accounting software or spreadsheets to manage accounts payable.

-

Maintain a Good Credit History: Promptly pay all invoices to maintain a good credit history with suppliers, which can lead to more favorable terms and better relationships.

-

Monitor Credit Limits: Regularly monitor credit limits to avoid exceeding the maximum allowed amount, which could result in penalties or credit restrictions.

-

Budget Effectively: Incorporate credit payments into the business's budget to ensure sufficient funds are available when payments are due. This helps avoid late payments and maintains financial stability.

-

Reconcile Accounts Regularly: Regular reconciliation of accounts payable ensures accuracy and identifies any discrepancies or errors promptly. This helps prevent disputes and maintains a positive relationship with suppliers.

Choosing Between Credit and Cash Purchases

The decision of whether to purchase supplies on credit or with cash depends on several factors:

-

Cash Flow: If a business has sufficient cash flow, paying cash offers the advantage of avoiding debt and interest charges.

-

Creditworthiness: Businesses with a strong credit history are more likely to secure favorable credit terms.

-

Bulk Discounts: Credit accounts often offer bulk discounts that can outweigh the cost of carrying debt.

-

Supplier Relationships: Establishing credit accounts can foster stronger relationships with suppliers.

Ultimately, the optimal approach is a strategic balance between leveraging credit for operational efficiency and maintaining fiscal responsibility. By carefully considering the advantages and disadvantages, understanding the accounting implications, and implementing effective management strategies, businesses can harness the power of credit purchases to enhance their financial health and operational success. This involves a continuous monitoring process of your financial health and a proactive approach to credit management, enabling sustainable growth and stability for your business. The key is informed decision-making and diligent record-keeping. This ensures that the benefits of credit purchases are realized without jeopardizing the financial stability of the business.

Latest Posts

Latest Posts

-

Identify The Best Support For A Separatory Funnel

Mar 30, 2025

-

Look At The Figure Below Which Of The Following Statements

Mar 30, 2025

-

How Does Inflation Typically Affect Bond Yields

Mar 30, 2025

-

Looking At Movies An Introduction To Film

Mar 30, 2025

-

Shortly After Assisting A 65 Year Old

Mar 30, 2025

Related Post

Thank you for visiting our website which covers about When Supplies Are Purchased On Credit It Means That . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.