When A Tax Is Imposed On A Good The

Holbox

Mar 29, 2025 · 7 min read

Table of Contents

- When A Tax Is Imposed On A Good The

- Table of Contents

- When a Tax is Imposed on a Good: A Comprehensive Analysis

- The Basic Supply and Demand Model and Tax Incidence

- Elasticity and Tax Incidence

- Graphical Representation of Tax Incidence

- Effects of a Tax on a Good

- 1. Higher Prices for Consumers

- 2. Lower Prices for Producers

- 3. Reduced Quantity Traded

- 4. Government Revenue

- 5. Deadweight Loss (Excess Burden)

- Types of Taxes and Their Impacts

- Factors Affecting Tax Incidence and Efficiency

- Beyond the Basic Model: Real-World Considerations

- Policy Implications

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

When a Tax is Imposed on a Good: A Comprehensive Analysis

The imposition of a tax on a good, whether it's a sales tax, excise tax, or value-added tax (VAT), significantly impacts the market for that good. Understanding these impacts is crucial for policymakers, businesses, and consumers alike. This article delves into the multifaceted consequences of such taxation, examining its effects on prices, quantities, consumer and producer surplus, government revenue, and overall economic welfare. We'll explore various scenarios and consider the complexities involved, providing a thorough understanding of this fundamental economic concept.

The Basic Supply and Demand Model and Tax Incidence

Before analyzing the effects of taxation, let's briefly revisit the fundamental supply and demand model. The intersection of the supply and demand curves determines the equilibrium price and quantity of a good in a perfectly competitive market. This equilibrium represents a market-clearing price where the quantity demanded equals the quantity supplied.

When a tax is imposed, it essentially creates a wedge between the price paid by consumers and the price received by producers. This wedge represents the tax amount. The incidence of the tax refers to the division of this tax burden between consumers and producers. This division depends on the relative elasticities of supply and demand.

Elasticity and Tax Incidence

Elasticity measures the responsiveness of quantity demanded or supplied to a change in price. A highly elastic demand curve implies that a small price increase will lead to a significant decrease in quantity demanded. Conversely, an inelastic demand curve suggests that quantity demanded is relatively unresponsive to price changes. The same principle applies to supply elasticity.

-

Inelastic Demand, Elastic Supply: If demand is inelastic and supply is elastic, the burden of the tax falls disproportionately on consumers. Producers, able to adjust their supply more easily, pass on a smaller portion of the tax to consumers.

-

Elastic Demand, Inelastic Supply: If demand is elastic and supply is inelastic, the burden shifts significantly to producers. Consumers, highly sensitive to price changes, reduce their quantity demanded substantially, leaving producers to bear a larger share of the tax.

-

Equal Elasticities: If both supply and demand have equal elasticities, the tax burden is shared equally between consumers and producers.

Graphical Representation of Tax Incidence

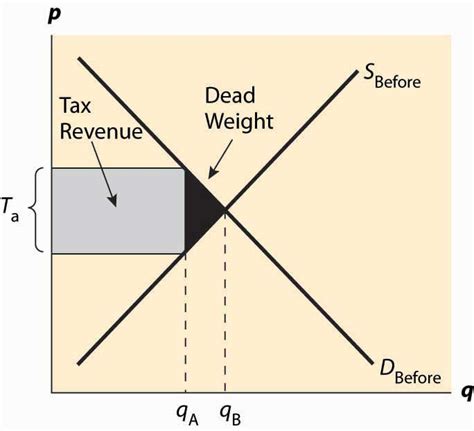

The effects of a tax can be illustrated graphically using the supply and demand model. When a per-unit tax is imposed, the supply curve shifts upward by the amount of the tax. This creates a new equilibrium with a higher price for consumers and a lower price received by producers. The difference between the two prices is the tax amount.

(Insert a graph here showing the supply and demand curves before and after the imposition of a tax, clearly labeling the consumer price, producer price, tax revenue, deadweight loss, and original equilibrium.)

Effects of a Tax on a Good

The imposition of a tax leads to several significant consequences:

1. Higher Prices for Consumers

The most immediate effect is a rise in the price consumers pay for the good. This price increase is not necessarily equal to the tax amount; it depends on the elasticities of supply and demand, as discussed above. Consumers face a reduced purchasing power as they now need to pay more for the same quantity.

2. Lower Prices for Producers

Producers receive a lower price for their goods after the tax is imposed. This reduction in revenue can impact their profitability and potentially lead to reduced production or investment. The extent of the price reduction depends again on the relative elasticities of supply and demand.

3. Reduced Quantity Traded

The higher price for consumers and lower price for producers leads to a contraction in the quantity traded in the market. This reduction in market efficiency represents a loss of potential gains from trade.

4. Government Revenue

The primary goal of imposing a tax is to generate government revenue. The tax revenue is calculated by multiplying the tax per unit by the new quantity traded after the tax is imposed. The amount of revenue generated depends on both the tax rate and the elasticity of demand. High elasticity implies that a large tax might result in a significant reduction in quantity demanded, limiting revenue generation.

5. Deadweight Loss (Excess Burden)

Perhaps the most crucial consequence is the creation of deadweight loss. This represents the loss of economic efficiency resulting from the tax. It's the reduction in total surplus (consumer surplus + producer surplus) that is not captured as government revenue. Deadweight loss arises because the tax prevents some mutually beneficial transactions from occurring. The larger the deadweight loss, the more inefficient the tax is.

(Insert a graph highlighting the deadweight loss triangle.)

Types of Taxes and Their Impacts

Different types of taxes have varying impacts on the market:

-

Specific Taxes (Per-Unit Tax): This is a fixed amount of tax levied on each unit of the good. The impact is a parallel shift in the supply curve.

-

Ad Valorem Taxes (Percentage Tax): This is a tax levied as a percentage of the good's price. The impact is a rotation of the supply curve.

-

Sales Taxes: These are broadly applied taxes on most goods and services. They affect the prices of a large number of goods.

-

Excise Taxes: These are taxes imposed on specific goods, such as gasoline or alcohol, often to discourage consumption or generate revenue.

Factors Affecting Tax Incidence and Efficiency

Several factors influence the distribution of the tax burden and the level of deadweight loss:

-

Elasticity of Demand and Supply: As previously discussed, these are crucial determinants of tax incidence.

-

Market Structure: The market structure (perfect competition, monopoly, etc.) affects the ability of producers to pass on the tax to consumers.

-

Tax Base: A broader tax base (more goods and services taxed) can reduce the deadweight loss associated with any single tax.

-

Tax Rate: Higher tax rates generally lead to greater deadweight loss.

Beyond the Basic Model: Real-World Considerations

The basic supply and demand model provides a useful framework for understanding the impact of taxes, but real-world scenarios are often more complex. These complexities include:

-

Market Imperfections: Factors like market power, externalities, and information asymmetry can significantly alter the effects of taxation.

-

Behavioral Responses: Consumers and producers may respond to taxes in ways not captured by simple models (e.g., changes in consumption patterns, tax avoidance).

-

International Trade: Taxes can impact international trade flows, leading to changes in domestic production and consumption.

-

Administrative Costs: Collecting and administering taxes involves costs that reduce the net revenue generated.

Policy Implications

Understanding the impacts of taxes is crucial for policymakers in designing efficient and equitable tax systems. The goal is to maximize revenue while minimizing deadweight loss and ensuring fair distribution of the tax burden. Policymakers should consider:

-

Choosing the right tax instrument: Selecting the type of tax that minimizes deadweight loss and generates sufficient revenue.

-

Targeting specific goods: Using taxes strategically to address externalities (e.g., carbon tax on polluting goods).

-

Considering distributional effects: Ensuring that the tax burden is not disproportionately borne by low-income households.

-

Improving tax administration: Reducing the administrative costs of tax collection to increase net revenue.

Conclusion

The imposition of a tax on a good has far-reaching consequences, affecting prices, quantities, consumer and producer surplus, government revenue, and overall economic welfare. While the basic supply and demand model provides a valuable framework for understanding these impacts, real-world scenarios are more nuanced. Policymakers need to carefully consider the elasticity of supply and demand, market structure, and distributional effects when designing tax policies. The goal is to create a tax system that is both efficient and equitable, maximizing revenue while minimizing deadweight loss and ensuring a fair distribution of the tax burden. The ongoing study and refinement of taxation policies are crucial for effective governance and economic stability.

Latest Posts

Latest Posts

-

You Must Encrypt Files With Any Of These Extensions

Apr 01, 2025

-

Which Of The Following Pairs Of Terms Is Mismatched

Apr 01, 2025

-

A Government Budget Deficit Exists When

Apr 01, 2025

-

In This Problem A B C And D

Apr 01, 2025

-

People With Lighter Colored Hair Have Melanin In The

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about When A Tax Is Imposed On A Good The . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.