What Is The Value Today Or Reciveing 5000

Holbox

Mar 13, 2025 · 5 min read

Table of Contents

- What Is The Value Today Or Reciveing 5000

- Table of Contents

- What's the Value Today of Receiving $5,000? A Comprehensive Look at Time Value of Money

- The Immediate Value: Purchasing Power

- The Time Value of Money (TVM): Future Potential

- Calculating Future Value: A Simple Example

- Risk and Return: Navigating Investment Choices

- Low-Risk Investments:

- Moderate-Risk Investments:

- High-Risk Investments:

- Beyond Financial Value: The Intangible Benefits

- Conclusion: Context is Key

- Latest Posts

- Latest Posts

- Related Post

What's the Value Today of Receiving $5,000? A Comprehensive Look at Time Value of Money

Receiving $5,000 today feels substantial, but its true worth depends heavily on context. This isn't just about the immediate purchasing power; it's about the potential for growth and the impact of inflation. Understanding the time value of money (TVM) is crucial to grasping the true value of this sum. This article will explore various perspectives, helping you assess the real worth of a $5,000 windfall.

The Immediate Value: Purchasing Power

The most straightforward assessment of $5,000 is its current buying power. You can use this money immediately to:

- Pay off debts: This is arguably the most valuable use if you're burdened with high-interest debt like credit card balances. Eliminating debt frees up future income and reduces financial stress.

- Cover immediate expenses: Unexpected bills, home repairs, or medical costs can be easily addressed with this lump sum. The relief from financial pressure is invaluable.

- Make a significant purchase: This could be anything from a much-needed appliance to a down payment on a car or even a small investment property. The specific value depends entirely on your needs and priorities.

- Invest in yourself: Use the funds for education, professional development, or starting a small business – investments that can significantly increase your earning potential in the long run.

However, simply focusing on immediate spending overlooks the potential for future growth. This is where the time value of money comes in.

The Time Value of Money (TVM): Future Potential

The core principle of TVM is that money available at the present time is worth more than the identical sum in the future due to its potential earning capacity. This is because money can earn interest or returns over time. $5,000 invested today will be worth significantly more in the future, depending on the investment vehicle and the rate of return.

Several factors influence the future value of $5,000:

- Investment Return: The rate of return you earn on your investment directly impacts its future value. Higher returns translate to faster growth. Conservative investments like high-yield savings accounts offer lower but steadier returns, while higher-risk investments like stocks could yield significantly more (or less).

- Investment Time Horizon: The longer you invest your money, the more time it has to grow. A longer time horizon allows for compounding, where returns themselves generate further returns.

- Inflation: Inflation erodes the purchasing power of money over time. The same $5,000 will buy fewer goods and services in the future due to rising prices. Therefore, it's crucial to consider inflation when evaluating the long-term value of your money.

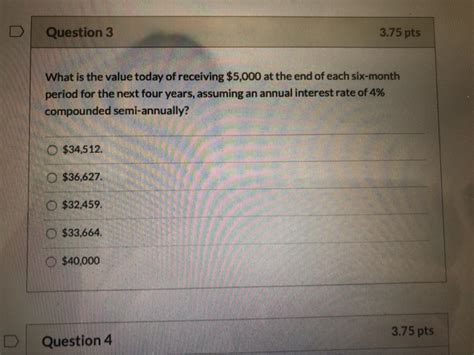

Calculating Future Value: A Simple Example

Let's assume a modest annual return of 5% and a 10-year investment horizon. Using a compound interest calculator (readily available online), we find that $5,000 invested today at 5% annually would grow to approximately $8,144.47 after 10 years.

However, inflation must be factored in. If we assume an average annual inflation rate of 2%, the real value of that $8,144.47 in 10 years would be somewhat lower. Precise calculation requires knowing the exact inflation rate for each year, which is difficult to predict accurately. Nevertheless, even with inflation, the real value would likely exceed the initial $5,000.

Risk and Return: Navigating Investment Choices

The potential return on your $5,000 is directly linked to the level of risk you're willing to accept.

Low-Risk Investments:

- High-Yield Savings Accounts: Offer modest but secure returns, protecting your principal while providing some growth. Ideal for short-term goals or emergency funds.

- Certificates of Deposit (CDs): Provide a fixed interest rate for a specific period, offering a predictable return. However, accessing your money before maturity may incur penalties.

- Government Bonds: Considered very low-risk, offering stable returns backed by the government. Suitable for risk-averse investors.

Moderate-Risk Investments:

- Index Funds: Diversified investments tracking a specific market index (like the S&P 500), offering potentially higher returns than low-risk options while mitigating some risk through diversification.

- Real Estate Investment Trusts (REITs): Invest in income-generating real estate, providing potentially higher returns but also carrying moderate risk.

High-Risk Investments:

- Individual Stocks: Offer the potential for high returns but also come with significantly higher risk. Requires careful research and understanding of the market.

- Cryptocurrencies: Highly volatile and speculative, offering potential for enormous gains but also substantial losses.

The optimal investment strategy depends on your individual risk tolerance, financial goals, and time horizon. It's advisable to consult with a financial advisor to determine the best approach based on your specific circumstances.

Beyond Financial Value: The Intangible Benefits

The value of $5,000 extends beyond its monetary worth. It can provide:

- Reduced stress: Eliminating debt or covering unexpected expenses can significantly alleviate financial stress, improving overall well-being.

- Increased opportunities: Investing in education or a business can unlock future earning potential and career advancement.

- Improved financial security: Building an emergency fund or making a down payment on a home provides a sense of financial stability and independence.

- Enhanced freedom and flexibility: Having extra funds can create more freedom to pursue personal interests, travel, or spend time with loved ones.

Conclusion: Context is Key

The true value of receiving $5,000 is subjective and highly dependent on individual circumstances. While its immediate purchasing power is a tangible benefit, the potential for long-term growth through wise investment must also be considered. The most valuable use of this money hinges on your financial goals, risk tolerance, and time horizon. Careful planning and potentially seeking professional financial advice are crucial steps in maximizing the value of this significant sum. Remember, the ultimate goal isn't just about the money itself, but about the positive impact it can have on your life and future. By understanding the time value of money and making informed decisions, you can ensure that $5,000 today translates into significantly greater value tomorrow.

Latest Posts

Latest Posts

-

What Is 70 Percent Of 90

May 20, 2025

-

How Many Seconds In 7 Hours

May 20, 2025

-

What Is 79 Kg In Pounds

May 20, 2025

-

How Many Pounds Is 6 Stone

May 20, 2025

-

How Many Seconds Are In 6 Minutes

May 20, 2025

Related Post

Thank you for visiting our website which covers about What Is The Value Today Or Reciveing 5000 . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.