What Is Meant By The Phrase Spreading The Overhead

Holbox

Mar 21, 2025 · 6 min read

Table of Contents

- What Is Meant By The Phrase Spreading The Overhead

- Table of Contents

- Spreading the Overhead: A Deep Dive into Cost Allocation and Profitability

- What are Overhead Costs?

- Why is Spreading Overhead Important?

- Methods for Spreading Overhead

- 1. Direct Labor Hours Method

- 2. Machine Hours Method

- 3. Direct Material Cost Method

- 4. Activity-Based Costing (ABC) Method

- 5. Plantwide Overhead Rate Method

- Choosing the Right Overhead Allocation Method

- Overcoming Challenges in Spreading Overhead

- Best Practices for Effective Overhead Allocation

- Spreading Overhead and Profitability

- Conclusion: The Significance of Spreading Overhead

- Latest Posts

- Latest Posts

- Related Post

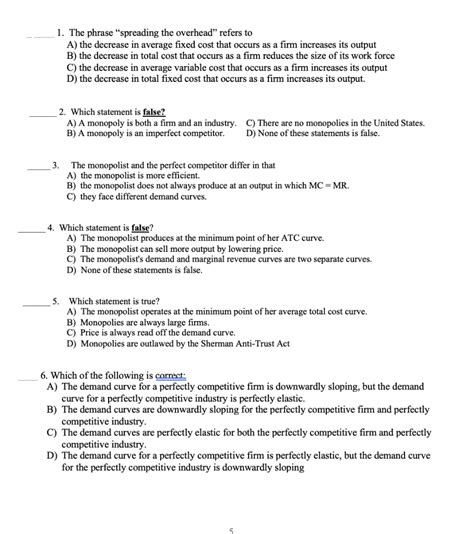

Spreading the Overhead: A Deep Dive into Cost Allocation and Profitability

The phrase "spreading the overhead" might sound like a clandestine operation, but it's a core concept in accounting and business management. It refers to the process of allocating indirect costs, also known as overhead costs, across different products, services, or departments. Understanding how to effectively spread overhead is crucial for accurate cost accounting, pricing strategies, and ultimately, profitability. This comprehensive guide will delve into the intricacies of overhead allocation, exploring various methods, their advantages and disadvantages, and best practices for accurate and meaningful cost distribution.

What are Overhead Costs?

Before diving into the mechanics of spreading overhead, it's essential to understand what constitutes overhead costs. These are indirect costs that are difficult to directly trace to a specific product or service. Unlike direct costs (like raw materials or direct labor), overhead costs are incurred to support the overall business operation. Examples include:

- Rent: The cost of renting factory space or office buildings.

- Utilities: Electricity, water, gas, and other utility expenses.

- Salaries of Support Staff: Pay for administrative personnel, security guards, and janitorial staff.

- Depreciation: The gradual reduction in the value of assets over time.

- Insurance: Premiums paid for property, liability, and other types of insurance.

- Maintenance and Repairs: Costs associated with keeping equipment and facilities in good working order.

- Research and Development: Expenses related to developing new products or improving existing ones.

- Marketing and Advertising: Costs incurred to promote products or services.

Why is Spreading Overhead Important?

Accurately spreading overhead is vital for several reasons:

- Accurate Product Costing: Understanding the true cost of producing each product or providing each service is crucial for setting profitable prices. Ignoring overhead costs can lead to underpricing and lost profits.

- Performance Evaluation: Allocating overhead to different departments or projects enables a more accurate assessment of their profitability and efficiency.

- Decision Making: Information about overhead costs is crucial for informed decision-making related to pricing, product mix, resource allocation, and strategic planning.

- Compliance and Reporting: Accurate overhead allocation is often required for financial reporting purposes and regulatory compliance.

Methods for Spreading Overhead

Several methods exist for allocating overhead costs, each with its own advantages and disadvantages. The choice of method depends on the complexity of the business, the nature of its operations, and the level of accuracy required. Here are some common methods:

1. Direct Labor Hours Method

This method allocates overhead based on the number of direct labor hours worked. It's simple to understand and implement, making it suitable for businesses with a relatively homogeneous workforce. However, it can be inaccurate if different workers have varying levels of efficiency or if automation reduces the reliance on direct labor.

Formula: Overhead Rate = Total Overhead Costs / Total Direct Labor Hours

2. Machine Hours Method

This method is ideal for businesses where machinery plays a significant role in production. Overhead is allocated based on the number of machine hours used. It's particularly suitable for manufacturing companies with automated processes. However, it may not be accurate if different machines have varying levels of efficiency or if other factors significantly impact overhead costs.

Formula: Overhead Rate = Total Overhead Costs / Total Machine Hours

3. Direct Material Cost Method

This method allocates overhead based on the direct material costs incurred. It's appropriate for businesses where material costs are a significant component of the production process. However, it can be less accurate if the relationship between material costs and overhead isn't strong.

Formula: Overhead Rate = Total Overhead Costs / Total Direct Material Costs

4. Activity-Based Costing (ABC) Method

ABC is a more sophisticated method that allocates overhead costs based on the activities that consume resources. It identifies cost drivers – the factors that cause overhead costs to be incurred – and allocates costs accordingly. This approach provides a more accurate and detailed understanding of overhead costs and their impact on different products or services. However, it's more complex and time-consuming than simpler methods.

5. Plantwide Overhead Rate Method

This method uses a single overhead rate for the entire plant or organization. While simple to calculate, it lacks the granularity to accurately reflect the different overhead consumption of various departments or products. It's suitable only for companies with very similar product lines and processes.

Choosing the Right Overhead Allocation Method

The choice of overhead allocation method is crucial for accurate cost accounting. Consider the following factors when selecting a method:

- Industry: Certain industries may be better suited to specific methods. Manufacturing companies often use machine hours, while service businesses might use direct labor hours.

- Complexity of Operations: Simple operations might benefit from simpler methods, while complex operations may require more sophisticated approaches like ABC.

- Accuracy Requirements: The level of accuracy needed for decision-making will influence the choice of method.

- Cost and Time Constraints: More sophisticated methods are generally more time-consuming and expensive to implement.

Overcoming Challenges in Spreading Overhead

Even with the best methods, challenges can arise in accurately spreading overhead:

- Arbitrary Allocations: Some overhead costs are difficult to directly link to specific products or services, requiring arbitrary allocations which may lack precision.

- Changing Cost Structures: Overhead costs are dynamic and can fluctuate significantly due to factors like changes in technology, market conditions, or regulatory requirements. This necessitates regular review and adjustment of the allocation method.

- Data Accuracy: Inaccurate or incomplete data can lead to significant errors in overhead allocation. Robust data collection and verification processes are crucial.

- Complexity of ABC: While ABC offers greater accuracy, its complexity can make implementation challenging and require specialized expertise.

Best Practices for Effective Overhead Allocation

To maximize the effectiveness of overhead allocation, consider these best practices:

- Regular Review and Update: Overhead allocation methods should be reviewed and updated regularly to reflect changes in the business environment and cost structure.

- Data Integrity: Implement robust systems for data collection, verification, and management to ensure the accuracy of cost information.

- Cost Driver Identification: Thoroughly identify and analyze cost drivers to ensure that overhead costs are allocated based on the factors that actually cause them to be incurred.

- Training and Education: Ensure that all personnel involved in overhead allocation understand the chosen method and its implications.

- Transparency and Communication: Maintain transparency in the overhead allocation process and clearly communicate the results to stakeholders.

- Integration with other systems: Integrate the overhead allocation process with other accounting and management systems for seamless data flow and efficient reporting.

Spreading Overhead and Profitability

Effective overhead allocation is not just about accurate cost accounting; it's directly linked to profitability. By accurately determining the cost of each product or service, businesses can:

- Set appropriate prices: Avoid underpricing and ensure that prices cover all costs, including overhead, resulting in healthy profit margins.

- Identify unprofitable products or services: Spot areas where overhead costs are disproportionately high and make informed decisions about eliminating or improving them.

- Optimize resource allocation: Identify areas where resources are being inefficiently used and make adjustments to reduce overhead costs.

- Improve operational efficiency: By analyzing overhead cost data, businesses can identify opportunities for streamlining processes and reducing waste.

Conclusion: The Significance of Spreading Overhead

Spreading overhead is a critical aspect of cost accounting and financial management. While it presents challenges, the benefits of accurate overhead allocation far outweigh the difficulties. By selecting the appropriate method, implementing robust data systems, and adhering to best practices, businesses can gain valuable insights into their cost structure, improve pricing strategies, enhance operational efficiency, and ultimately, boost profitability. Understanding and effectively managing overhead costs is a key factor in achieving sustainable business success. It's not just about "spreading" the cost; it's about understanding where it originates and how to optimize its management for a healthier bottom line.

Latest Posts

Latest Posts

-

The Term Double Taxation Refers To Which Of The Following

Mar 28, 2025

-

Write 1 2 3 10 Using Sigma Notation

Mar 28, 2025

-

Porths Essentials Of Pathophysiology 5th Edition Ebook

Mar 28, 2025

-

In Viewing A Microscopic Specimen Oil Is Used To

Mar 28, 2025

-

In Order To Prevent Pest Infestations It Is Important To

Mar 28, 2025

Related Post

Thank you for visiting our website which covers about What Is Meant By The Phrase Spreading The Overhead . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.