When A Petty Cash Fund Is In Use

Holbox

Mar 21, 2025 · 7 min read

Table of Contents

- When A Petty Cash Fund Is In Use

- Table of Contents

- When a Petty Cash Fund is in Use: A Comprehensive Guide

- What is a Petty Cash Fund?

- When is a Petty Cash Fund Necessary?

- 1. Frequency of Small Expenses:</h3>

- 2. Lack of Convenient Payment Options:</h3>

- 3. Emergency Situations:</h3>

- 4. Employee Convenience:</h3>

- 5. Maintaining Confidentiality:</h3>

- Setting up a Petty Cash Fund: Best Practices

- 1. Determine the Fund's Size:</h3>

- 2. Assign a Custodian:</h3>

- 3. Establish Procedures:</h3>

- 4. Implement Controls:</h3>

- 5. Use a Petty Cash Box or Safe:</h3>

- Managing the Petty Cash Fund: A Step-by-Step Guide

- 1. Document Every Transaction:</h3>

- 2. Regular Reconciliation:</h3>

- 3. Replenishing the Fund:</h3>

- 4. Periodic Audits:</h3>

- 5. Addressing Discrepancies:</h3>

- Accounting for Petty Cash: Journal Entries and Procedures

- Security and Internal Controls: Minimizing Risk

- When to Consider Alternatives to Petty Cash

- Conclusion: Optimizing Petty Cash Management

- Latest Posts

- Latest Posts

- Related Post

When a Petty Cash Fund is in Use: A Comprehensive Guide

Petty cash funds are a common feature in many businesses, providing a convenient way to handle small, everyday expenses. While seemingly simple, understanding when a petty cash fund is appropriate, how to manage it effectively, and the associated accounting implications is crucial for maintaining financial accuracy and operational efficiency. This comprehensive guide delves into the intricacies of petty cash, offering practical advice and best practices for businesses of all sizes.

What is a Petty Cash Fund?

A petty cash fund is a small amount of cash kept on hand to cover minor, routine expenses. These expenses are typically too insignificant to justify writing a check or using a credit card. Think of things like postage stamps, office supplies, coffee runs, or small taxi fares. The fund operates on a reimbursement basis, meaning that when the petty cash is depleted, it's replenished to its original amount. This replenishment involves documenting all expenditures and submitting them for reimbursement.

When is a Petty Cash Fund Necessary?

A petty cash fund isn't always necessary, and its suitability depends heavily on the nature and scale of a business. Consider these factors:

1. Frequency of Small Expenses:</h3>

If your business regularly incurs numerous small expenses, a petty cash fund can streamline operations and save time. Constantly writing checks or using credit cards for minor purchases is inefficient and can be cumbersome.

2. Lack of Convenient Payment Options:</h3>

Some vendors or situations may not accept checks or credit cards. For instance, a small street vendor might only accept cash. In such cases, petty cash provides a necessary solution.

3. Emergency Situations:</h3>

Having a small cash reserve can be invaluable during unexpected situations requiring immediate payment, such as a sudden need for transportation or minor repairs.

4. Employee Convenience:</h3>

A petty cash fund can enhance employee convenience, particularly for those who frequently need to make small purchases on behalf of the company. This can improve efficiency and morale.

5. Maintaining Confidentiality:</h3>

In some situations, using petty cash might be preferred to maintain confidentiality, especially when purchasing sensitive items or services.

Setting up a Petty Cash Fund: Best Practices

Establishing a well-managed petty cash fund involves several crucial steps:

1. Determine the Fund's Size:</h3>

The fund's size should reflect the typical volume of small expenses. It should be large enough to cover anticipated needs without being excessively large, minimizing the risk of loss or theft. A good starting point might be a few hundred dollars, but this needs to be adjusted based on the specific needs of your business.

2. Assign a Custodian:</h3>

Select a responsible employee to manage the petty cash. This person will be accountable for all transactions and must be meticulous in record-keeping. Clear responsibilities and accountability are essential to prevent misuse or loss.

3. Establish Procedures:</h3>

Develop clear procedures for requesting reimbursement, documenting expenses, and replenishing the fund. This includes using petty cash vouchers or receipts for every transaction. These procedures should be documented and communicated clearly to all involved employees.

4. Implement Controls:</h3>

Implement strong internal controls to safeguard the fund. This could involve regular reconciliation, surprise audits, and limiting access to the petty cash box. These controls are vital for preventing fraud and ensuring accuracy.

5. Use a Petty Cash Box or Safe:</h3>

Store the petty cash in a secure, locked box or safe to prevent theft or loss. The location of the box should also be secure and inaccessible to unauthorized individuals.

Managing the Petty Cash Fund: A Step-by-Step Guide

Effective management is crucial for maintaining the integrity of the petty cash fund. Follow these steps:

1. Document Every Transaction:</h3>

For every expenditure, the custodian must complete a petty cash voucher. This voucher should include the date, description of the expense, the amount paid, and supporting documentation such as a receipt. This detailed record-keeping is essential for accurate accounting.

2. Regular Reconciliation:</h3>

The petty cash fund should be reconciled regularly – typically weekly or monthly. This involves counting the remaining cash on hand and comparing it to the total amount spent, as documented on the petty cash vouchers. Any discrepancies must be investigated immediately.

3. Replenishing the Fund:</h3>

When the petty cash fund reaches a predetermined low balance, it should be replenished to its original amount. The custodian submits all petty cash vouchers and supporting receipts to the accounting department for reimbursement. The accounting department then prepares a journal entry to record the replenishment.

4. Periodic Audits:</h3>

Periodic audits, conducted by someone independent of the petty cash custodian, help to ensure the accuracy and integrity of the fund. These audits should be unannounced to maintain objectivity and deter any fraudulent activities.

5. Addressing Discrepancies:</h3>

Any discrepancies discovered during reconciliation or audits should be investigated thoroughly. This investigation should identify the cause of the discrepancy and implement corrective measures to prevent future occurrences. Accurate record-keeping is crucial in resolving these issues effectively.

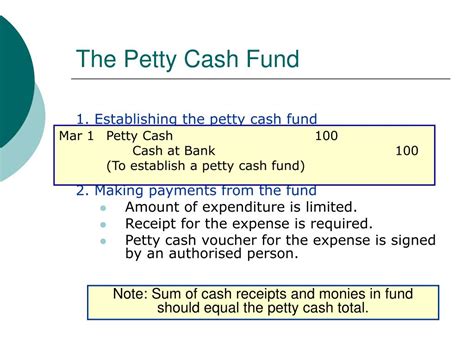

Accounting for Petty Cash: Journal Entries and Procedures

Accurate accounting for petty cash is essential for maintaining the financial integrity of your business. Here's how to handle the journal entries:

Replenishing the Petty Cash Fund:

When replenishing the petty cash fund, the following journal entry is typically made:

- Debit: Various expense accounts (postage, office supplies, etc.) – This reflects the individual expenses documented on the petty cash vouchers.

- Credit: Cash – This represents the amount of cash used to replenish the fund.

Example:

Let's say the petty cash fund needs replenishment. The expenses are:

- Postage: $25

- Office Supplies: $50

- Coffee: $15

The journal entry would be:

- Debit: Postage Expense $25

- Debit: Office Supplies Expense $50

- Debit: Miscellaneous Expense $15

- Credit: Cash $90

Handling Discrepancies:

If a shortage is discovered during reconciliation, the journal entry would include:

- Debit: Cash Short and Over (expense account) – This account records cash shortages.

- Credit: Cash

If an overage is discovered:

- Debit: Cash

- Credit: Cash Short and Over (revenue account) – This account records cash overages.

Security and Internal Controls: Minimizing Risk

Protecting your petty cash fund is paramount. Consider these security measures:

- Limited Access: Only authorized personnel should have access to the petty cash box and the procedures for its management.

- Two-Person Control: Consider requiring two employees to be involved in replenishing the fund to provide an additional layer of oversight.

- Regular Reconciliation: Frequent reconciliation minimizes the time a discrepancy can go undetected, making it easier to identify and resolve issues quickly.

- Surprise Audits: Unannounced audits act as a deterrent against fraud and help to ensure the accuracy of the records.

- Segregation of Duties: The person responsible for managing the petty cash should not also be responsible for accounting duties related to the fund.

- Physical Security: The petty cash box should be kept in a secure location, ideally under lock and key.

When to Consider Alternatives to Petty Cash

While petty cash offers simplicity, it's not always the optimal solution. Alternatives include:

- Company Credit Cards: For larger or more frequent expenses, company credit cards offer better tracking and control.

- Expense Reimbursement Systems: These systems streamline the expense reporting process and offer better visibility into spending patterns.

- Prepaid Debit Cards: Prepaid debit cards can be used for specific expenses, offering more control and tracking capabilities than petty cash.

Conclusion: Optimizing Petty Cash Management

A well-managed petty cash fund can be a valuable asset for businesses that handle frequent small expenses. However, its success hinges on establishing clear procedures, implementing strong internal controls, and maintaining meticulous records. By following the best practices outlined in this guide, businesses can leverage the convenience of petty cash while mitigating risks and ensuring financial accuracy. Remember, regular reconciliation, surprise audits, and clear accountability are essential components of a robust petty cash management system. Always consider alternatives if the volume or nature of your small expenses outweigh the benefits of a petty cash system. By carefully weighing the pros and cons and implementing effective controls, businesses can maximize the efficiency and security of their petty cash operations.

Latest Posts

Latest Posts

-

Globalization Is Criticized Because It Increases The Power Of

Mar 27, 2025

-

Data Mining Is A Tool For Allowing Users To

Mar 27, 2025

-

A Patient Is Hospitalized For A Small Bowel Obstruction

Mar 27, 2025

-

Swapping Items Between Memory And Storage

Mar 27, 2025

-

Samuel A Psychologist Wants To Investigate

Mar 27, 2025

Related Post

Thank you for visiting our website which covers about When A Petty Cash Fund Is In Use . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.